| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-03-25 | |

| Add new links | Nisha | Sep-05-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Blog

- cred case study

CRED Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

CRED didn’t enter the fintech space with a product. It entered with the idea that good financial behavior deserves recognition. Launched in 2018, CRED quickly gained a reputation for being the best fintech platform for India’s top credit card users. It wasn’t just about paying bills, but about being part of a trusted community.

This CRED case study looks beyond the surface to understand what made a credit card payment app feel premium. With exclusive rewards and a members-only customer base, CRED built both loyalty and intrigue.

But how sustainable is it? What powers the CRED Business Model, and how does a rewards-first app justify its massive valuation? Let’s unpack the brand that turned financial discipline into social currency.

About CRED

CRED is a Bengaluru-based fintech platform founded by Kunal Shah in 2018. It is a platform that allows individuals with high-credit scores to get registered and make payments while earning rewards. The various services offered by CRED include:

- CRED Cash+ (short-term credit against mutual funds)

- CRED Pay (payments using CRED coin or saved credit cards)

- CRED Mint (peer-to-peer lending)

- Rent payments

- Curated e-commerce section called CRED Store

The platform utilizes an AI-backed system to assess user’s credit behavior, verify eligibility, and tailor customized experiences. This technology enables CRED to maintain its premium user base. The platform also offers personalized suggestions, real-time tracking, and many more features.

With a strong focus on design, exclusivity, and community, CRED has become one of India’s most distinctive fintech brands. Its app offers not just utility, but an elevated financial experience for credit-savvy users who value rewards, simplicity, and trust.

CRED Valuation

In May 2025, CRED raised $75 million in a Series G funding round. Existing investors, including GIC, Sofina, and RTP Global led it. This round brought the company’s total funding to over $1 billion across nine rounds.

The current valuation is approximately $3.5 billion, a sharp drop from $6.4 billion in 2022. Additionally, the company plans to launch an initial public offering (IPO) in the near future.

CRED Key Statistics (As of FY 24)

| Metric | Data |

|---|---|

| Revenue | ₹2,473 crore |

| User Base | 13 Million |

| Monthly Transacting Users (MTU) | 11.5 Million, an increase of 34% |

| Total Payment Value (TPV) | ₹6.87 lakh crore, which is a rise of 55% |

| Operating Losses | A fall of 41% to ₹609 crore |

| Customer Acquisition Cost (CAC) | Reduction of 40% approx. |

Currently, the company continues to focus on expanding its user base and enhancing monetization strategies. This is why it is essential to understand the company’s performance; a complete SWOT analysis of CRED is essential.

Read Also: Zaggle Case Study: Business Model, Financials, and SWOT Analysis

Business Model of CRED

CRED primarily follows a Business-to-Consumer (B2C) model. This model targets individuals with high credit scores who use credit cards. The platform incentivizes responsible financial behavior, such as when the user pays bills on time and earns rewards. To drive engagement, it focuses on gamification and personalized experiences.

Recently, CRED has expanded into some Business-to-Business (B2B) services. These are primarily focused on corporate expense management through its Happay platform, which CRED acquired in 2021 for $180 million. But still, its core revenue stream and growth comes from B2C only.

How Does CRED Work?

CRED functions as an invite-only platform. Typically, a 750 credit score is needed to get accepted. Once the app is downloaded, the credit score is checked at the backend. If the same is found satisfactory, the user is onboarded.

After onboarding, users can:

- Pay Credit Card Bills: This is the primary feature. Users earn CRED coins on transactions.

- Redeem Rewards: CRED coins can be used to claim exclusive offers and discounts on products from the CRED Store.

- Access Financial Services: Users can access CRED Cash for instant credit, use CRED Mint for lending, and even pay rent via credit cards.

- Monitor Your Credit Health: The app provides insights into your payment history. You can keep an eye on your credit card payments. CRED’s AI features help you track spend patterns and other card usage statistics with due date reminders on each payment.

The system is designed to reward responsible financial behavior while offering access to curated financial tools and premium benefits.

How Does CRED Earn?

CRED’s business model is designed to generate revenue from multiple sources. While the app is free for users, its monetization comes from options like:

- Financial services

- Brand partnerships

- Platform-based tools

- Others

If we dig in deeper, then here are the detailed revenue streams that CRED operates on:

1. Lending and Interest-Based Products

CRED earns revenue through CRED Cash, which offers short-term credit to users. It also facilitates peer-to-peer lending through CRED Mint, taking a service fee on interest earned.

2. Transaction and Processing Fees

Through features like RentPay, CRED allows users to pay rent using credit cards. A small convenience fee is charged on each transaction. Similarly, CRED Pay earns a merchant commission per successful order.

3. Brand Collaborations and Sponsored Content

Brands listed on the CRED Store pay for visibility through listing fees or commission on sales. Sponsored offers and reward placements also generate ad revenue.

4. Subscription Revenue from Businesses

After acquiring Happay, CRED now earns revenue by providing corporate expense management solutions for enterprises.

These revenue streams together fuel CRED’s long-term monetization strategy.

Read Also: Blinkit vs Zepto: Which is Better?

Marketing Strategy of CRED

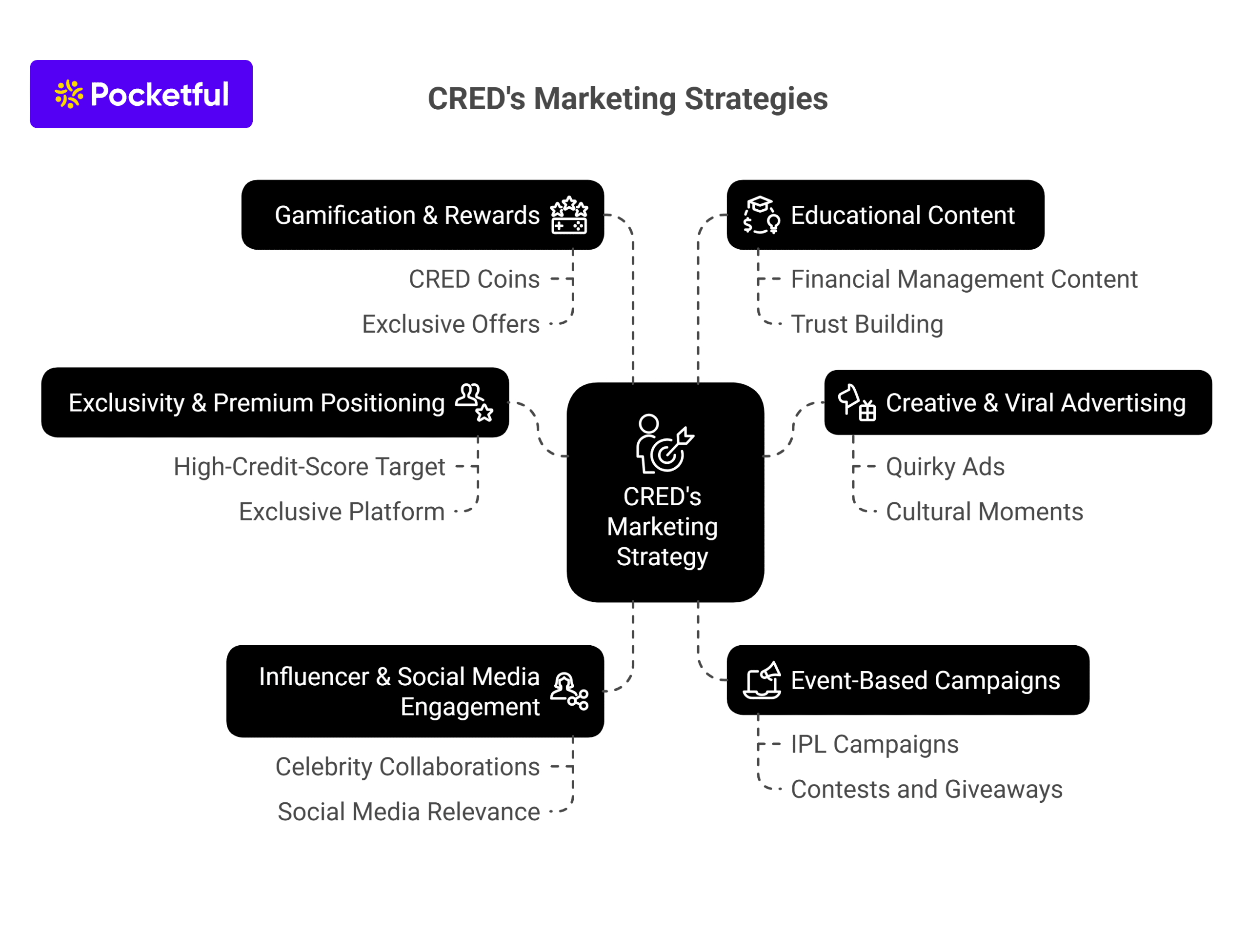

CRED aims to position itself as not just a fintech platform, but one that helps people maintain good credit discipline. This is one of the reasons that its marketing strategies focus on keeping messaging simple, engaging, and interactive. Some of the notable marketing strategies of CRED are as follows:

1. Exclusivity & Premium Positioning

CRED targets high-credit-score individuals. It positions itself as an exclusive, aspirational platform. The brand’s slogan is “Not Everyone Gets It.” This reinforces a sense of privilege, making membership feel special and desirable.

2. Creative & Viral Advertising

The advertisements or creatives are mostly quirky. These ads are designed to entertain, spark conversation, and become cultural moments. This helps the brand stand out in a crowded fintech market. Additionally, it enables people to connect with the brand.

3. Influencer & Social Media Engagement

The brand collabs with celebrities, comedians, and influencers to amplify reach and credibility. Witty, on-trend content on platforms like Instagram, Twitter, and YouTube helps the CRED stay relevant among its user base.

4. Event-Based Campaigns

CRED runs major promotional campaigns. This is mainly during high-visibility events like the IPL. It uses contests and giveaways to drive user engagement and app downloads.

5. Gamification & Rewards

The CRED Coins rewards program incentivizes users to pay credit card bills through the app. This empowers repeated usage and loyalty with exclusive offers at times.

6. Educational Content

CRED also educates its niche audience about financial management through engaging content. This builds trust and positions CRED as a leader in personal finance applications.

Here are some notable advertisements by CRED that captured audience attention greatly.

Rahul Dravid – “Indiranagar ka Gunda” (IPL 2021)

This ad became a cultural phenomenon. It featured the usually calm cricketer Rahul Dravid losing his temper in traffic and declaring himself “Indiranagar ka Gunda.” This unexpected portrayal instantly went viral, sparking widespread discussion on social media.

Bollywood Auditions (2020)

This was an ad featuring celebrities like Anil Kapoor, Madhuri Dixit, and Govinda. All of them were auditioning for a CRED commercial. The theme was poking fun at themselves and the idea of celebrity endorsements. The self-deprecating humor and unexpected scenarios resonated with viewers. This helps in setting CRED apart from conventional fintech advertising.

Read Also: IRCTC Case Study: Business Model, Financials, and SWOT Analysis

Financial Analysis of CRED

| Financial Metrics | FY 2024 | FY 2023 | FY 2022 |

|---|---|---|---|

| Revenue (₹ Crores) | 2,473 | 1,484 | 422 |

| Net Profit/Loss (₹ Crores) | -1,644 | -1,347 | -1,279 |

User Growth and Engagement

- CRED’s monthly active user (MAU) base reached 13 million in November 2022. It has maintained a steady customer base of 13 million for 16 consecutive months, up to early 2024.

- By FY24, some reports estimated the total user base at 16 million. This reflects a year-on-year growth of about 58%. However, new user growth has remained stagnant for a while now.

- The average monthly transacting user performs around 20 sessions per month.

- CRED’s share in UPI transaction volume doubled from 0.5% to 1% between April 2023 and March 2024. Its share by value increased from 1.5% to 2.3% in the same period.

- As of March 2025, CRED processed 144 million UPI transactions. These transactions are worth ₹55,000 crore. It is now ranking seventh in UPI transaction volume in India.

Financial Performance

- Revenue rose sharply from ₹422 crore in FY22 to approximately ₹1,500 crore in FY23. It further increased to ₹2,473 crore in FY24.

- Operating losses went from ₹1,024 crore in FY23 to ₹609 crore in FY24. This was mainly due to reduced marketing and customer acquisition costs.

- Net losses increased modestly, from ₹1,347 crore in FY23 to ₹1,644 crore in FY24.

- CRED reduced its customer acquisition cost by approximately 80% over 4 years. It also achieved a 27% reduction in marketing expenses in FY23.

- Cash reserves stood at around ₹2,050 crore in FY23. This provides a runway for continued operations and growth.

Other Key Metrics

- The average value of UPI transactions on CRED declined from ₹13,000 in January 2022 to ₹3,400 in March 2024. This is mainly due to the platform diversifying into smaller merchant and utility payments.

- CRED’s product expansion has increased cross-selling opportunities, although the core user base remains stable.

Major Achievements of CRED

CRED has been able to stand out due to its persistent efforts and strategic approach. Some of the major achievements of CRED that you must know are as follows:

- Rapid Revenue Growth: CRED’s revenue surged by 66% to ₹2,473 crore in FY24. It is estimated to reach around ₹3,000 crore in FY25, reflecting strong financial momentum.

- Large and Engaged User Base: By June 2024, CRED reported 13 million monthly active users and processed 144 million UPI transactions worth ₹55,000 crore in March 2025. This makes it the seventh-largest UPI payment app in India.

- Product Diversification: CRED evolved from a credit card bill payment platform into a financial super app. It is now offering UPI payments, utility billing, vehicle management, travel, wealth management, and loans against mutual funds.

- Strategic Acquisitions: The company expanded its portfolio by acquiring platforms like Happay (expense management), CreditVidya (lending), Spenny (investments), and Kuvera (wealth management).

- Strong Funding and Valuation Milestones: CRED became a unicorn within three years. It has raised over $1 billion from global investors. Also, despite a recent valuation reset to $3.5–$4 billion, it remains one of India’s most valuable fintech startups.

Read Also: Haldiram’s Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

SWOT Analysis of CRED

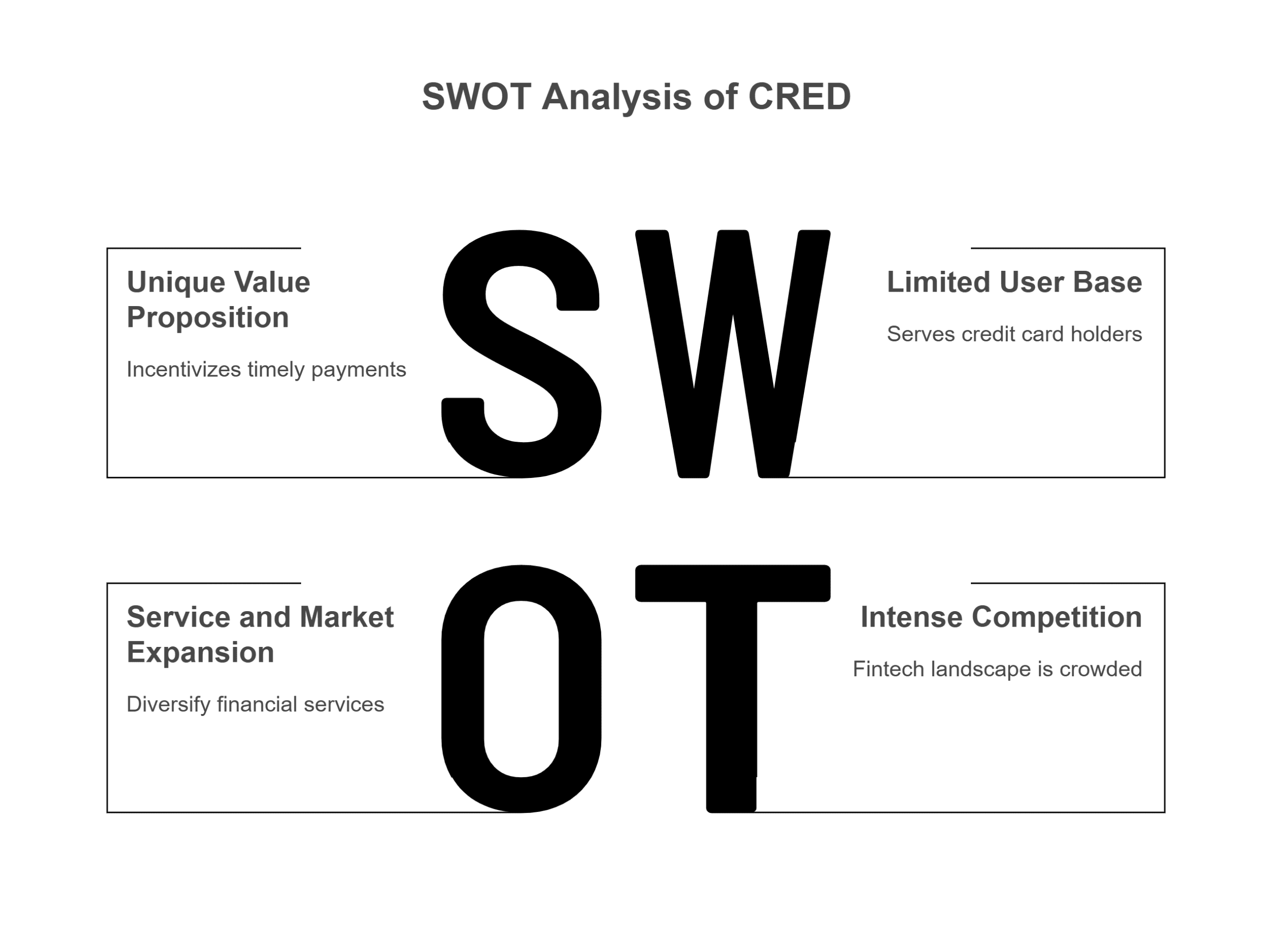

Now that you have all the basic details for CRED, let us complete a detailed SWOT analysis for better understanding. So, here are the things that you must know:

Strengths

- Unique value proposition: CRED incentivizes timely credit card bill payments with rewards. This fosters financial discipline and strong user engagement through gamification and exclusive offers.

- Strong brand identity and reputation: CRED is a premium and aspirational brand and is recognized for its innovative marketing strategies. It has created partnerships with leading brands.

- Loyal and affluent user base: The platform attracts high-credit-score users. This makes it appealing for premium partnerships and targeted financial products.

Weaknesses

- Limited user base: CRED primarily serves credit card holders. This excludes a large segment of the Indian population that doesn’t use credit cards.

- High dependence on rewards: User engagement is heavily tied to the attractiveness of rewards. So, if these diminish, user retention could suffer.

- Profitability challenges: Despite strong revenue growth, CRED remains loss-making, with high operational and marketing costs.

Opportunities

- Service and market expansion: CRED can diversify into personal loans, insurance, investments, and target non-credit card users (e.g., UPI, debit card holders).

- Data-driven personalization: Leveraging big data analytics and AI can enhance user experience and retention.

- Partnerships and international expansion: It can collaborate with e-commerce platforms and explore new geographies, unlocking new growth avenues.

Threats

- Intense competition: The fintech landscape is crowded, with new entrants and established players constantly trying to increase their market share.

- Regulatory risks: Changes in digital payments or credit card regulations could impact operations and growth.

- User fatigue: Over-reliance on rewards and gamification can lead to declining engagement as the novelty wears off.

Read Also: One MobiKwik Systems Case Study: Business Model, Financials & SWOT Analysis

Conclusion

CRED has transformed how creditworthy users manage their finances in India. By blending design, exclusivity, and financial tools, it has built a brand that feels aspirational yet useful. Its journey from bill payments to a full-fledged fintech platform reflects smart product offerings and bold marketing.

While profitability remains a challenge, strong revenue growth and product expansion indicate long-term promise. With IPO plans ahead, CRED’s next phase will test its ability to scale sustainably. Its story offers a clear example of how user trust, community, and consistency can shape success in the fintech space.

FAQs

What is CRED?

CRED is a fintech company that rewards users for paying credit card bills and offers lending, investment, and premium financial services.

Who can join CRED?

Only users with a credit score above 750 can join CRED, making it an exclusive platform for financially responsible individuals.

How does CRED make money?

CRED earns from lending, transaction fees, brand listings, financial product commissions, and B2B services.

Is CRED profitable?

Not yet. CRED has reduced losses and increased revenue. Yet, it is still working toward long-term profitability and financial stability.

What makes CRED different from other fintech apps?

CRED offers exclusive rewards and financial tools to users with high-credit scores, thereby promoting responsible financial behavior, making it different from other apps that promote discretionary spending.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle