| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-03-25 | |

| Add ETF Landing page Link | Nisha | Sep-11-25 | |

| Add ETF Landing page Link | Nisha | Sep-11-25 |

Read Next

- Why Are Steel Share Prices Increasing in India?

- Top Nifty Metal ETFs in India 2026

- Best Gold Investment Schemes in India 2026

- How to Build a Portfolio With Exchange-traded Funds (ETFs)

- How to Invest in US Stocks from India

- Platinum Price Forecast in India (2026–2030)

- Why Is the Gold Price Going Down?

- Top 10 BESS Stocks in India (2026)

- Why is the Silver Price Going Down?

- Best Construction Stocks in India

- Why Gold Prices Hit ₹1,80,000 – Key Reasons

- List of Best Sensex ETFs in India

- Best Commodities to Trade in India

- Best Cyclical Stocks in India 2026

- How to Check the Purity of 20-Carat Gold: Easy Methods & Tips

- Why Are Silver Prices Rising in India?

- Difference Between Hallmark Gold, KDM Gold and BIS 916

- Why Are Gold Prices Rising in India?

- 1 Tola Gold in India: How Many Grams, Price & Investment Insights

- 22K vs 24K Gold: Which Is Better for Jewellery & Investment?

- Blog

- features and benefits of etf

Features and Benefits of ETF (Exchange Traded Funds)

Exchange Traded Funds (ETFs) are becoming increasingly popular in today’s time. These investment instruments trade like stocks but offer the diversification and transparency of mutual funds by tracking stock market indices. In 2025, the global ETF market attracted $2 trillion of new capital, which shows their credibility and demand.

In this blog, the features and benefits of ETFs are explained in a simple and detailed manner. Moreover, a comparison between ETF and other investment options is shown to better understand them.

What are Exchange Traded Funds (ETFs)?

ETFs or Exchange Traded Funds are an investment option that follows a stock market index such as Nifty 50 or Sensex. The most special thing about these funds is that they can be bought and sold in the market throughout the day just like shares. That is, unlike mutual funds, ETFs can be bought and sold throughout the trading day at real-time prices, without waiting for end-of-day NAV pricing.

What do ETFs invest in?

ETFs invest not just in stocks but also in many other asset classes, such as:

- Equity: Stocks included in the index

- Bonds: Government or corporate bonds

- Commodities:Such as gold, silver, etc.

- International: ETFs that invest in companies of foreign countries

- Sector-focused: Such as technology, pharma, banking, etc.

Some special features of ETFs (ETF Features)

- Liquidity: Buy and sell whenever you want, like shares.

- Transparency: ETFs provide their holding information and tracking error on a regular basis.

- Low Cost: Fees are much lower than mutual funds.

- Tax Efficiency: Better for tax planning.

Due to all these features, ETFs are becoming a smart, accessible and affordable option for investors these days. Be it a new investor or an experienced one, ETFs are proving to be useful for every investor profile.

Know More: Calculate returns on ETF investments.

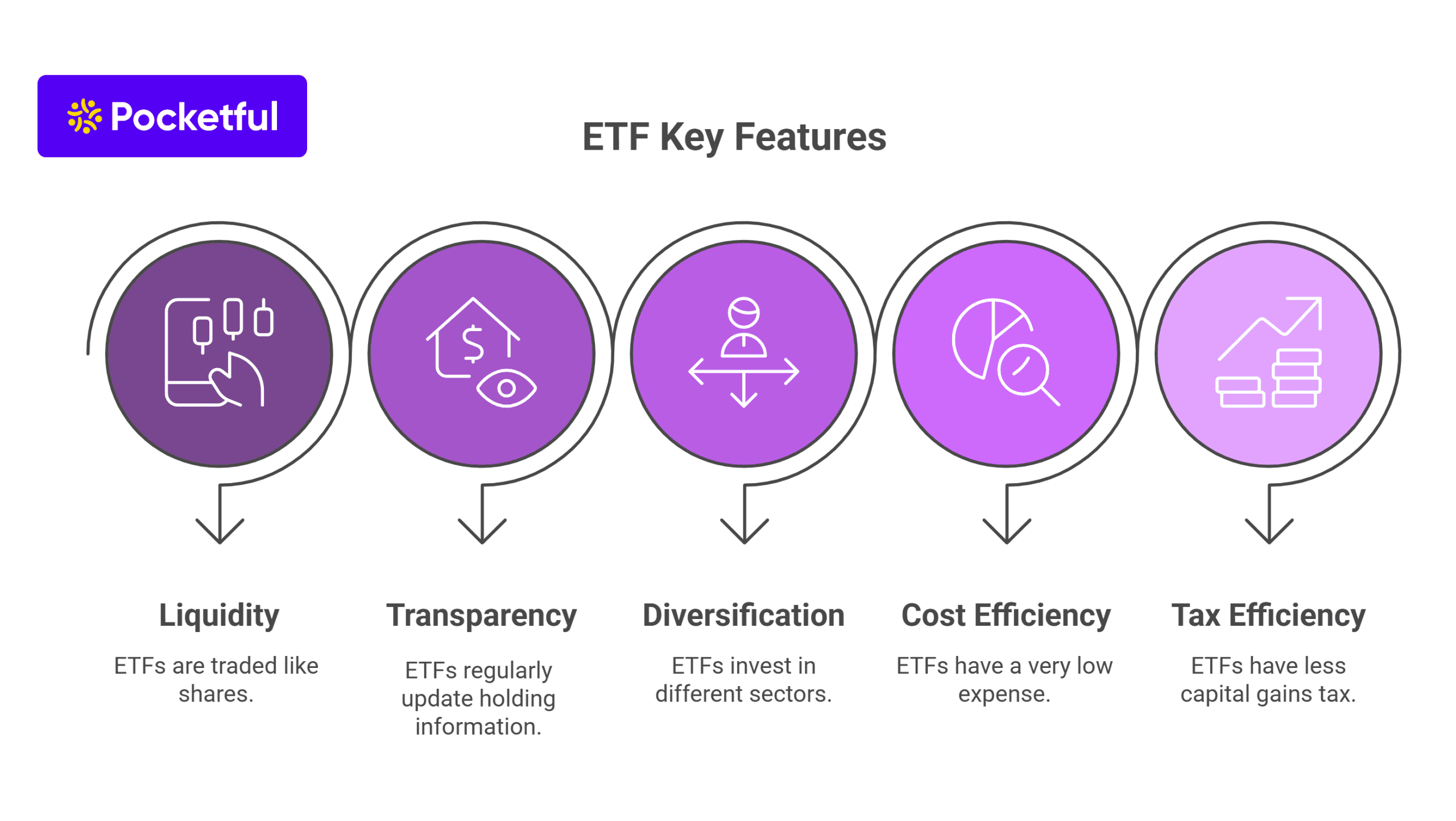

Key Features of Exchange Traded Funds

Exchange Traded Funds (ETFs) are easy to understand, but they have some special features that make them different from other investment options.

- Liquidity: ETFs can be bought or sold like shares throughout the trading hours. This means that when the market is open, investment or withdrawal in an ETF can be done at any time, that too at real-time price. This facility is not available in mutual funds.

- Transparency: Most ETFs update their holding information on a regular basis. This helps the investor to know in which companies or assets his money has been invested.

- Diversification : Investment can be made in different sectors, companies or asset classes through a single ETF. This distributes the risk and diversifies the portfolio.

- Cost Efficiency: ETFs usually have a very low expense ratio because they passively follow the index, which results in reduced cost to the investor.

- Tax Efficiency: ETFs are structured in such a way that the impact of capital gains tax is less. Especially when invested for a long time, the benefit of tax saving increases even more.

Benefits of Investing in ETFs

Exchange Traded Funds (ETFs) provide investors with an option that balances risk and also provides returns. Here are some reasons why ETFs are considered a smart investment choice today:

- Flexibility: ETFs are traded just like stocks, which allows them to be used for intraday trading. This allows active investors to adopt multiple trading strategies.

- Low Investment Threshold: Most ETFs do not require a large amount to start investing, which allows new and small investors to enter the market.

- Variety of Choices : Today, there are sector-based, theme-based, international and bond-based ETFs, providing options for any investment goal.

- Performance Tracking: The specialty of these funds is that they track the index or sector very closely, making the returns easily comparable.

- Real-time pricing: The price of ETFs keeps changing throughout the trading hours, allowing for timely entry and exit.

- Automatic risk diversification: An ETF invests in many stocks or assets, reducing the impact of a single company’s decline on the entire portfolio.

- No entry or exit load: There are no entry or exit loads when investing in ETFs, making the investment process cost-efficient.

- Better control and transparency: Since ETFs are listed on the stock exchange, investors are better informed about their holdings and market movements.

Read Also: How to Invest in Gold ETF – Benefits, Risks and Charges

ETFs vs other Investment options: Which is better and when?

Exchange Traded Funds (ETFs) are often compared with mutual funds or other investment options. But each option has its own strengths and limitations. The table below gives a quick overview of their key features:

| Feature/Aspect | ETFs | Mutual Funds | Fixed Deposits |

|---|---|---|---|

| Trading Flexibility | Trades like stocks throughout the day | Transact at end of day at NAV only | Lock-in and invested for a Fixed Period |

| Cost / Fees | Very low expense ratio | Relatively higher fees | No fund management charges |

| Transparency | Investors have a better idea of where their money has been invested as holdings information is published daily. | Holdings are published quarterly, which makes them less transparent. | Limited information is available as the bank lends your deposited amount. |

| Liquidity | High – can be bought/sold at any time | Moderate – redemption takes time | Low – Early withdrawal penalty |

| Market Exposure | Diversified index, sector, commodities, etc. | Based on the investment strategy mentioned in the fund documents | No direct link to the market |

Considerations Before Investing in ETFs

Although ETFs have many benefits, it is important to understand a few key points before investing.

- Effect of market volatility: ETFs are directly linked to the stock market, so their prices can also go down rapidly when the market falls.

- Possibility of tracking error: Sometimes the return of an ETF does not match the index it is following. This is called tracking error.

- Understand the investment strategy: Before investing, it is important to know in which assets or sectors the ETF is investing.

- Research and clarity are important: Before investing in an ETF, conduct your own research to select the best fund for your portfolio.

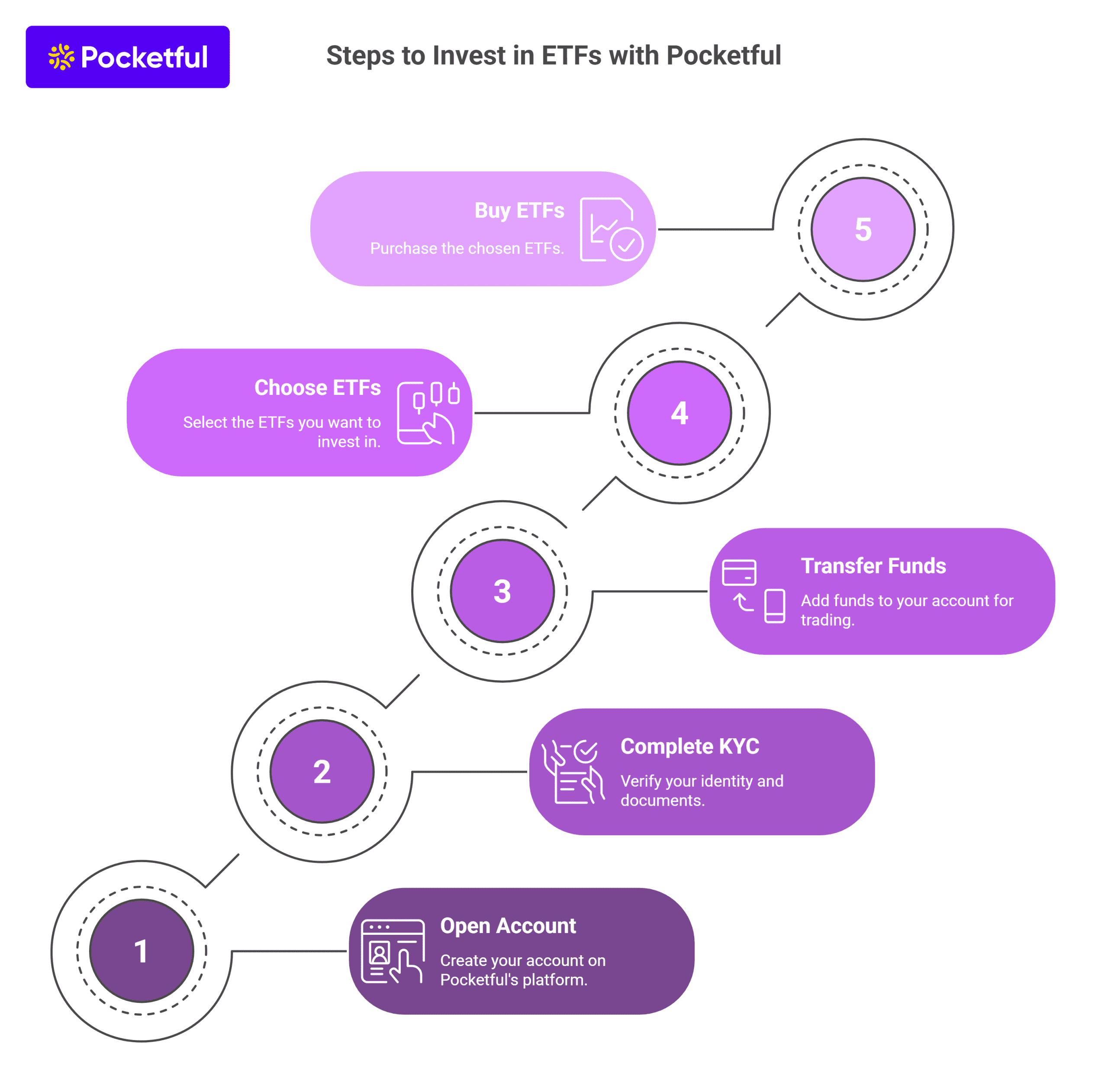

How to Invest in ETFs Step-by-Step with Pocketful?

You can easily invest in ETFs with Pocketful by following the steps mentioned below:

- Open an account on Pocketful: First, create your account by visiting Pocketful’s website or app.

- Complete KYC and verification: Your account will be activated after your documents and other information are verified.

- Transfer funds to your account So that you can trade in the stock market.

- Choose and buy ETFs : Select the fund of your choice from the ETFs available on the Pocketful platform and buy.

- 0 Charges on Delivery Investment: There is no charge for delivery of ETF units on Pocketful, making investing even more affordable.

Pocketful’s user-friendly platform and low cost makes investing easy.

Read Also: Best ETFs in India to Invest

Conclusion

ETFs are an easy, flexible and affordable option for investment. They are traded in the stock market, allowing real-time buying and selling. ETFs have low cost and offer transparency and diversification, which helps in reducing risk. For any investor, whether new or experienced, adding ETFs to their portfolio can be a wise move. For a better decision, one should include ETFs in their investment portfolio after consulting an expert or doing thorough research on their own.

Frequently Asked Questions (FAQs)

How are ETFs different from mutual funds?

ETFs trade like stocks throughout the day, whereas mutual funds are bought or sold only at the end of the day at NAV.

Are ETFs cheaper than mutual funds?

Yes, ETFs generally have lower expenses than mutual funds.

Can I buy and sell ETFs anytime?

Yes, ETFs can be bought or sold at any time during trading hours.

What are the main benefits of investing in ETFs?

Investing in ETFs reduces costs and provides diversification.

Do ETFs carry risk?

Yes, ETFs are also linked to the stock market, hence they are also affected by market fluctuations.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle