| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-22-25 |

Read Next

- What is Commodity Valuation?

- Exchange of Futures for Physical (EFP)

- Top Major Commodity Exchanges in India

- The Pros and Cons of Commodity Trading

- What is the Commodity Index?

- Types of Commodity Market in India

- Tax on Commodity Trading in India

- Understanding Commodity Market Analysis

- Risks in Commodity Trading and How to Manage Them

- 5 Tips for Successful Commodity Trading

- Best Online Commodity Trading Platforms in India: Top 10 Picks for Traders

- Commodity Trading Regulations in India: SEBI Guidelines & Impact

- What is the Timing for Commodity Market Trading?

- Stock Market vs Commodity Market

- How to Trade in the Commodity Market?

- What is Commodity Market in India?

- What Is the National Commodity and Derivatives Exchange (NCDEX)?

Commodity Arbitrage – Types & Strategies in India

Commodity arbitrage is like playing a game of “buy low, sell high” — but across two markets at the same time. Usually, traders wait for a favorable price movement to exit their positions but this is not the case with commodity arbitrage. Traders spot price mismatches across different markets, strike fast, and turn price gaps into quick profit.

In this blog, we will explain the concept of commodity arbitrage in detail along with its types, advantages, risks, etc.

What is Commodity Arbitrage?

Commodity arbitrage is a method by which traders make profits by taking advantage of the difference in commodity prices in different markets. For example, if gold is available at a lower price in one place and at a higher price in other simultaneously, the trader buys gold from the market with lower price and sells it in the market with higher price. In this way, a good profit can be made without taking much risk.

Key features of Commodity Arbitrage

- Direct profit: When you get the goods at a lower price and sell them at a higher price, you can realize a quick profit.

- Increases Market Efficiency: Arbitrage reduces the price gap between different markets, making the market more transparent.

- Risk identification: A correct understanding of this helps traders avoid purchasing in overpriced markets and avoid potential losses.

Check Out – Commodities Screener

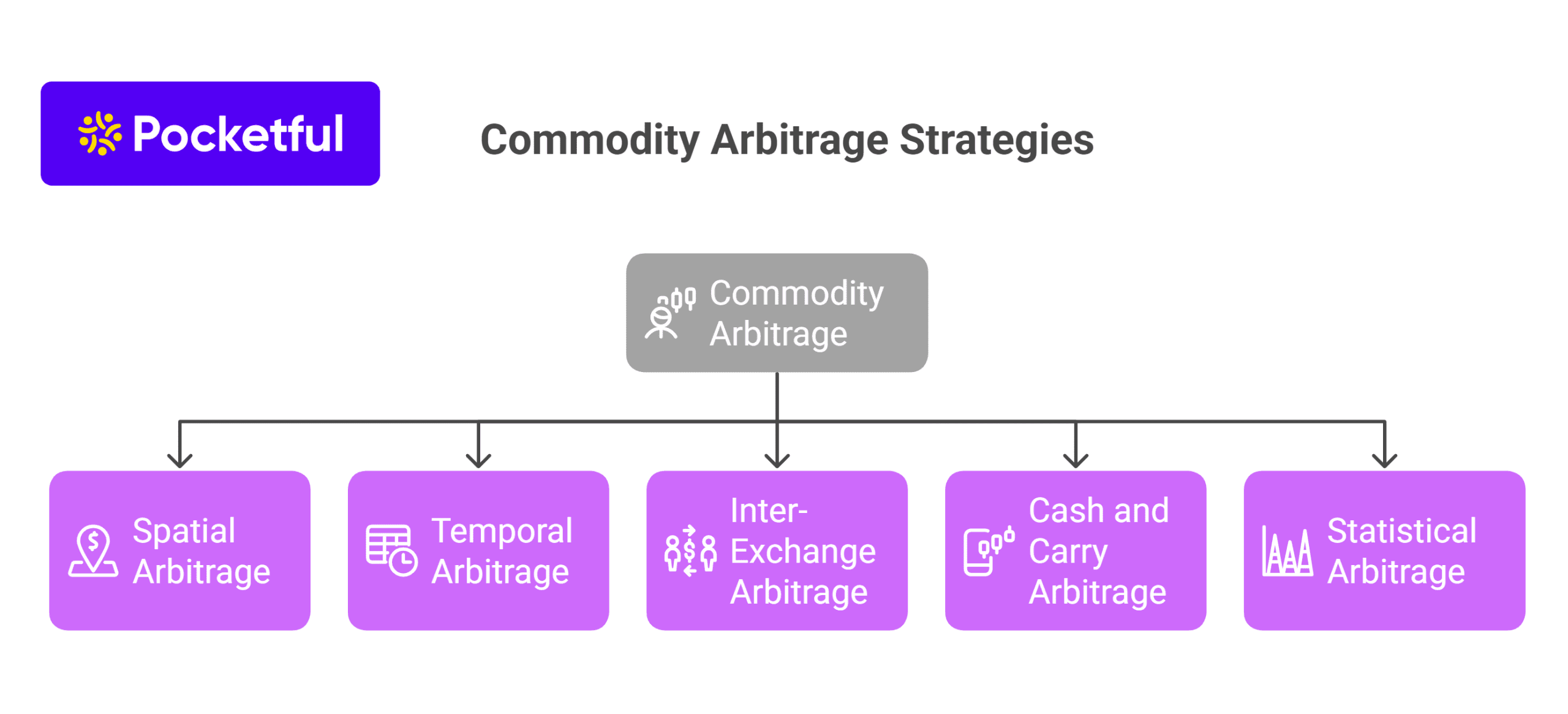

Types of Commodity Arbitrage

Different types of commodity arbitrage are listed below:

1. Spatial Arbitrage

Spatial arbitrage is a situation when the price of the same commodity is in different markets at different geographical locations. In this situation, traders buy the commodity from a place where the price is low and sell it where the price is high. In a country like India, where there are regional differences in taxes, transportation costs and demand-supply, this strategy can be particularly effective.

2. Temporal Arbitrage

Temporal arbitrage is a strategy to take advantage of changes in prices based on time. In this, traders buy a commodity when its price is low and sell it in the future, when the price rises.

For example, if the June contract of crude oil is cheap and the July one is expensive, then an experienced trader can make a profit from this price difference.

3. Inter-Exchange Arbitrage

Sometimes the price of the same commodity is different on two different exchanges such as MCX and NCDEX. By taking advantage of this price disparity, traders can make a profit by buying at a lower price on one exchange and selling at a higher price on the other. This strategy is usually more useful in agri commodities due to lower liquidity.

4. Cash and Carry Arbitrage

This strategy takes advantage of the difference in prices of the spot market and the futures market. In this, the trader buys the commodity in the spot market and sells (shorts) the same commodity in the futures market. It is effective only when the futures price is higher than the spot price. Make sure the difference between the spot and futures prices cover the carry cost (such as storage, financing).

5. Statistical Arbitrage

This is an advanced strategy in which traders take advantage of price imbalances using statistical and mathematical models. It often involves analysing the relationship between co-related commodities (such as copper and zinc) and trading in case of any divergence to make a profit. This strategy is more popular among quant traders using automated systems.

Read Also: Tax on Commodity Trading in India

Commodity Arbitrage Strategies in India

Here is a simple and accurate description of the major commodity arbitrage strategies used in India:

- Calendar Spread Arbitrage : This strategy seeks to profit from the price difference between two futures contracts of the same commodity with different expiry dates. Traders take a long position in one contract and a short position in the other.

- Inter-Commodity Arbitrage : This is applicable when price divergence is observed between two related commodities, such as crude oil and natural gas, or gold and silver, based on a historical or statistical relationship. If this relationship breaks temporarily, traders can profit by taking long positions in one commodity and short in the other.

- Regulatory Arbitrage : In India, regulatory arbitrage opportunities arise due to differences in regulations, tax structures, and delivery policies of different states or exchanges. Traders analyze such regulations and buy and sell in different markets so that the overall regulatory burden or cost is less. However, this strategy is adopted only by experienced traders and dealers.

- Algorithmic Trading : This is a modern technical strategy that uses programmed software and algorithms to spot arbitrage opportunities in the market in milliseconds. In this, traders automate their trades by using quantitative models, volume data, and price movements in real-time. This strategy can be extremely profitable in active commodity markets or exchanges such as MCX, provided the system’s speed is fast and transparent data feed.

All these strategies are designed keeping in mind the structure and trading behavior of the participants of the Indian commodity market.

Commodity Arbitrage Example

Suppose an experienced trader noticed a slight difference in the spot price of gold and futures price of Gold on MCX. This small difference can also give good profits with the right strategy and timing.

Gold Price in Spot Market: ₹97,000 per 10 grams

Gold Futures Price in MCX: ₹97,800 per 10 grams

Price difference: ₹800 per 10 grams i.e. ₹80,000 per kilogram

Trading process

- Spot the opportunity: The trader caught this difference in price and immediately prepared a trading plan.

- Purchase: He bought 1 kg of gold in the spot market at ₹97,000 per 10 grams for ₹97,00,000.

- Logistics and other expenses: Suppose the total cost including transport, insurance, GST etc. is about ₹10,000.

- Sale: He also sold one Gold Futures contract trading at ₹97,800 per 10 grams. The underlying asset for Gold Futures contract is 1 kg of gold. The trading position is held onto until the contract expires.

Profit calculation at Futures Contract Expiry:

- Sale price = ₹97,80,000

At contract expiry, the trader can deliver 1 kg of gold in exchange for ₹97,80,000.

- Total cost = ₹97,00,000 + ₹10,000 = ₹97,10,000

This was the initial outlay.

- Net profit = ₹97,80,000 – ₹97,10,000 = ₹70,000

This is a simple yet effective commodity arbitrage strategy (cash and carry), where you can profit without taking too much risk. If you have real-time market data and knowledge about arbitrage strategies, such opportunities can yield good profits.

Advantages of Commodity Arbitrage Trading

The advantages of commodity arbitrage trading are:

- Low Risk: This trading approach is relatively low risk, which can benefit both new and experienced traders.

- Quick Profits: Using commodity arbitrage, quick profits can be made from the difference in market prices of the same commodity by buying in one market and selling in another market instantly.

- Consistent Returns: With a little planning and data analysis, consistent good returns are possible.

Read Also: How to Trade in the Commodity Market?

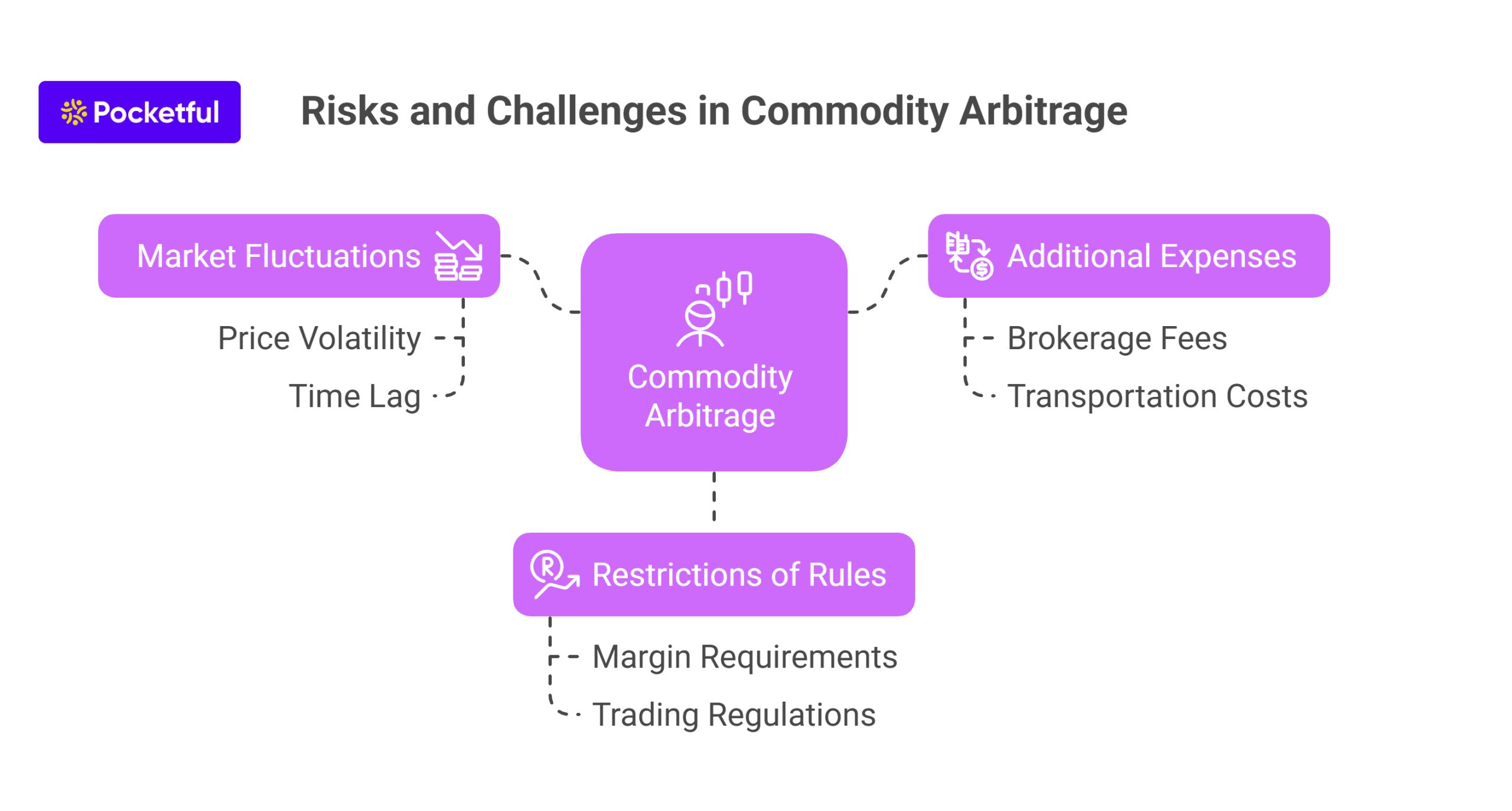

Risks and Challenges in Commodity Arbitrage

Commodity arbitrage is often considered a safe trading strategy, but there are some risks and challenges that need to be taken care of. If these are ignored, losses can occur.

- Market fluctuations : Commodity prices can change very quickly. From the time you spot a trading opportunity to the time you complete the trade, the prices can change. The profits due to time lag can either be reduced or completely eliminated.

- Additional expenses : Transaction costs such as brokerage, taxes, transportation and other fees can reduce your profits to a great extent. Sometimes these expenses become so high that arbitrage is no longer profitable.

- Restrictions of rules : SEBI and other organizations keep a strict watch on commodity trading on exchanges. Improper knowledge about margin requirements and other trading regulations can cause losses.

Read Also: Commodity Trading Regulations in India: SEBI Guidelines & Impact

Conclusion

Commodity arbitrage is a trading technique that focuses on earning profits by taking advantage of price disparities of the same commodity across different markets or periods of time. There are several types prevalent in India such as Spatial Arbitrage, Inter-Exchange Arbitrage, Temporal Arbitrage, and Cash & Carry. Each arbitrage strategy comes with its own risks and rewards, and their correct evaluation is essential for successful trading.

An effective arbitrage strategy requires deep market understanding, data-driven decision-making, and accurate execution. Also, transaction costs, regulatory guidelines, and market volatility must be taken into account. It is advised to consult a financial advisor before trading.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | What is Commodity Market in India? |

| 2 | Best Online Commodity Trading Platforms in India: Top 10 Picks for Traders |

| 3 | Stock Market vs Commodity Market |

| 4 | Understanding Commodity Market Analysis |

| 5 | Top Major Commodity Exchanges in India |

FAQs

What is commodity arbitrage?

It is a trading strategy in which profits are made by taking advantage of the difference in prices of the same commodity at different markets or times.

Is commodity arbitrage legal in India?

Yes, it is a legitimate trading strategy as long as all the regulatory rules are followed.

Which exchanges allow commodity arbitrage in India?

Traders can use the MCX (Multi Commodity Exchange) and the spot market to execute commodity arbitrage strategies.

What are the major types of commodity arbitrage?

The main types are: spatial, cash and carry, temporal, inter-exchange, and statistical arbitrage.

How much profit can one make through arbitrage trading?

It completely depends on the price difference, transaction cost and timing. Usually the profit margins are limited due to high liquidity.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle