| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-30-25 |

Read Next

- Future Industry in India 2026

- What is Auction Market?

- Top Green Hydrogen Stocks in India

- Ashish Dhawan Portfolio : Top Holdings, Strategy & Lessons

- Top 10 Wind Energy Stocks in India

- Aluminium Price Predictions for Next 5 Years in India

- Zinc Price Predictions for Next 5 Years in India

- Best Sectors to Invest in Next 10 Years in India

- Why Tobacco Stocks Are Falling in India: ITC, Godfrey Impact

- Copper Price Predictions for the Next 5 Years in India

- Book Value vs Market Value of Shares: Meaning, Formula & Key Differences

- Why Share Market is Down Today? Reasons Behind Stock Market Fall

- Steel Price Predictions for the Next 5 Years in India

- What are Bond ETFs?

- Best ULIP Plans in India

- Difference Between Shareholders and Debenture Holders

- Nifty 50 vs Nifty 500: Which Is Better

- Big Bulls of Indian Stock Market: The Complete List

- Best Sugar Stocks in India

- What Is a Ponzi Scheme? Meaning, Scam & India Laws

- Blog

- gold bees vs silver bees

Gold BeES vs Silver BeES: Which is the Better Investment?

Investing in gold or silver today no longer means just buying jewellery as the way to invest in gold and silver has changed. Today, investing in these metals through ETFs like Gold BeES and Silver BeES is not only easy but also very transparent and affordable. Recently, the total trading volume of these ETFs crossed ₹644 crore on Akshaya Tritiya 2025, which is three times more than last year.

Gold BeES is considered a symbol of stability and reliability, while Silver BeES has the potential to give better returns. In this blog, both the options are weighed wisely to make the right investment decisions.

Understanding Gold BeES

Gold BeES is an exchange-traded fund (ETF) that tracks the domestic price of gold and allows investors to invest in gold digitally. It was launched by Nippon India Mutual Fund.

Key Features

- Each unit represents approximately 0.01 grams of 99.5% pure gold, and its value fluctuates with gold prices.

- It can be bought and sold like shares on NSE or BSE.

- Investment is possible through Demat accounts.

- There is no hassle of storage cost, making charges or theft.

- There is an opportunity to invest in gold even with less capital.

- Provides stability in long term portfolio and protection from inflation (Inflation Hedge).

- Gold is traditionally considered a safe haven asset.

Understanding Silver BeES

Silver BeES is an ETF that tracks domestic silver prices and gives investors the option to invest in it digitally without buying physical silver. It has also been launched by Nippon India Mutual Fund.

Key features:

- Each unit contains the value of about 1 gram of silver.

- It can also be traded like a stock in real time on NSE/BSE.

- Investment can be done with the help of a Demat account.

- There is no need to store physical silver, which reduces the risk.

- Silver is also an industrial metal, which is used in electronics, solar and auto sectors.

- There is a sharp fluctuation in prices, which can lead to high returns in the short term.

- Risk is slightly higher, but growth opportunities are also better.

Gold BeES vs Silver BeES: Key Differences

| Points | Gold BeES | Silver BeES |

|---|---|---|

| Underlying Asset | Tracks 99.5% pure physical gold. | Tracks domestic silver prices, which depend on both industrial and investment demand. |

| Liquidity and Accessibility | Liquidity remains good due to high trading volume. | The trading volume is comparatively lower, but still significant. |

| Demand in Industries | Mainly used for jewellery and investment purposes, industrial demand is low. | There is high demand for silver in industries like electronics, solar panels, automobiles. |

| Volatility and Risk | Prices remain relatively stable, considered a safe investment option. | Prices fluctuate wildly, risk is high but the potential for returns is also high. |

| Returns | Gold BeEs give stable returns in the long term and help in protecting against inflation. | Potential for higher returns in the short-term, but prices are more volatile. |

Read Also: Gold BeES vs Gold ETF: Meaning, How It Works, Taxation

Performance Comparison: Gold BeES vs Silver BeES

Lets compare the performance of Gold BeEs and Silver BeEs:

1. Historical Returns

Gold BeES has given investors an annual compounded annual growth rate (CAGR) of around 20.37% in the past 3 years. This means that long-term investment in gold has been stable and profitable.

On the other hand, Silver BeES has risen rapidly to achieve a CAGR of around 12.20% between 2022 and 2025. Since silver prices are influenced by industrial demand, its performance has been volatile.

2. 2024 Annual Performance

Gold ETFs delivered an average return of 19.23% in 2024, which was a big positive for investors amid economic uncertainty and inflation concerns. Silver ETFs also achieved a return of around 15.01%, which was possible due to global economic recovery and rising industrial demand.

3. Market Trends and Economic Factors

- Gold BeES : Gold is traditionally considered a ‘safe haven’. When global economic uncertainty, inflation or geopolitical tensions rise, Gold BeES performs better. It helps investors protect their portfolios.

- Silver BeES : Silver prices are linked to its demand in the manufacturing industry. Its increasing demand in sectors such as electronics, solar panels, and automobiles can increase Silver BeES prices rapidly. However, its prices are highly volatile, so it can be a bit risky for new investors.

4. Comparison from Investor Perspective :

Both investing in Gold BeES and Silver BeES depends on the investor’s financial goals, risk tolerance and holding period.

- Gold BeES performance is generally considered stable and suitable for long-term investments.

- Silver BeES has higher volatility, making it suitable for investors who can tolerate more risk and are focused on faster growth.

Pros and Cons of Investing in Gold BeES and Silver BeES

Both Gold BeES and Silver BeES are exchange traded funds (ETFs) that track the prices of gold and silver. While both these metals are considered valuable, the advantages and disadvantages of investing in them can differ:

1. Pros and Cons of Gold BeES

Pros

- Stability : Gold is traditionally considered a safe asset, performing stable in economic uncertainty.

- Inflation Hedge : Gold prices often rise in times of inflation, helping preserve value.

- High Liquidity : Gold BeES has a high trading volume, making it easy to buy and sell.

Cons

- Lower Short-Term Potential: Returns may be slow in the short term.

2. Pros and Cons of Silver BeES

Pros

- Affordable : Low unit price makes it affordable even for small investors.

- Short-Term Gain Potential : Prices may rise if industrial demand increases.

- Industrial Support : Sustainable demand comes from electronics and green energy sectors.

Cons :

- High Volatility : Prices can change rapidly, which can increase risk.

- Industry Cycles Impact : Investment performance may be affected by economic recession or production decline.

Know More: Calculate returns on ETF investments.

Which is Better for Your Investment Portfolio?

Both ETFs Gold BeES and Silver BeES may look similar but their return profiles and market behaviour differ. Every investor has different needs, time horizon and risk appetite, and hence the utility of these options may vary.

Selection based on investment goals and risk profile

1. For those seeking stability – Gold BeES

- Investors who prioritize stability and low risk are often attracted to assets that do not fluctuate much.

- Gold BeES prices remain relatively stable, and it maintains its value even in times of economic uncertainty.

- It can help balance a portfolio over the long term.

2. For those seeking growth – Silver BeES

- Some investors prefer options with higher return potential, even if it comes with a little more risk.

- Silver BeES is more volatile, but it can provide good returns when industrial demand increases.

3. Investment Horizon

- Gold BeES is generally considered better for the long term as its price increases steadily over time.

- Silver BeES has the potential to deliver faster returns in the short to medium term, but the risk is higher.

4. Importance of Diversification

- Many investors prefer to create a diversified portfolio that includes both – Gold BeES and Silver BeES.

- Gold provides protection against inflation and global uncertainty, while silver offers growth potential.

- Combining the two can create a balanced investment portfolio that balances both risk and return.

How to Invest in Gold BeES and Silver BeES?

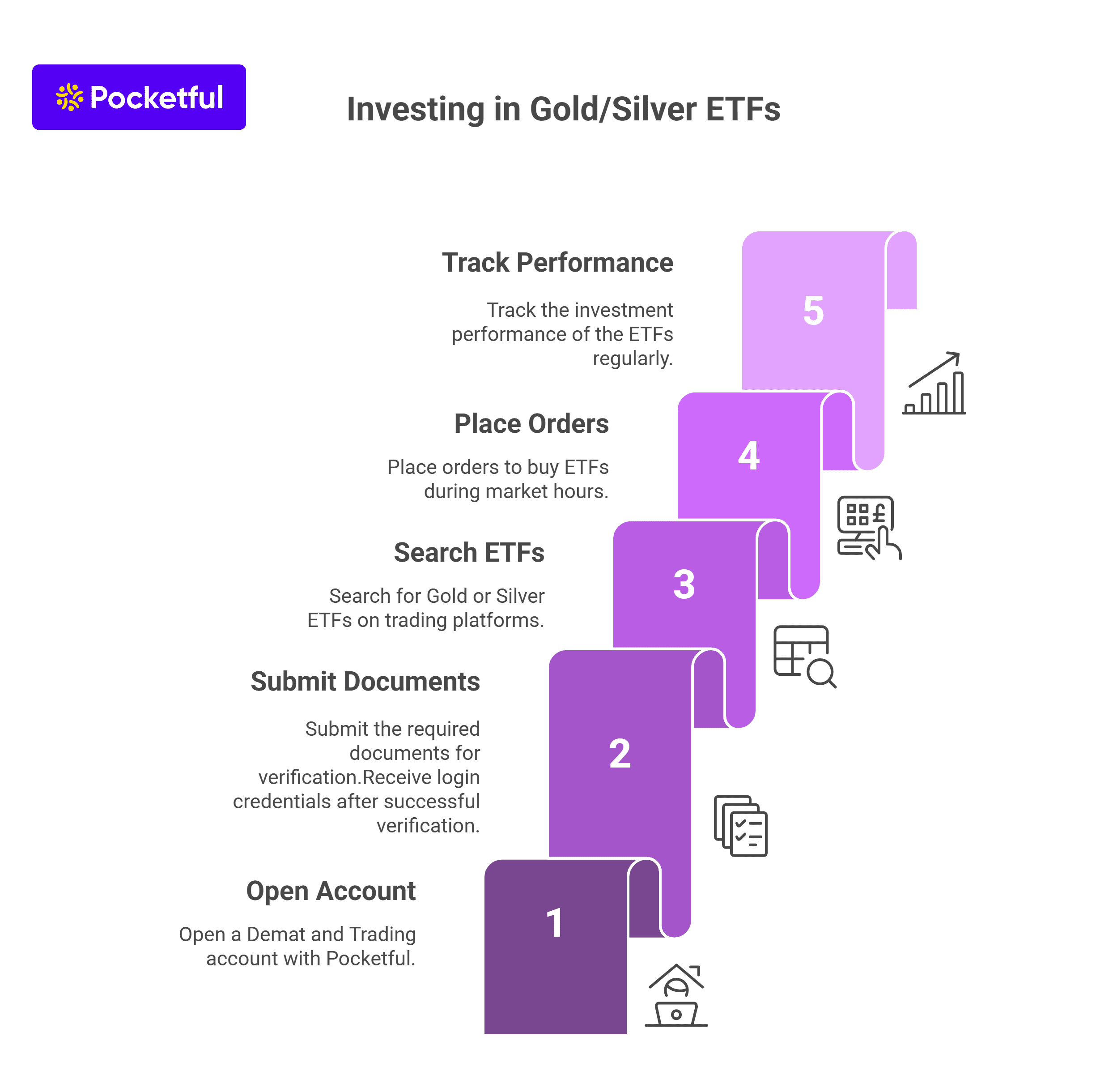

Investment Process (Step-by-Step Process) :

- First, it is necessary to open a Demat and Trading account. You can open one free of cost with Pocketful.

- Submit the required documents and after successful verification, you will be sent the login credentials, which you can use to log in to your trading account.

- Investors can search for Gold BeES or Silver BeES on the trading platforms. It is useful to check factors such as expense ratio, fund performance and tracking error before investing.

- Then, orders can be placed to buy these ETFs during market hours.

- TRack the investment performance of the ETFs at regular intervals.

Easy Investing with Pocketful : Pocketful is a registered stock broking platform from where one can invest in Gold BeES and Silver BeES in just a few clicks. Pocketful offers its clients a user-friendly interface, fast order execution and dedicated support team.

Read Also: How to Invest in Gold ETF – Benefits, Risks and Charges

Conclusion

Gold and silver are different in nature; one is a safe haven linked to tradition, the other is a volatile metal driven by industrial demand. Gold BeES and Silver BeES allow investors to invest in these precious metals without having to buy them physically. It is important to understand these ETFs not just from a returns perspective but also economic and market dynamics behind them. It can be useful to keep in mind the objective, time horizon and market trends while deciding their suitability for your investment portfolio. Consult a financial advisor for advice before investing.

FAQs

What is the minimum amount required to invest in Gold BeES or Silver BeES?

Investment can be started from as low as ₹100 as both ETFs are currently priced below ₹100.

Can I hold Gold BeES or Silver BeES for the long term?

Yes, both these ETFs are considered suitable for long term holding.

Are Gold BeES and Silver BeES backed by physical gold/silver?

Yes, these ETFs are usually backed by physical gold or silver.

Is there any tax on profit from Gold BeES or Silver BeES?

Yes, long term and short term gains are taxed.

Are these ETFs safe to invest in?

They are regulated and listed on an exchange, but every investment carries some risk.

Can I sell Gold BeES or Silver BeES anytime?

Yes, you can sell it anytime during market hours, just like you sell any stock.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle