| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-08-24 | |

| Add new links | Nisha | Feb-21-25 |

Read Next

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Bajaj Finserv and Bajaj Finance: Which is Better?

- CRED Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Haldiram’s Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- BHEL vs BEL -Best Defence and Manufacturing Sector Stocks

- Meesho Case Study – Key Stats, SWOT Analysis & Marketing Strategy

- Asian Paints vs Berger Paints – Which is Better?

- Maruti Suzuki India Vs Hyundai: Which Car Stock is Better?

- Devyani International Vs Sapphire Foods – Which is Better?

- Ather Energy Case Study: Business Model, Financials, and SWOT Analysis

- Blog

- elcid investments indias costliest stock from inr 3 to inr 236250 share price history

Elcid Investments – India’s Costliest Stock: From INR 3 to INR 2,36,250 – Share Price History

If you are an investor who regularly participates in the stock market, you probably might have heard of scenarios of if someone had invested INR 10,000 twenty years back in a particular stock, then the investor would have been a multi-millionaire by now. But what if we tell you that recently, a stock turned an investment of INR 10,000 into more than INR 70 crores, not gradually but overnight?

In this blog, we will provide an overview of Elcid Investments Ltd. and explain the reasons behind the recent price increase.

Elcid Investments Overview

In 1981, Elcid Investments Ltd. was established and registered with the Reserve Bank of India as a non-banking financial company. The company’s main business is investing in a range of securities, including mutual funds, shares, and debentures. The business is listed on the Bombay Stock Exchange. It has two subsidiaries, Suptaswar Investment & Trading Company Ltd. and Murahar Investments & Trading Company Ltd., both of which are registered with the RBI as non-banking financial corporations. The company’s main office is located in Mumbai.

Due to the firm’s significant dividends and the restricted supply of shares on the market, the stock price experienced a significant upward trend in early 2020, making the company a hidden gem for investors. The company’s promoters have made attempts to delist or repurchase shares at a base price of INR 1,61,203, but they were unsuccessful since they did not have public shareholder’s approval.

Latest News About Elcid Investments

When Elcid Investments’ share price surpassed that of MRF Limited, it became the most expensive stock on the Indian equity market and made headlines. The share’s price has jumped over 75,000 times overnight, which made the stock a topic of discussion among investors. The company was last traded on 21 June 2024 and closed at INR 3.55. The next time it was traded was on 29 October 2024, and the stock price closed at INR 2,36,250.

Elcid– Penny Stock to Most Expensive Stock

The story began when SEBI published a circular in June mentioning the use of a price mechanism called the Special Call Auction of Investment Holding Companies and Investment Companies to determine the companies’ fair prices. This circular aimed to lessen the price gap between holding companies’ book values and current market prices. There won’t be price bands in this auction.

The company consistently pays large dividends to its owners, which attracts investors. Since the company paid out a dividend of INR 25 in August 2024 despite its share price being only INR 3, no investor was prepared to sell their holdings.

Back in 2013, when the share’s current market price was below 2.73 INR, the company’s promoters chose to delist the security and offered an alluring price of INR 11,455. However, according to SEBI laws, 90% of the public shareholders must approve of the offer to delist, and in this instance, the shareholders rejected it. The company recently made a delisting offer of INR 1,61,203 per share, but the investors also rejected this offer.

The company owns approximately 2.83% stake in Asian Paints, which is valued at 8,500 crores. The stock is still trading at a 45% discount to its intrinsic value of INR 4.25 lakh per share based on its position in Asian Paints.

Did You Know – Other than Elcid Investments Limited, only 30 stocks in India have share prices above INR 10,000. These businesses include MRF, Page Industries, Honeywell Automation India, and Shree Cement.

Market Details of Elcid Investments Ltd.

| Current Market Price | INR 2,36,250 |

| Market Capitalization (In INR Crores) | 4,725 |

| Book Value | INR 5,84,225 |

| 52 Week High | INR 2,36,250 |

| 52 Week Low | INR 3.37 |

| Face Value of Share | INR 10 |

| P/E Ratio (x) | 22.1 |

Read Also: Case Study of Petrol & Diesel Price History in India

Financial Statements of Elcid Investments

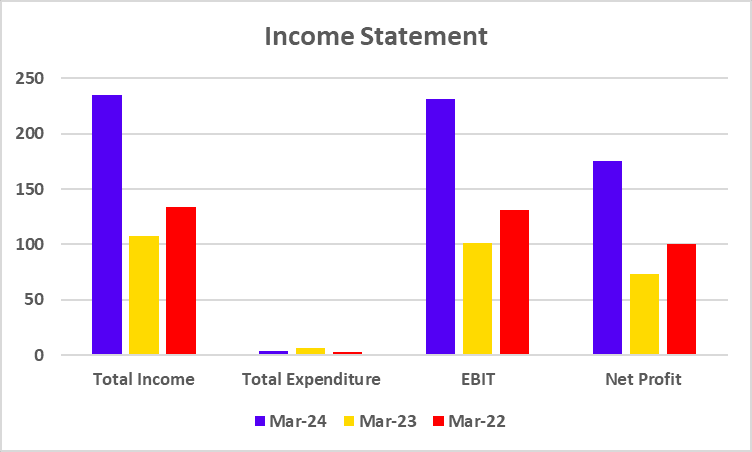

Income Statement

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Total Income | 235 | 108 | 134 |

| Total Expenditure | 4 | 6 | 3 |

| EBIT | 231 | 101 | 131 |

| Net Profit | 175 | 73 | 100 |

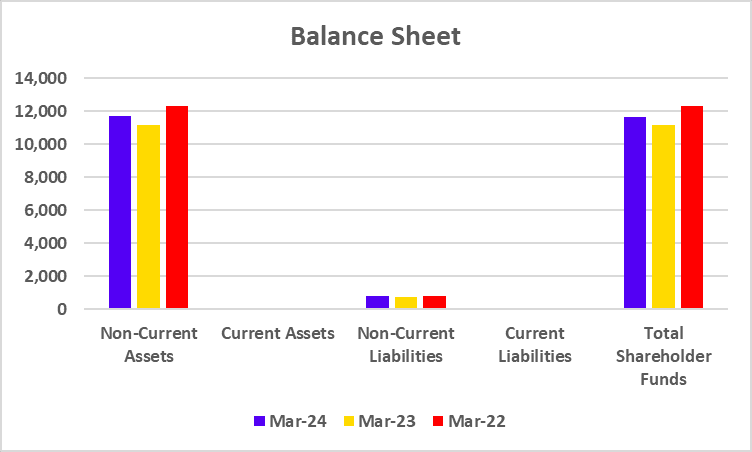

Balance Sheet

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Non-Current Assets | 11,695 | 11,191 | 12,342 |

| Current Assets | 95.71 | 73.20 | 21.47 |

| Non-Current Liabilities | 786 | 744 | 835 |

| Current Liabilities | 106 | 71.76 | 34.94 |

| Total Shareholder Funds | 11,685 | 11,192 | 12,329 |

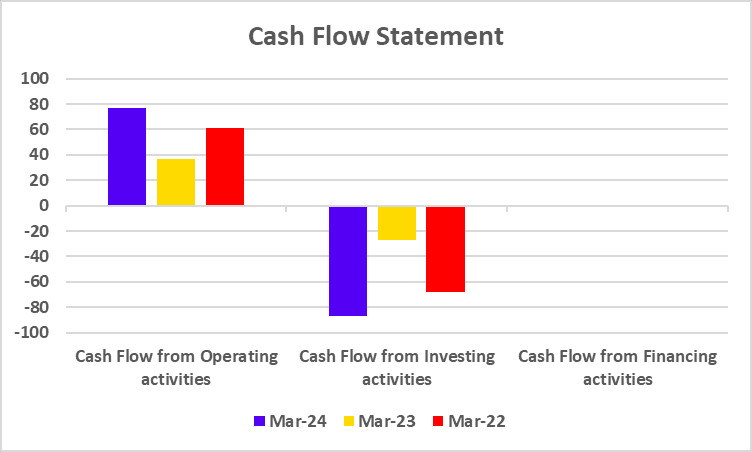

Cash Flow Statement

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Cash Flow from Operating activities | 77 | 37 | 61 |

| Cash Flow from Investing activities | -87 | -27 | -68 |

| Cash Flow from Financing activities | 0 | 0 | 0 |

Key Performance Indicators (KPIs)

| Particulars | March 2024 | March 2023 | March 2022 |

|---|---|---|---|

| Operating Profit Margin (%) | 98.43 | 93.68 | 97.24 |

| Net Profit Margin (%) | 74.69 | 67.43 | 74.22 |

| Return on Net Worth/Equity (%) | 1.5 | 0.65 | 0.81 |

| ROCE (%) | 1.85 | 0.85 | 0.99 |

| Return on Asset (%) | 1.40 | 0.61 | 0.75 |

Read Also: Hyundai Motor India Case Study: Business Model, Financial Statements, And SWOT Analysis

Conclusion

Elcid Investments has experienced exponential growth in recent years because it owns a 2.83% stake in Asian Paints. However, because of the market’s limited liquidity, the share prices do not reflect the company’s fair value. As a result, even after the call auction, the company is still trading below its fair value. Investors may find it challenging to buy this stock because of its low liquidity. However, investors must consult their investment advisor before making any investment.

Frequently Asked Questions (FAQs)

Where is the headquarters of Elcid Investment Limited?

The headquarters of Elcid Investment Limited is situated in Mumbai.

What caused the increase in the share price of Elcid Investments?

The BSE’s unique call auction mechanism, which enables firms to find a reasonable price without a price band, caused the share price of Elcid Investment Ltd. to soar on 29 October 2024.

Why does Elcid Investment Ltd. share have low liquidity?

The company’s share price has low liquidity as it declares high dividends and trades below its fair value, which is why investors are not willing to sell their holdings.

Is Elcid Investment the costliest stock in India?

Elcid Investment Ltd.’s share price is valued at INR 2,36,250, making it the costliest stock in India as of 29 October 2024.

Who are the major investors in Elcid Investment Ltd.?

The promoters of Asian Paints hold around 75% stakes in Elcid Investments Limited, and other shareholders, such as Hydra Trading Pvt. Ltd., hold around 9.04% stake.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle