| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-24-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Blog

- bhel vs bel

BHEL vs BEL -Best Defence and Manufacturing Sector Stocks

When it comes to investing, investors look for government-owned companies operating in industries which have high growth potential. Their performance is directly linked to government spending. Bharat Heavy Electricals Limited and Bharat Electronics Limited are two major entities operating in different sectors to cater to the demand for equipment used in power, infrastructure, and the defence sector.

In this blog, we will provide you with a comparison between BHEL and BEL, and based on such a comparison help you determine which stock is suitable for you.

Overview of BHEL Stock

In 1956, a company named Heavy Electricals (India) Limited was established with an aim to manufacture heavy electrical equipment in India. The first plant was set up in Bhopal. Considering the high demand for heavy electrical equipment, it was decided to set up three additional plants and to manage them, BHEL was formed. BHEL or Bharat Heavy Electricals Limited, established in 1964, is a state-owned enterprise primarily manufacturing equipment for the power and transmission sector. BHEL was merged with Heavy Electricals (India) Limited in 1974. BHEL has executed various projects across 76 countries. The company has 16 manufacturing plants, spread across the country, and 2 repair units. The company is the sole supplier of nuclear turbines in India. In recent years, it has expanded in the renewable energy sector. The company’s headquarters are situated in New Delhi.

Product Portfolio

BHEL is one of the largest manufacturers of power plant equipment. The product portfolio of BHEL includes the following:

- Equipment for Thermal Power Plants: It manufactures boilers, steam turbines, boiler feed pumps, etc.

- Equipment for Hydro Power Plant: Hydro Turbines, Hydro Generators, etc.

- Equipment for Gas-based Power Plants: Gas Turbines are manufactured by BHEL for this segment.

- Equipment for Nuclear Power Plants: BHEL is the only company in India that manufactures steam generators, reactors and control equipment for nuclear plants.

- Other Sector: It also manufactures various industrial equipment such as high voltage transformers, electric motors, traction motors, etc.

Overview of BEL Stock

Bharat Electronics Limited was founded in 1954 as a public sector undertaking, under the Ministry of Defence. The company is primarily engaged in providing electronic equipment for the Indian armed forces. The company has been given the status of Navratna by the Government of India. Its wide range of products includes communication devices, electronic warfare systems, night vision devices, etc. The company exported defense equipment worth $2.63 billion in FY2024, an increase of 32.5% over the past year. The company is also active in the non-defense segment and manufactures key components for railways, metro, civil aviation, antennas, etc. Its headquarters are situated in Bangalore.

Product Portfolio

The product portfolio of Bharat Electronics Limited is as follows:

- Defence Related Products: It manufactures various defence-related products such as radars, missile systems, communication devices, jammers, naval systems, avionics, etc.

- Non-Defence Related Products: It manufactures crucial components and equipment such as antennas, jammers, solar energy solutions, signalling systems for the transport sector, cyber security solutions, etc.

Read Also: List Of Best Defense Stocks in India

Comparison of Market Details – BHEL and BEL

| Particulars | BHEL | BEL |

|---|---|---|

| Current Market Price (₹) | 248 | 383 |

| Market Capitalisation (In ₹ Crores) | 86,212 | 2,80,220 |

| 52 Week High (₹) | 335 | 386 |

| 52 Week Low (₹) | 176 | 230 |

| Book Value (₹) | 71 | 27 |

| Face Value of Share (₹) | 2 | 1 |

| P/E Ratio (x) | 161 | 52.7 |

Performance Comparison of BHEL and BEL

| Particulars | BHEL | BEL |

|---|---|---|

| 1 Month | 8.40 % | 26.42 % |

| 6 Months | 5.59 % | 36.55 % |

| 1 Year | -18.03 % | 35.23 % |

| 5 Years | 908.15 % | 1724.45 % |

| YTD | 6.12 % | 30.49 % |

Inference: Based on the returns mentioned in the table above, we can conclude that BEL has posted higher returns than BHEL on each timeframe whether it is long term or short term.

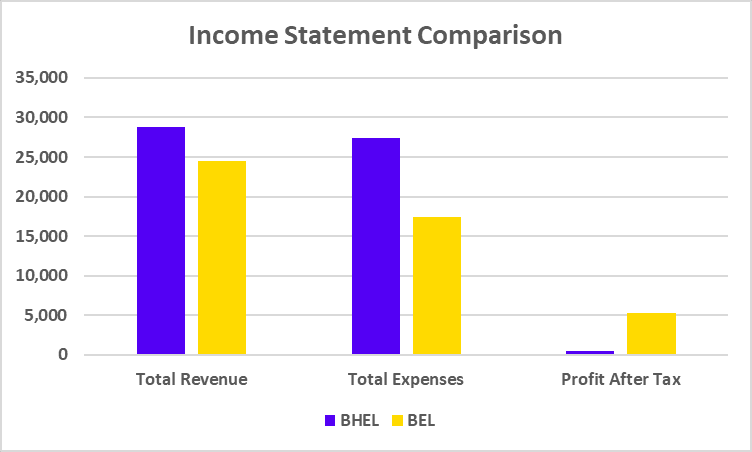

Income Statement Comparison

| Particulars | BHEL | BEL |

| Total Revenue | 28,804 | 24,511 |

| Total Expenses | 27,369 | 17,402 |

| Profit After Tax | 474 | 5,287 |

(As of March 2025)

Inference: Bharat Heavy Electricals Limited has recorded higher revenue than BEL for FY 2025, however, BHEL has incurred relatively higher expenses, therefore its Profit After Tax is lower than BEL’s Profit.

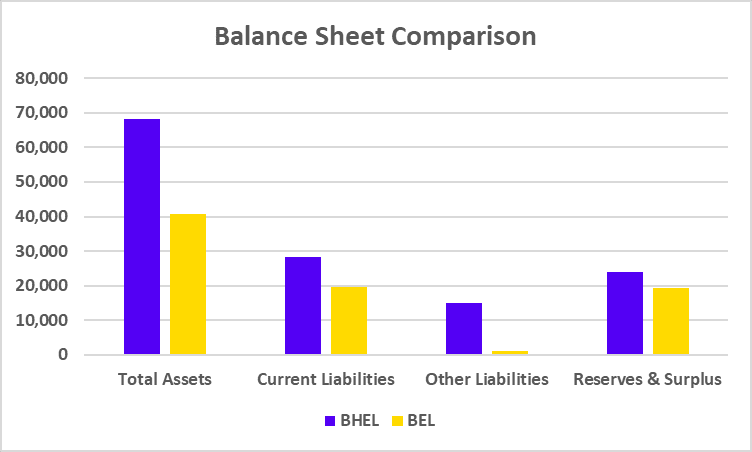

Balance Sheet Comparison

| Particulars | BHEL | BEL |

|---|---|---|

| Total Assets | 68,083 | 40,831 |

| Current Liabilities | 28,225 | 19,752 |

| Other Liabilities | 15,135 | 1,105 |

| Reserves & Surplus | 24,025 | 19,242 |

Inference: The above table indicates that BHEL has higher assets than BEL, however, it also has higher liabilities.

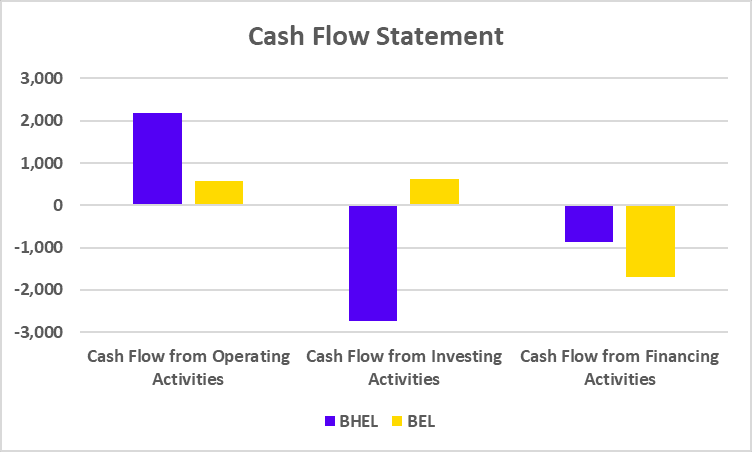

Cash Flow Statement

| Particulars | BHEL | BEL |

|---|---|---|

| Cash Flow from Operating Activities | 2,191 | 586 |

| Cash Flow from Investing Activities | -2,730 | 616 |

| Cash Flow from Financing Activities | -856 | -1,696 |

Inference: BHEL has a high cash flow from operating activities, but has a significantly negative investing cash flow as compared to BEL.

Read Also: Best Small-Cap Defence Stocks in India

Key Performance Ratios

| Particulars | BHEL | BEL |

|---|---|---|

| Basic EPS (INR) | 1.53 | 7.28 |

| Operating Profit Margin (%) | 5.06 | 29.90 |

| Net Profit Margin (%) | 1.67 | 22.24 |

| ROE (%) | 2.15 | 26.64 |

| ROCE (%) | 3.60 | 33.72 |

| Debt to Equity (x) | 0.36 | 0 |

Inference: The comparison of key performance ratios indicates that BEL has significantly better profit margins and other return metrics compared to BHEL.

Shareholding Pattern

| Particulars | BHEL | BEL |

|---|---|---|

| Promoter (%) | 63.17 | 51.14 |

| FII (%) | 7.19 | 17.56 |

| DII (%) | 16.35 | 20.88 |

| Others (%) | 1.52 | 1.1 |

Inference: FIIS holds a significant stake of around 17% in BEL, whereas in BHEL, promoters hold 63.17%, which is comparatively higher than BEL.

Which Stock is Better?

Identifying which stock is better between Bharat Electronics Limited and Bharat Heavy Electricals Limited is difficult if you do not know your investment objective and risk profile. Both are public sector undertakings (PSU), yet they have different, distinct characteristics. BHEL is primarily operating in the power and energy sector and provides a wide range of equipment for thermal, hydro, gas, and nuclear power plants, in addition to defence equipment, and transport sectors.

On the other hand, BEL primarily operates in the defence sector and manufactures defense equipment like radars, missile systems, warfare technologies, and communication systems. BHEL has higher revenue compared to BEL, but has posted comparatively less profit. A detailed fundamental analysis of both companies is required before making an informed decision. Moreover, the investor’s risk tolerance and investment goal will determine which stock is ideal and it is advised to consult a financial advisor before investing.

Read Also: Top Defence Stocks to Watch After Operation Sindoor

Conclusion

On a concluding note, despite being well-known government-owned companies with important roles in India’s defence and infrastructure sector, they differ significantly in performance and future outlook. BEL focuses more on defence-related equipment, and is a debt-free company with higher profit margins, whereas BHEL operates in a more capital-intensive industry. Performance of both depends on the budget allocation announced towards power, infrastructure and defence sector. Both of them offer a great investment opportunity for investors, yet carry certain risks. Therefore, it is advisable to consult with your financial advisor before making any investment decision.

One can easily invest in both the shares using Pocketful’s advanced trading application without paying any brokerage on equity delivery. So open a free demat account with us now.

Frequently Asked Questions (FAQS)

Who is the current CEO of BHEL?

As of 22 May 2025, Mr. Koppu Sadashiv Murthy is the chairman and managing director of Bharat Heavy Electricals Limited (BHEL).

Which stock is suitable for long-term investment, BHEL or BEL?

BEL has better KPI metrics than BHEL along with a higher market capitalization, but investing in either of them requires thorough research.

Which is the best company between BHEL and BEL?

Based on past returns, market capitalisation and profit margins, etc. Bharat Electronics Limited is a better company to invest in when compared with BHEL. However, investment in either of them requires careful analysis of their financial performance and investors risk profile for which you should consult a financial advisor.

Is BHEL a government company?

Yes, Bharat Heavy Electricals Limited is a central government company. As of 31 March 2025, the central government holds around 63.17% stakes in this company.

Is BEL a large-cap company?

Yes, as of 22 May 2025, the market capitalization of Bharat Electronics Limited stood around 2,80,220 crores, and it belongs to the large-cap category.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle