| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-12-25 |

Read Next

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- What is Corporate Demat Account? Features, Benefits, and Eligibility

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2026 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2026

- How Do You Open a Demat Account Without a Broker?

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

- Eligibility Criteria to Open a Demat Account

What is Non-Repatriable Demat Account? Meaning and Definition

If you are an NRI with earnings in India and are looking for an option to deploy this income and earn returns, there are various options such as equities, mutual funds, bonds, etc. However, to invest in these assets, you are required to open a non-repatriable demat account.

In this blog, we will explain to you what a non-repatriable demat account is, and how it works.

What is a Non-Repatriable Demat Account?

A Non-Repatriable Demat Account can be opened by non-resident individuals who wish to invest in shares, bonds, and mutual funds in India. There are certain restrictions on the transfer of funds of these accounts, i.e. the income earned on investments held in these accounts cannot be easily transferred out of India. Non-repatriable means funds cannot be freely transferred abroad, but remittance is allowed up to $1 million per financial year, subject to conditions. As it is mandatory to hold shares, etc., in electronic form in a demat account, a non-repatriable demat account makes sure that funds are not easily transferable from India.

Read Also: How to Open an NRI Demat & Trading Account in India

Key Features of Non-Repatriable Demat Account

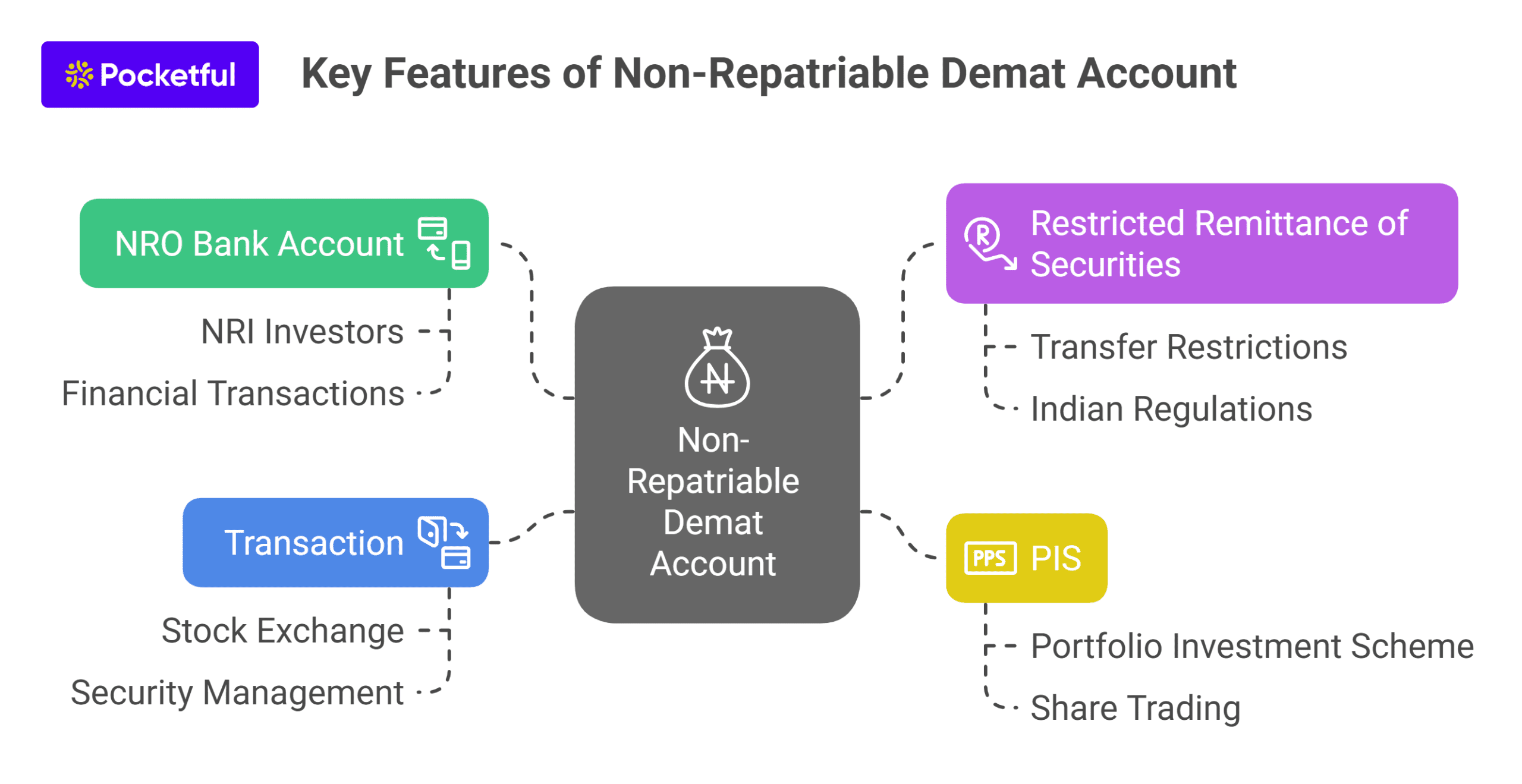

The key features of a non-repatriable demat account are as follows:

- NRO Bank Account: The non-repatriable demat account must be linked with the Non-Resident Ordinary bank account.

- Restricted Remittance of Securities: The holdings in a non-repatriable demat account cannot be freely transferred out of India easily.

- PIS: A non-repatriable account generally does not require a separate PIS (Portfolio Investment Scheme) account for buying and selling shares.

- Transaction: It allows NRI investors to hold and sell securities on the stock exchange easily.

How a Non-Repatriable Demat Account Works

A non-repatriable demat account is specially for NRIs. Let’s see how this non-repatriable demat account works:

- Investment: The non-repatriable demat account is used by an NRI to invest funds earned in India into Indian securities such as bonds, shares, mutual funds, etc.

- Restriction on Transferring Funds: The funds in a non-repatriable demat account are not freely transferable. The interest and principal amount from the account can be transferred only after deducting tax.

- NRO Account: The non-repatriable demat account is only for NRIs, and only a Non-Resident Ordinary (NRO) can be linked with a non-repatriable demat account.

- Limited Investment: An NRI can invest only up to 5% in a company’s paid-up capital through these accounts.

Read Also: What is Corporate Demat Account? Features, Benefits, and Eligibility

Example of Non-Repatriable Demat Account

Let’s understand how a non-repatriable demat account works through an example.

Mr. A has been an NRI working in Dubai for the last five years. He owns a flat in New Delhi, which he rented out for ₹20,000 per month. He wishes to invest the rent received from this flat into mutual funds in the form of an SIP. For this, he is required to open an NRO bank account, after which he needs to open a demat account, which is non-repatriable in nature, as he wishes to invest in mutual funds through a demat account. He linked his NRO bank account to his non-repatriable demat account and bought mutual funds. The principal and interest earned on the investment can be repatriated up to $1 million annually.

Difference Between Repatriable Demat Account and Non-Repatriable Demat Account

There are certain differences between Repatriable and Non-Repatriable Demat Accounts, which are as follows:

| Particulars | Repatriable Demat Account | Non-Repatriable Demat Account |

|---|---|---|

| Objective | Freely invest in India and transfer funds to another country. | To invest in India and retain income within the country. |

| Bank Account | Only an NRE (Non-Resident External) account can be linked with a repatriable demat account. | A NRO (Non-Resident Ordinary) bank account is allowed to be attached to this demat account. |

| Fund | One can invest their foreign income and overseas savings through a repatriable demat account. | Income earned in India can be invested through a non-repatriable demat account. |

| Repatriation | Repatriation is allowed in this demat account as both principal and gains can be easily transferred to another country. | Repatriation of principal and interest earned is allowed up to $1 million per year. |

| Taxation | Some incomes may be exempted. | The income and gains generated through this demat account are fully taxable in India. |

| PIS Scheme | It requires PIS permission. | It does not always require PIS permission, as there are certain non-PIS routes available. |

| Limit | There is no limit on repatriation funds from this account. | There is a limit defined by the RBI to remit money from a non-repatriable demat account. |

| Suitability | This account is ideal for NRIs who wish to move funds out of India. | It is suitable for NRIs who want to keep their funds and use them in India. |

Read Also: Lifetime Free Demat Account (AMC Free)

Conclusion

On a concluding note, a non-repatriable account is mandatory for an NRI who wishes to invest in India and does not want to take the income outside. You can easily open a non-repatriable demat account with a registered stockbroker. However, there are certain restrictions placed by the RBI regarding the transfer of funds from this demat account, therefore, if you are an NRI and wish to invest income generated in India in the Indian stock market, then you must consult your investment advisor.

Frequently Asked Questions (FAQS)

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle