| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-27-25 |

Read Next

- Future Industry in India 2026

- What is Auction Market?

- Top Green Hydrogen Stocks in India

- Ashish Dhawan Portfolio : Top Holdings, Strategy & Lessons

- Top 10 Wind Energy Stocks in India

- Aluminium Price Predictions for Next 5 Years in India

- Zinc Price Predictions for Next 5 Years in India

- Best Sectors to Invest in Next 10 Years in India

- Why Tobacco Stocks Are Falling in India: ITC, Godfrey Impact

- Copper Price Predictions for the Next 5 Years in India

- Book Value vs Market Value of Shares: Meaning, Formula & Key Differences

- Why Share Market is Down Today? Reasons Behind Stock Market Fall

- Steel Price Predictions for the Next 5 Years in India

- What are Bond ETFs?

- Best ULIP Plans in India

- Difference Between Shareholders and Debenture Holders

- Nifty 50 vs Nifty 500: Which Is Better

- Big Bulls of Indian Stock Market: The Complete List

- Best Sugar Stocks in India

- What Is a Ponzi Scheme? Meaning, Scam & India Laws

- Blog

- top 10 mnc companies in india

Top 10 MNC Companies in India

India’s rapid economic growth has made it a hub for leading multinational companies and global business talent. These firms bring with them cutting-edge technology, global knowledge, and strong financial resources which helps in improving employment opportunities, economy, and life in general in a country.

In this blog, we will look at the top 10 multinational companies in India and how they aid in the advancement of the country.

What are MNC Companies?

Multinational companies (MNCs) as defined by the Foreign MNC Policy 2005 are the companies established or registered in two or more countries and have facilities, offices and subsidiaries in different regions. They have their headquarters in one country but run offices, factories, or stores in different countries.

MNCs are known for their strong brand image, high-quality products, and global business operations. In India, MNCs play a critical role in sectors like information technology, automobile, consumer products, etc. by providing employment and innovative products and services, and foreign capital in the country’s economy.

Top 10 Multinational Companies in India

| Company Name | Current Price (₹) | Current Price (₹) | 52 Week High (in ₹) | 52 Week Low (in ₹) |

|---|---|---|---|---|

| Reliance Industries | 1,507 | 20,39,614 | 1,609 | 1,115 |

| Bharti Airtel | 2,015 | 12,09,167 | 2,025 | 1,408 |

| Infosys | 1,618 | 6,72,037 | 2,007 | 1,307 |

| ITC Limited | 420 | 5,25,468 | 495 | 390 |

| Larsen & Toubro | 3,691 | 5,07,625 | 3,964 | 2,965 |

| HCL Technologies | 1,730 | 4,69,464 | 2,012 | 1,303 |

| Sun Pharmaceuticals Industries | 1,671 | 4,00,929 | 1,960 | 1,498 |

| Wipro | 268 | 2,80,869 | 325 | 225 |

| Indian Oil Corporation Ltd | 147 | 2,07,229 | 186 | 111 |

| Tata Steel Ltd. | 162 | 2,02,296 | 178 | 123 |

Read Also: 10 Top Companies in India by Market Capitalization

Overview of the Top 10 Multinational Companies in India

An overview of the top 10 multinational companies in India is given below:

1. Reliance Industries

Reliance Industries Ltd Is the largest private sector company in the country and was established by Dhirubhai Ambani in 1958. It started as a textiles business and over the years expanded its business operations to petrochemicals, refining, telecom, retail, and energy. After his death, Dhirubhai Ambani’s two sons, Anil and Mukesh Ambani, split up the company. Under Mukesh Ambani’s leadership, the company has soared to new heights by branching out into several sectors, including retail, telecommunications, entertainment, etc. The company’s headquarters is in Mumbai.

Read Also: Reliance Industries Case Study

2. Bharti Airtel

Bharti Airtel Ltd It is a prominent telecom company in the world, was founded by Sunil Bharti Mittal in 1995. It started offering mobile services in Delhi and has now expanded to 18 countries in South Asia and Africa and has over 550 million subscribers. The company has also expanded and diversified from wireless broadband to offer digital payments and various enterprise grade solutions. Some of its key brands include Airtel, Wynk Music, Airtel Xstream, etc. offering mobile, broadband, DTH, payments, digital banking and data services.

Read Also: Bharti Airtel Case Study

3. Infosys

Infosys Ltd was founded in 1981 in Pune and over the years has expanded its business operations in more than 50 countries, delivering IT consulting, outsourcing, and digital transformation services to clients worldwide. The company is renowned for its expertise in artificial intelligence, cloud, and automation solutions. As of 2025, Infosys employs over 340,000 professionals globally, making it one of the largest IT services companies in the world. The company is headquartered in Bengaluru.

Read Also: Infosys Case Study

4. ITC Limited

It is a diversified conglomerate founded in 1910 and headquartered in Kolkata. ITC operates across multiple sectors including FMCG, hotels, paperboards, packaging, agribusiness, and information technology. The company began operating in the hospitality industry in 1975, opening its first hotel in Chennai. In 2001, the company entered the branded packaged foods industry, selling items such as biscuits, noodles, and confectionery. ITC Limited has been using renewable sources of energy to meet nearly 50% of its energy needs. Internationally, ITC exports its products to over 90 countries and has established a global presence through its agri and FMCG businesses.

Read Also: ITC Case Study

5. Larsen & Toubro

In 1938, two Danish engineers, Henning Holck-Larsen and Soren Kristian Toubro, started L&T. It now operates as an Indian multinational company with a strong foothold in technology, engineering, construction, manufacturing, and financial services. L&T was among the first first companies to import machinery and later ventured into manufacturing and construction, becoming one of the key players in India’s industrial and infrastructural growth. It has been instrumental in completing landmark projects like India’s airports, metros, and nuclear power plants. The L&T Group comprises 5 associates, 97 subsidiaries, and 15 joint ventures. Its headquarters are located in Mumbai.

Read Also: Larsen & Toubro Ltd Case Study

6. HCL Technologies

HCL Technologies Founded in 1976 by Shiv Nadar, the company is now one of the biggest IT service firms. Originally focused on hardware, HCLTech shifted its focus in the 1990s to software and IT services. Today, the company provides IT, engineering, cloud, and digital services and operates in over 60 countries, with more than 200 delivery centers and 150 innovation labs worldwide. Its clientele spans diverse industries, including banking, healthcare, automotive, telecommunications, and retail. It has its headquarters in Noida.

Read Also: HCL Technologies Case Study

7. Sun Pharmaceuticals Industries

Sun Pharmaceuticals Industries It is a global pharmaceutical company, founded by Dilip Sanghvi in 1983 and headquartered in Mumbai. Sun Pharma is the fourth largest generic pharmaceutical company in the world, with manufacturing and business operations in over 100 countries. The company is known for its strong presence in the US, Europe, and emerging markets, and it continues to expand its global footprint through acquisitions and partnerships. The corporation operates 43 manufacturing sites and complies with regulations set forth by several regulatory bodies, including the Pharmaceutical and Medical Devices Agency (PMDA) in Japan, the European Medicines Agency (EMA), and the US Food and Drug Administration (FDA).

Read Also: Sun Pharma Case Study

8. Wipro

Founded in 1945 as a vegetable oil company based in Amalner, Wipro shifted its focus towards the IT sector during the 1980s. Now it is the leading global IT, consulting and business process firm with its headquarters in Bengaluru. The company has a workforce exceeding 2,34,000. In 1999 it became one of the few Indian IT companies to be listed on the New York Stock Exchange. Wipro Ltd is headquartered in Bengaluru and offers its services in more than 65 countries.

Read Also: Wipro Case Study and Marketing Strategy

9. Indian Oil Corporation

It was originally incorporated as Indian Oil Company in 1959. Indian Oil Corporation was formed in 1964 through the merger of Indian Oil Company Ltd. and Indian Refineries Ltd. The company has interests in the entire hydrocarbon value chain ranging from exploration, refining, pipeline transportation and marketing petroleum products. Some of the well known brands and products include Indane (LPG), Servo lubricants and XTRAPREMIUM/XP100 (premium fuels).

Read Also: Indian Oil Case Study

10. Tata Steel

Tata Steel Ltd was established in 1907. Headquartered in Mumbai, the company has a rich legacy in India’s steel industry and played a key role in supplying steel to the defense sector during World War II. In a move to expand its global presence, it acquired Singapore-based NatSteel Holdings in 2004. Since then, it has completed multiple acquisitions both in India and abroad, the most recent being the acquisition of Bhushan Steel Limited in 2018.

Read Also: Tata Steel Case Study

Key Performance Indicators

| Company Name | Basic EPS (₹) | Operating Profit Margin (%) | Net Profit Margin (%) | ROE (%) | ROCE (%) |

|---|---|---|---|---|---|

| Reliance Industries | 51.47 | 13.50 | 8.37 | 8.25 | 8.70 |

| Bharti Airtel | 58 | 28.42 | 19.52 | 29.52 | 14.72 |

| Infosys | 64.50 | 23.32 | 16.41 | 27.87 | 35.85 |

| ITC | 27.79 | 35.66 | 46.38 | 49.61 | 36.41 |

| Larsen & Toubro | 109.36 | 10.33 | 6.91 | 15.39 | 14.89 |

| HCL Technologies | 64.16 | 20.42 | 14.86 | 24.96 | 30.84 |

| Sun Pharmaceuticals | 45.60 | 27.88 | 20.88 | 15.13 | 19.83 |

| Wipro | 12.56 | 21.26 | 14.80 | 15.94 | 19.03 |

| Indian Oil Corporation Ltd | 9.87 | 2.99 | 1.58 | 7.29 | 8.22 |

| Tata Steel Ltd. | 2.74 | 7.51 | 1.36 | 3.75 | 8.49 |

Factors to Consider before Investing in MNC Stocks

Various factors to consider before investing in MNC stocks are given below:

- Company Performance Metrics: Evaluate financial metrics such as profit margins, returns on equity, and debt levels. Strong financial numbers indicate possible growth in the future.

- Brand Recognition and Market Presence: Products and services of companies with established brands and significant market presence are in constant demand. A strong customer base helps the company earn stable revenues.

- Trends in the Industry and Sector: Assess the growth potential of the sector business operates in as well as the impact of economic cycles and changes in regulations.

- Management Structure and Corporate Policy: Experienced management and well-established governance policies helps companies deliver consistent performance over time.

- Dividends Policy: High dividends to shareholders makes investing in MNC stocks appealing for investors looking for passive income.

- Global Trends and Other factors: Evaluate global economic conditions, foreign currency risks, regulatory frameworks, and others factors that could impact the company’s performance.

Analyzing these factors in detail can help investors make better investment decisions and reduce risk when investing in the shares of multinational companies in India.

Read Also: Top Power Companies in India

Advantages and Disadvantages of Investing in MNCs

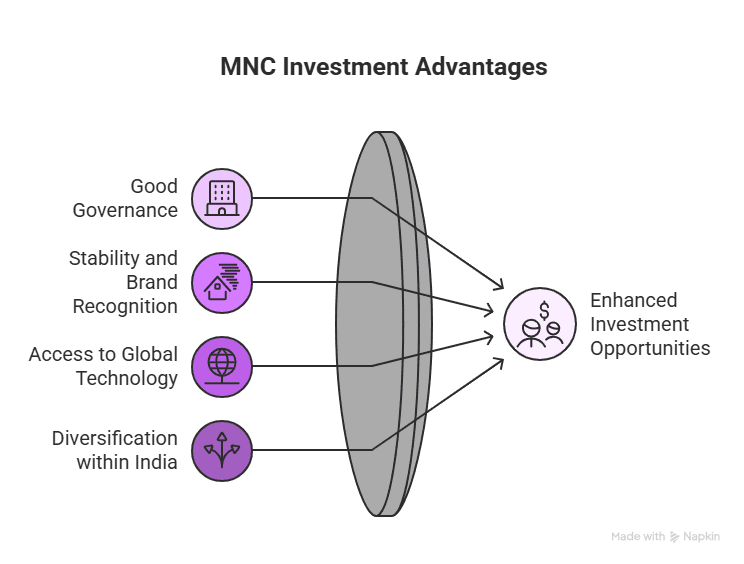

Advantages

- Good Governance: MNCs listed in India offer a good investment opportunity as they offer greater transparency to investors due to the strict corporate governance policies set by their parent companies according to the best practices worldwide.

- Stability and Brand recognition: These companies have a solid international presence and business model, helping them earn stable income streams and be resilient during economic downturns.

- Access to Global Technology & Expertise: Investors can obtain indirect exposure to sophisticated technology, research and development, and best global practices brought in by the MNCs, which can foster innovation and market leadership.

- Diversification within India: While listed in India, their global presence as well as their diversified product portfolios provide the investors a level of diversification.

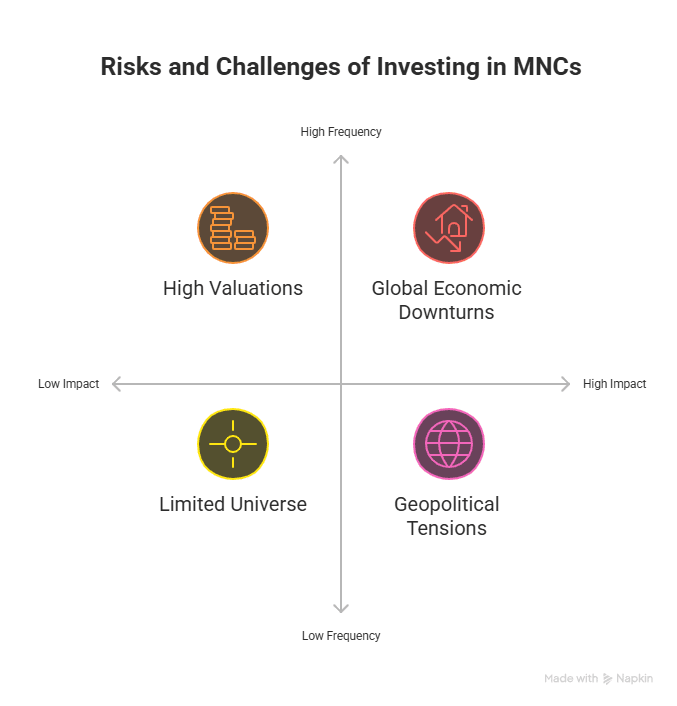

Disadvantages

- Limited Universe & High Valuations: MNC stocks available in India are relatively few in number, leading to a higher than average P/E ratio which makes these stocks expensive to buy.

- Global Headwinds Impact: These companies remain vulnerable to global economic downturns, geopolitical tensions, or shifts in trade policies that would impact operations worldwide. Moreover, operations in different countries results in foreign exchange risk, geopolitical risk, etc.

Advantages and Disadvantages of Investing in MNCs

Advantages

- Good Governance: MNCs listed in India offer a good investment opportunity as they offer greater transparency to investors due to the strict corporate governance policies set by their parent companies according to the best practices worldwide.

- Stability and Brand recognition: These companies have a solid international presence and business model, helping them earn stable income streams and be resilient during economic downturns.

- Access to Global Technology & Expertise: Investors can obtain indirect exposure to sophisticated technology, research and development, and best global practices brought in by the MNCs, which can foster innovation and market leadership.

- Diversification within India: While listed in India, their global presence as well as their diversified product portfolios provide the investors a level of diversification.

Disadvantages

- Limited Universe & High Valuations: MNC stocks available in India are relatively few in number, leading to a higher than average P/E ratio which makes these stocks expensive to buy.

- Global Headwinds Impact: These companies remain vulnerable to global economic downturns, geopolitical tensions, or shifts in trade policies that would impact operations worldwide. Moreover, operations in different countries results in foreign exchange risk, geopolitical risk, etc.

Conclusion

In conclusion, the foreign companies contribute significantly to the Indian economy by providing high quality goods and services and attractive investment returns due to their strong global presence. MNCs in India will continue to aid in the development of the Indian economy in the near future.

Multinational corporations (MNCs) significantly shaped India’s economy by creating jobs, foreign direct investment, and transferring information about modern technologies along with best practices across sectors. Their presence has bolstered infrastructure development, sparked homegrown innovation, and enhanced the participation of Indian firms in global supply chains. Given the bright economic future of India alongside favorable government policies, MNCs are positioned to increase the growth trajectory of the Indian economy and India’s competitive standing worldwide.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Different Types of Companies in India |

| 2 | Top Navratna Companies list in India |

| 3 | Fastest Growing Industries in India |

| 4 | List of Maharatna Companies in India |

| 5 | Miniratna Companies in India |

Frequently Asked Questions (FAQs)

What defines a multinational company (MNC)?

An MNC has operations in a number of countries and is involved in manufacturing or providing services in more than one nation.

What makes India attractive to MNCs?

Multinational companies are attracted to India due to its vast market, skilled human resources, and supportive business policies.

How do MNCs impact local businesses?

xcorporations encourage healthy competition which has mixed effects for local businesses. They create more business opportunities through service contracts or buying from local suppliers.

Does India have laws governing operations of multinational c ompanies?

Yes, foreign companies operating in India need to operate as per the relevant laws in India.

Can Indian companies become MNCs?

Definitely, numerous Indian companies are already operating in multiple countries and have become MNCs over the years.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle