| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-26-25 |

Read Next

- Difference Between Mainboard IPO and SME IPO

- Bharat Coking Coal IPO Allotment Status Check Online: GMP, Subscription, Price, and & Key Highlights

- Bharat Coking Coal IPO Day 2: Subscription at 33x, GMP Jumps to ₹10.85

- What is Pre-IPO Investing?

- What is Prospectus?

- ICICI Prudential AMC IPO Allotment Status: Check Latest GMP, Steps to Verify Status

- ICICI Prudential AMC IPO Day 2: Subscription at 2.02x, GMP Jumps to ₹268

- What is SME IPO?

- Meesho IPO Allotment Status: Check Latest GMP, Steps to Verify Status

- Aequs Ltd. IPO Allotment Status: Check Latest GMP, Steps to Verify Status

- Meesho IPO: 8.26x Subscription on Day 2, GMP ₹44.5 & Key Details

- Aequs Ltd. IPO GMP Today: Subscription Status, Allotment Dates & Details

- What is a Deemed Prospectus?

- What is Oversubscription in IPOs?

- Groww (Billionbrains Garage Ventures Ltd.)IPO Allotment Status, GMP, Subscription & Listing Date

- Top 10 Most Highest Subscribed IPOs in India

- Lenskart Solutions IPO Allotment Status, GMP, Subscription & Listing Date

- Studds Accessories IPO Allotment Status: Check Latest GMP, Steps to Verify Status

- Top 10 Largest IPOs in India

- What is a Confidential IPO Filing?

What is IPO Listing Time?

IPO is one of the most important events for a company as it marks the first time the company’s shares are offered to the general public. The company is said to have gone public after the IPO as retail investors also get a chance to own shares in the company and become a part of its future growth story. There are certain timelines defined by the SEBI regarding the listing of IPO.

In this blog, we will explain the IPO listing timeline and its process to you.

What is an IPO?

An IPO, or Initial Public Offering, is a process through which a company raises money from the public by offering them shares. After the IPO, the company becomes a publicly listed company, and its shares are traded on the stock exchange. The company can raise money from the public to pay off its debt, for expansion, etc.

But what happens on the first day the company’s shares are about to get traded on the stock exchange? Let’s look at the whole process that takes place on the listing day in detail.

IPO Listing Timeline on the Listing Day

The time of the IPO listing is as follows:

| Phase of Trading | Particulars | Timing |

|---|---|---|

| Pre-Market | During the pre-market session, the limit orders are placed by the investor. During pre-market order timing, the Indicative Equilibrium Price (IEP) changes based on the orders placed by the investors. | 9:00 AM to 9:45 AM |

| Order Matching and Execution | Based on the final Indicative Equilibrium Price, the exchange will calculate the opening price of the Stock. | 9:45 AM to 9:55 AM |

| Buffer Session | During the buffer session,the exchange ensures that the market can smoothly transit from order matching and execution session to regular trading session. | 9:55 AM to 10:00 AM |

| Normal Trading | This is also known as the “Bell Ringing” session, after which the regular trading session begins, and investors can now start trading. | At 10 AM |

Read Also: What is the IPO Allotment Process?

IPO Listing Process in India

The listing of an IPO in India involves various steps, details of which are as follows:

- Appointment of Merchant Banker: Once the company decides that it wants to list itself on the stock exchange, it appoints an investment banker, who completes all the regulatory formalities related to listing, ranging from compliance to preparing the DRHP.

- Filing of DRHP: During this step, the company files a DRHP or Draft Red Herring Prospectus with the Securities and Exchange Board of India (SEBI) and waits for its approval.

- Selection of Stock Exchange: In this step, the company decides the exchange on which it wants to get its shares listed.

- Pricing: In this, the lead managers determine the offer price based on the market demand.

- Marketing: Once the price is decided, a marketing campaign is launched to promote the IPO.

- Issuing the Prospectus: The final prospectus, known as the Red Herring Prospectus or RHP is issued, which includes the offer price range.

- Opening for Subscription: The IPO opens for different categories of investors for a defined period of three days.

- Allotment: Once the IPO subscription period is closed, the shares are allotted to the successful bidders based on a lottery system.

- Refund: Those who do not get any shares during the IPO allotment, the amount refunded to them within 7-10 working days.

- Listing: After the completion of the allotment process, the company’s shares are listed on the respective stock exchanges. Once listed, they are available for trading.

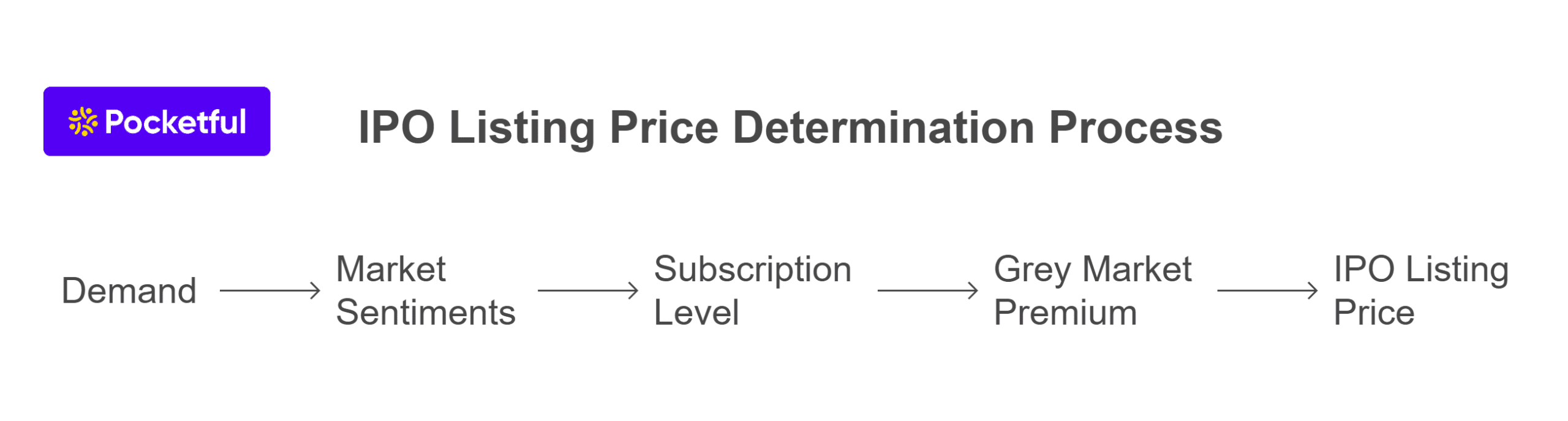

How is the IPO Listing Price Determined?

There are several factors based on which the pricing of an IPO is determined; a few of such key factors are mentioned below:

- Demand: If an IPO has high demand during the subscription phase, it might lead to a high premium on listing.

- Market Sentiments: Current market trends play an important role in determining the listing price of an IPO. If the market is in a bullish trend, it can lead to high listing prices due to bullish investor sentiment.

- Subscription Level: During the IPO subscription process, if the subscription figures are on the lower side, it might lead to lower listing premiums or even list at a discount. On the other hand if the IPO is oversubscribed, then it indicates positive investor sentiment towards the IPO and the shares may list at a premium.

- Grey Market Premium (GMP): The GMP in the unofficial metric that tells us about the expected premium at which the share may list. Grey market gives us a good idea about the listing price of the IPO shares. If GMP is higher, the IPO is expected to list at a premium and vice-versa.

Read Also: What is Grey Market, and How Are IPO Shares Traded?

IPO Issue Price vs IPO Listing Price

The definitions of IPO issue price and IPO listing price is listed below:

IPO Issue Price: It is a price at which the company offers shares to the general public. This price can be determined through fixed-price or book-building methods.

IPO Listing Price: It is the price at which the company’s shares get listed on a stock exchange. In simple terms, we can say that at this price, the shares started trading for the first time on the exchange.

Conclusion

On a concluding note, an IPO priced fairly offers an investor a great opportunity to earn listing gains, but one should have information about the IPO process. Generally, traders invest in IPO only to get the listing gains. However, if you are a seasoned investor or trader, you must stay updated on the IPO schedule as investing in an IPO carries certain risks, Therefore, it is advised to consult your investment advisor before making any investment decision.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Anchor Investors in IPOs – Meaning, Role & Benefits |

| 2 | Apply in IPO Through ASBA- IPO Application Method |

| 3 | Why Invest in an IPO and its Benefits? |

| 4 | IPO Application Eligibility Criteria: |

| 5 | What is the IPO Cycle – Meaning, Processes and Different Stages |

Frequently Asked Questions (FAQs)

At what time does trading in an IPO start?

The trading in the IPO begins at 10:00 AM on the scheduled listing date after all the regulatory formalities are completed.

Can I sell my stock on the listing day?

Yes, you can easily sell stocks allotted to you on the scheduled listing day like any other ordinary stock.

What is the impact of pre-open sessions on IPO listings?

The pre-open session starts from 9:00 AM, and the trading starts in the IPO from 10 AM. During this period, the demand and supply might influence the listing price of the IPO.

What is the duration of an IPO’s subscription period?

Generally, IPOs are open for subscription for 3 working days.

Can an IPO list below the issue price?

Yes, an IPO can list the issue price below, as the listing price depends on various parameters such as market sentiments, demand for the IPO, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle