| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-10-24 |

Read Next

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Bajaj Finserv and Bajaj Finance: Which is Better?

- CRED Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Haldiram’s Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- BHEL vs BEL -Best Defence and Manufacturing Sector Stocks

- Meesho Case Study – Key Stats, SWOT Analysis & Marketing Strategy

- Asian Paints vs Berger Paints – Which is Better?

- Maruti Suzuki India Vs Hyundai: Which Car Stock is Better?

- Devyani International Vs Sapphire Foods – Which is Better?

- Ather Energy Case Study: Business Model, Financials, and SWOT Analysis

- Blog

- bank of baroda vs canara bank

Bank of Baroda Vs Canara Bank: Which is Better?

Two well-known banks with a long history of innovation and tradition stand out in India’s banking landscape: Canara Bank and Bank of Baroda. These financial institutions have survived economic shifts, political challenges, and societal changes for a long time.

Today’s blog explores the origins of these two banks, how they differ financially, and their rise to prominence.

Bank of Baroda – An Overview

The Bank of Baroda is a prominent Indian public sector bank with its headquarters in Vadodara, Gujarat. It is one of the largest banks in India and has a significant presence in both domestic and international markets.

BOB was established on 20 July 1908 in Baroda, with the support of Maharaja Sayajirao Gaekwad III of Baroda. It started its operations with INR 10 lakh and 28 staff members. In 1969, the Bank of Baroda underwent nationalization along with 13 other prominent banks in India, which was a crucial step by the government to exert control over the banking sector.

In 2018, the Bank of Baroda was merged with Vijaya Bank and Dena Bank, forming one of the largest public sector banks in India, with branches and subsidiaries spread across numerous countries, such as the UK, the US, the Middle East, and Africa.

Canara Bank – An Overview

Canara Bank is a major Indian public sector bank with its headquarters in Bangalore, Karnataka. The bank was founded in 1906 by Shri Ammembal Subba Rao Pai, a great visionary and philanthropist, making it one of India’s oldest banks.

It was initially established as a Canara Hindu Permanent Fund in Mangalore. In 1961, the bank acquired the Bank of Kerala and Seasia Midland Bank. Canara Bank was nationalized along with 13 other major banks in India as part of the government’s efforts to control the banking sector.

The bank has 13 subsidiaries or sponsored institutions in India and abroad. As of June 2024, Canara Bank services over 11.42 crore customers through a network of 9,627 branches and 12,256 ATMs/Recycler spread across all Indian states and Union Territories.

Comparative Analysis

| Particular | Bank of Baroda | Canara Bank |

|---|---|---|

| Current Share Price | INR 250 | INR 112 |

| Market Capitalisation (in INR crores) | 1,29,336 | 1,01,165 |

| 52-Week High | INR 300 | INR 129 |

| 52-Week Low | INR 188 | INR 65.5 |

| FII Holdings (%) | 11.45 | 11.91 |

| DIIs Holdings (%) | 16.03 | 11.19 |

| Book Value per Share | INR 231 | INR 102 |

| PE Ratio (x) | 6.79 | 6.48 |

Read Also: Bank of Baroda vs SBI

Financial Statements Analysis

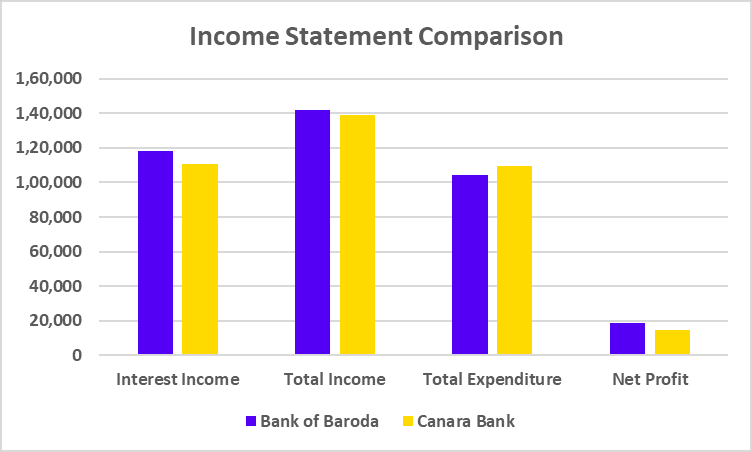

Income Statement (FY 2024)

| Particular | Bank of Baroda | Canara Bank |

|---|---|---|

| Interest Income | 1,18,379 | 1,10,518 |

| Total Income | 1,41,778 | 1,39,164 |

| Total Expenditure | 1,04,174 | 1,09,454 |

| Net Profit | 18,471 | 14,782 |

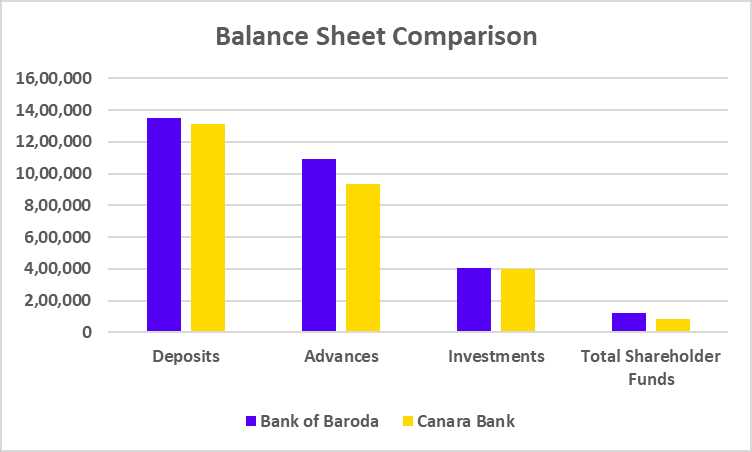

Balance Sheet (FY 2024)

| Particular | Bank of Baroda | Canara Bank |

|---|---|---|

| Deposits | 13,51,801 | 13,12,242 |

| Advances | 10,88,983 | 9,31,786 |

| Investments | 4,07,136 | 3,99,207 |

| Total Shareholder Funds | 1,18,676 | 81,200 |

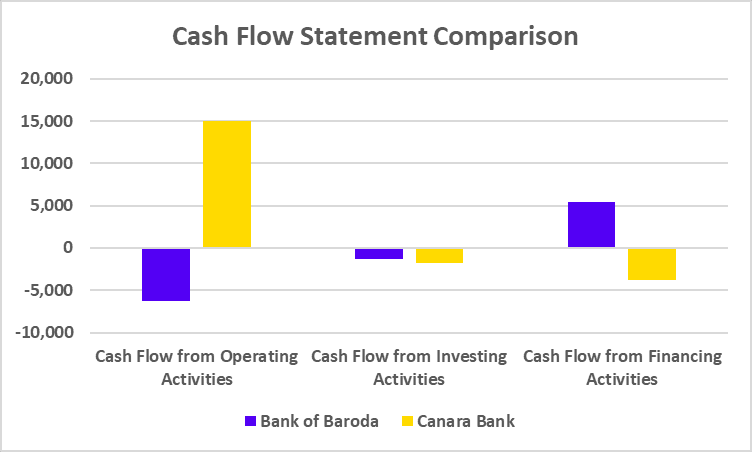

Cash Flow Statement (FY 2024)

| Particular | Bank of Baroda | Canara Bank |

|---|---|---|

| Cash Flow from Operating Activities | -6,273 | 15,046 |

| Cash Flow from Investing Activities | -1,285 | -1,748 |

| Cash Flow from Financing Activities | 5,475 | -3,834 |

Key Performance Indicators (KPIs)

| Particulars | Bank of Baroda | Canara Bank |

|---|---|---|

| Net Interest Margin (%) | 2.92 | 2.50 |

| Net Profit Margin (%) | 15.55 | 13.37 |

| ROE (%) | 15.67 | 18.40 |

| ROCE (%) | 2.38 | 2.03 |

| CASA (%) | 38.58 | 29.90 |

Read Also: PNB vs Bank of Baroda

Conclusion

The Bank of Baroda and Canara Bank have a rich legacy and significant presence in the financial sector. Despite sharing similar characteristics, BOB and Canara Bank differ in terms of financial performance and range of services. Additionally, it is important to consider factors such as branch accessibility, digital banking capabilities, past financial performance, and the overall reputation of each bank before making an investment decision. However, it is advised to consult a financial advisor before investing.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | HDFC Bank vs Axis Bank |

| 2 | SBI vs ICICI Bank |

| 3 | PNB vs SBI |

| 4 | HDFC vs SBI |

| 5 | Axis Bank vs ICICI Bank |

Frequently Asked Questions (FAQs)

What were the key changes experienced by banks after nationalization?

The banks experienced rapid growth, expanded their branch networks, and diversified their services.

Do the Bank of Baroda and Canara Bank have a digital presence?

Both banks have strong digital banking platforms, offering internet banking, mobile banking, etc.

Which bank is better for personal banking?

An individual needs to select a bank based on his/her specific needs and preferences. Further, it is suggested that both banks be compared on every metric before making any decision.

Has Canara Bank been involved in any mergers and acquisitions?

In 1961, Canara Bank acquired the Bank of Kerala and Seasia Midland Bank and recently underwent a merger with the Syndicate Bank in 2020.

Do the Bank of Baroda and Canara Bank have international operations?

Both banks have a global presence as they have subsidiaries, offices, and branches in various countries.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle