| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-25-25 | |

| Add new links | Nisha | Sep-05-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Bajaj Finserv and Bajaj Finance: Which is Better?

- Blog

- rapido case study

Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

Rapido is a leading Indian two-wheeler ride-hailing service that launched in 2015 and is now active in over 100 cities. The platform offers services like bike-taxi, auto-rickshaw, parcel delivery and operates on an asset-light model.

In this Rapido case study, we will try to understand the Rapido Business Model, marketing strategy of Rapido, financial analysis of Rapido and SWOT analysis of Rapido in detail.

Rapido: An Overview

Rapido was launched in October 2015 when three youngsters Aravind Sanka, Pavan Guntupalli, and SR Rishikesh previously ran a logistics platform, the Karrier. While this option was stable, scaling was difficult. They realised that two-wheelers (motorcycles) account for nearly 75% of vehicles in India, and could make for a much faster, cheaper option. This insight led them to launch ‘Rapido’ a bike‑taxi platform.

Market Context : At the time, India was dominated by big players like Ola and Uber, but these were focused on four-wheelers. The country had traffic jams, expensive travel, and insufficient public transport. Rapido has introduced an asset‑light, two-wheeler-based, last‑mile solution to provide affordable and faster travel, especially in Tier‑2, Tier‑3 cities.

Rapido has achieved several key milestones:

- Expansion across cities: Rolls out to 100+ cities by 2022

- Unicorn status: Becomes a Unicorn with a $200 million Series E funding round in September 2024; valuation recorded at $1.1 billion

- Financial progress: Revenues rise to ₹648 crore in FY24 (₹443 crore in FY23), and losses narrow to ₹370 crore (₹675 crore in FY23)

Some of the key metrics of Rapido are shown in the table below:

| Metric | Data |

|---|---|

| Revenue (FY24) | ₹648 crore (increased from ₹443 crore FY23) |

| Losses (FY24) | ₹370 crore (decreased from ₹675 crore) |

| Gross Order Value (GOV) FY24 | ₹4,257 crore (from ₹2,419 crore FY23) |

| Ride Orders (FY24) | Around 44.50 crores rides (increased from 30.7 crores FY23) |

| Cities of Operation | 100+ cities |

Rapido Business Model

Rapido is a bike taxi aggregator that is rapidly transforming local transportation in India’s urban and semi-urban areas. Its model is based on a tech-enabled, asset-light, two-sided marketplace – where there are customers (riders) on one side and bike drivers (Captains) on the other. Rapido connects the two through a seamless mobile app.

- Aggregator Platform – No vehicle, just technology : Rapido does not own any bike. It is a platform-based aggregator that provides services through other people’s bikes. Captains register on the app with their documents and bikes and then accept on-demand rides. The entire system is managed by the app and GPS tracking.

- Asset-Light Model Low Cost, High Scale : Rapido’s business model is based on an asset-light structure, i.e. the company does not buy any bikes itself. This keeps its fixed cost very low and it can start its operations in new cities very quickly.

- Hyperlocal Market Focus Small cities, big scope : Rapido’s strategy is not limited to metro cities only. It has also launched its service in small and medium cities, where there is a demand for local transport but there is a lack of organized solutions. With this hyperlocal penetration, Rapido has gained early-mover advantage in markets with less competition.

Rapido Earns – How does revenue come about?

Rapido makes money from multiple sources:

- Per Ride Commission : Rapido takes a commission of around 15% to 20% on every ride. The rest of the money goes to the driver’s account.

- Surge Pricing : When demand is high (peak hours, festivals), the price of the ride increases, which gives more revenue to the company.

- Rapido Local & Delivery : Rapido has now added delivery services to its platform, such as sending parcels, groceries or office documents. This has added a new revenue stream.

- Subscription Plans : Monthly subscription plans have also been introduced for frequent users in some metro cities, which gives discounts to the users and assured income to the company.

- Brand Collaborations & Ads : Rapido also earns through in-app advertising and promotional campaigns in collaboration with other brands on its app.

Read Also: Ola Electric Case Study: Business Model, Financials, and SWOT Analysis

Marketing Strategy of Rapido

1. Brand Positioning & Messaging

Rapido has positioned itself as “India’s Bike-Taxi Disruptor” with a focus on affordability, faster service, and local connect. Their tagline “Bike Wali Taxi, Sabse Asaan” with simple messaging assures users that getting a ride is now easy and affordable.

2. Digital & Social Media Marketing

- Social Campaigns: Rapido ran campaigns like #GoRapido and #NoStressSawari that presented real-life problems of daily commute in a relatable way.

- Influencer Marketing: Collaborated with regional content creators to increase reach to local audiences.

- App Optimization: App store optimization, push notifications, and personalized deals were used to drive user engagement and retention.

3. Celebrity Branding

In 2023, Ranveer Singh was made the brand ambassador. Catchy ads like “Smart ho toh Rapido” were launched with him which especially appeal to the youth. In 2024-25, campaigns were made more relatable by adding local actors and influencers from small cities.

4. On-ground Strategy

- Focus on small cities : Rapido initially chose those cities where bike usage was already high. The youth and delivery agents there were made “Captains”.

- Referral Bonus : People who had already joined were given a bonus for bringing their friends this increased both trust and network rapidly.

- Local Branding : On-ground branding at places like railway stations, petrol pumps and local markets made the brand familiar in the eyes of the people.

5. Go-To-Market Plan for Food Delivery

- One App, Two Jobs : Rapido integrated ride as well as food delivery in the same app so that users do not have to open separate apps.

- Low Commission Strategy : While Zomato/Swiggy charge a hefty commission, Rapido charged only half the amount from restaurants. This helped more vendors to join.

- Tier-2/3 Cities Onboarding : In small cities, local dhabas and restaurants were onboarded as quickly as possible by offering zero commission or ₹25 fixed delivery charge.

6. Multi-Modal Mobility & Partnerships

Rapido did not limit itself to just one bike-taxi app. They collaborated with big entities like DMRC and ONDC to create pickup/drop zones at metro stations and also introduced features like metro ticket booking.

Financials Analysis of Rapido

Financial Metrics

| Financial Metrics | FY 2024 | Q2 FY25 |

|---|---|---|

| Revenue (₹ in crores) | ₹648 crore (46% YoY growth) | — |

| Net Loss (₹ in crores) | ₹370 crore (down by around 45%) | ₹17 crore (drop from ₹74 crore) |

| GOV (Gross Order Value) | ₹4,257 crore | ₹2,461 crore (2.5x of Q2 FY24) |

Rapido has shown rapid growth in the past years. The company’s total revenue in FY24 was ₹ 648 crores, which is about 46% more than last year (₹ 443 crores). During the same period, the company has also reduced its losses, the loss was ₹ 675 crores in FY23 which reduced to ₹ 370 crores in FY24.

Rapido’s Gross Order Value (GOV) also doubled to ₹ 4,257 crores in FY24. The main reason for this GOV growth was the increasing demand for the company’s services and expansion in tier-2/tier-3 cities.

Read Also: Blinkit Case Study: Business Model, Financials, and SWOT Analysis

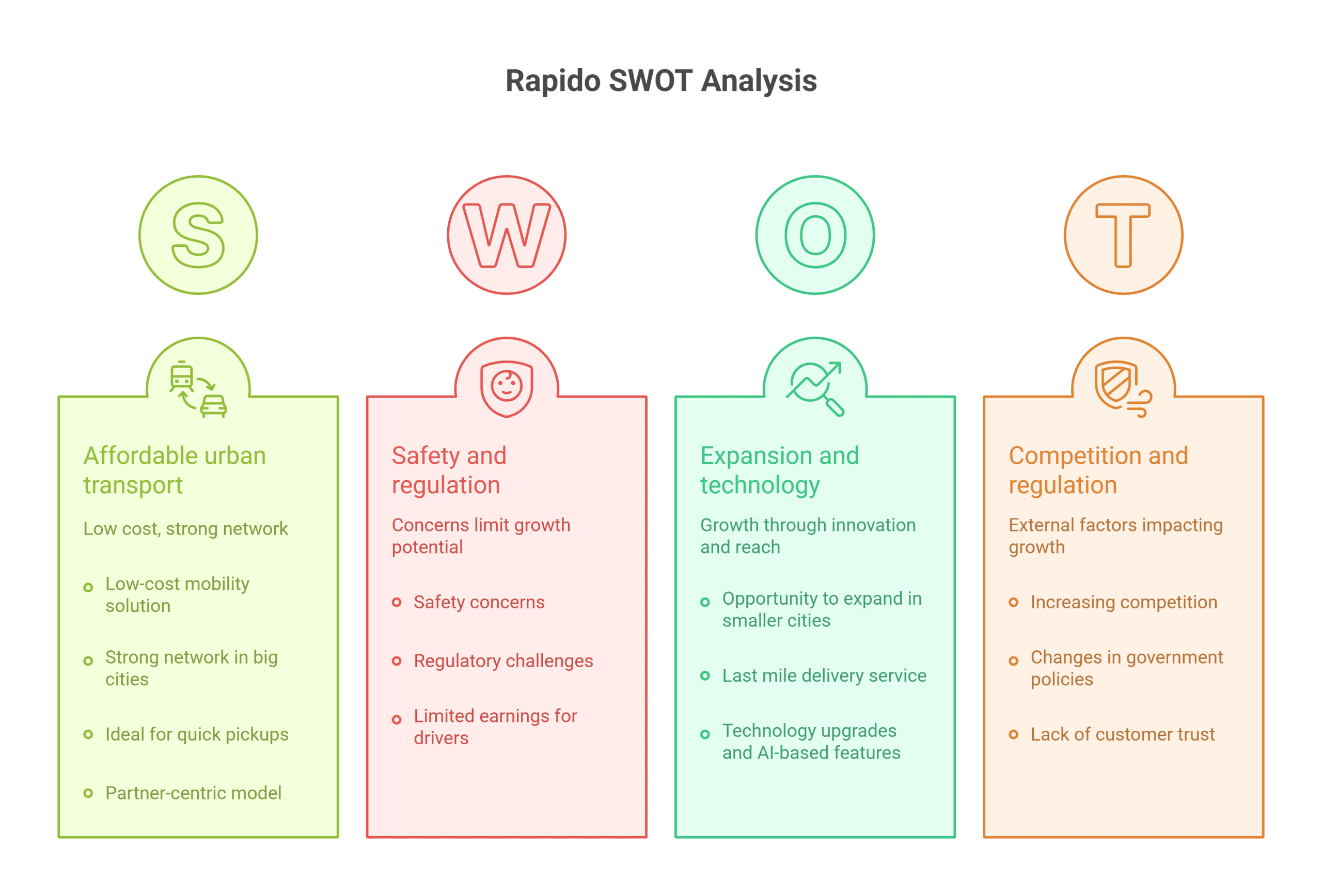

SWOT Analysis of Rapido

Strengths

- Low-cost mobility solution: Rapido offers an affordable option for two-wheeler riding, which is a better option for users troubled by traffic in metros and big cities. Its rides are much cheaper than taxis or autos.

- Strong network in big cities: Rapido has made its presence felt in 100+ cities in India, including metro cities like Delhi, Bangalore, Hyderabad and Chennai. Its driver network is also constantly growing.

- Ideal for quick pickups and short distance rides: Rapido is a fast, convenient and reliable medium for short distance trips. The bike easily passes through the traffic, which saves time.

- Partner-centric model: Rapido offers flexible timings, good incentives and an easy joining process to its captains (drivers), which helps it attract more riders to the platform.

Weaknesses

- Safety concerns: Bike rides have less safety than taxis, especially for women or in bad weather. This makes many users reluctant to book a ride.

- Regulatory challenges: Many states do not have clear rules regarding bike taxis or they are banned. This affects the company’s growth.

- Limited earnings for drivers: Due to excessive competition and cheap rates, the earnings of drivers are limited, which can make it difficult for them to remain associated with the platform.

Opportunities

- Opportunity to expand in smaller cities: Rapido can now enter tier 2 and tier 3 cities where there is a lack of public transport and there is a demand for cheap rides.

- Last mile delivery service: Rapido can also quickly enter the last mile delivery market through its logistics service “Rapido Local”.

- Technology upgrades and AI-based features: Using AI and data analytics, Rapido can perform route optimization, user personalization and safety enhancement.

Threats

- Increasing competition: Increasing competition from Ola, Uber and new local startups can affect Rapido’s market share.

- Changes in government policies: If state governments ban bike taxis, Rapido’s operation capacity may decrease.

- Lack of customer trust: Many users consider bike taxis to be less safe, which makes it difficult to build brand trust.

Conclusion

Rapido has changed the way of commuting in cities with less cost, less time and less hassle. This has become a big relief especially for the middle class and students. However, obstacles like legal policy and regulation still stand in its way. But the way the company has grown rapidly, focused on technology and won the trust of the people shows that it has the strength to run for the long haul. If it gets policy support, Rapido can become a big name in India’s mobility sector.

Frequently Asked Questions (FAQs)

Who is the CEO of Rapido?

The CEO of Rapido is Aravind Sanka, who is also the co-founder of the company.

Who owns Rapido?

Rapido is owned by its three founders Aravind Sanka, Rishikesh SR and Pavan Guntupalli and some investors.

Who invested in Rapido?

Rapido has investments from several major investors, such as WestBridge Capital, Nexus Venture Partners, and Swiggy has also made strategic investments.

Can anyone become a Rapido rider?

Yes, if you have a bike, valid license and required documents then you can register.

What makes Rapido different from Ola or Uber?

Rapido primarily provides bike riding service, which is fast, affordable and convenient in traffic.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle