InMobi Secures $100 Million in Debt Financing to Fuel AI Drive and Expansion

Mobile advertising network software company InMobi has secured a significant $100 million in debt financing from MARS Growth Capital, a joint venture between MUFG and Liquidity Group. This investment is expected to propel the company’s ambitious plans for artificial intelligence (AI) development, strategic acquisitions, and further expansion.

Key Points:

- InMobi aims to leverage AI to offer more immersive, personalized experiences for brands and consumers

- The funding will enable the company to accelerate its efforts in AI development and technology innovation

- InMobi plans to take advantage of its advanced machine learning and AI technologies to optimize ad performance and user experience

- With operations in over 165 countries, InMobi continues to expand its global presence with a significant presence in San Francisco and Singapore

A Unicorn’s Ambitions

This deal marks a significant raise for InMobi, which has been a decade since the company last raised funds. It is worth noting that InMobi was India’s first unicorn back in 2011. InMobi’s mobile-first content platform, Glance, has received major investments from Jio and Google, further solidifying its position in the market.

IPO Plans and Future Expansion

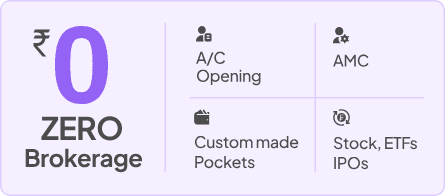

InMobi is planning an initial public offering (IPO) in India, expected in the second half of next year, with a valuation of $10 billion. The company is also planning to move its domicile from Singapore to India in the next few months.

InMobi, a mobile advertising network software company, has secured a $100 million debt financing deal from MARS Growth Capital, a joint venture between MUFG and Liquidity Group. This investment will support InMobi’s AI drive and strategic acquisitions, aimed at delivering more immersive, personalized ad experiences for brands and consumers. Additionally, the company plans to continue expanding its global presence, with plans to move its domicile to India and pursue an IPO valued at $10 billion.