| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-30-25 |

Read Next

- SEBI Action on Jane Street: Impact on Indian Markets

- What is Personal Finance?

- Military Wealth Management: Strategies for Growing and Preserving Your Assets

- India’s Republic Day 2025: Honoring the Nation’s Defense Achievements

- 10 Essential Financial Planning Tips for Military Members

- How Do You Apply for PAN 2.0 Online and Get It on Your Email ID?

- 10 Best YouTube Channels for Stock Market in India

- LTP in Stock Market: Meaning, Full Form, Strategy and Calculation

- 15 Best Stock Market Movies & Web Series to Watch

- Why Do We Pay Taxes to the Government?

- What is Profit After Tax & How to Calculate It?

- Budget 2024: Explainer On Changes In SIP Taxation

- Budget 2024: F&O Trading Gets More Expensive?

- Budget 2024-25: How Will New Tax Slabs Benefit The Middle Class?

- Semiconductor Industry in India

- What is National Company Law Tribunal?

- What is Capital Gains Tax in India?

- KYC Regulations Update: Comprehensive Guide

- National Pension System (NPS): Should You Invest?

- Sources of Revenue and Expenditures of the Government of India

- Blog

- personal finance

- how to become a sub broker in india

How to Become a Sub Broker in India: A Comprehensive Guide

If a person is thinking of making a career in the stock market and has the ability to guide people about investing or trading, then becoming a sub broker can be a good career option. In today’s world, the demand for trading related services is constantly increasing.

This blog will explain in detail what steps are to be taken to become a sub broker, what are the qualifications and documents required for this, and how success can be achieved in this field with less investment.

What is a Sub Broker?

A sub-broker is a person or firm that works with a registered stockbroker and provides services such as share trading, investment and demat accounts to its clients. As per today’s regulations, SEBI has replaced the term “Sub-Broker” with “Authorised Person (AP)” but among the general public, the term sub-broker is still popular. A sub-broker does not deal directly with the exchange itself but works under the network of brokerage houses and earns on a commission basis. This role is best suited for those who are interested in selling financial products and building a client network.

Eligibility Criteria to Become a Sub Broker in India

The following eligibility criteria are required to become a sub-broker (now Authorised Person) in India:

- Age: The applicant must be at least 18 years of age.

- Educational Qualification: It is mandatory to have passed a minimum of 10+2 (Higher Secondary). However, higher education such as a graduate degree and experience in the financial market enhances career prospects.

- NISM Certification: It is mandatory to pass the NISM-Series-VIII: Equity Derivatives Certification Examination, if you are dealing in derivatives as most of the brokerage is generated through derivatives trading activities.

- Other Requirements: A person or an entity cannot be appointed as an AP on the same stock exchange by more than one trading member and there should not be any criminal or fraud case pending against him.

Note: SEBI has recently proposed new eligibility norms requiring a graduate degree and at least 3 years of experience in the financial markets, but these are not yet mandatory.

By fulfilling these criteria, you can take the first step towards becoming a successful sub-broker in India.

Read Also: NISM Certifications: An Easy Explainer

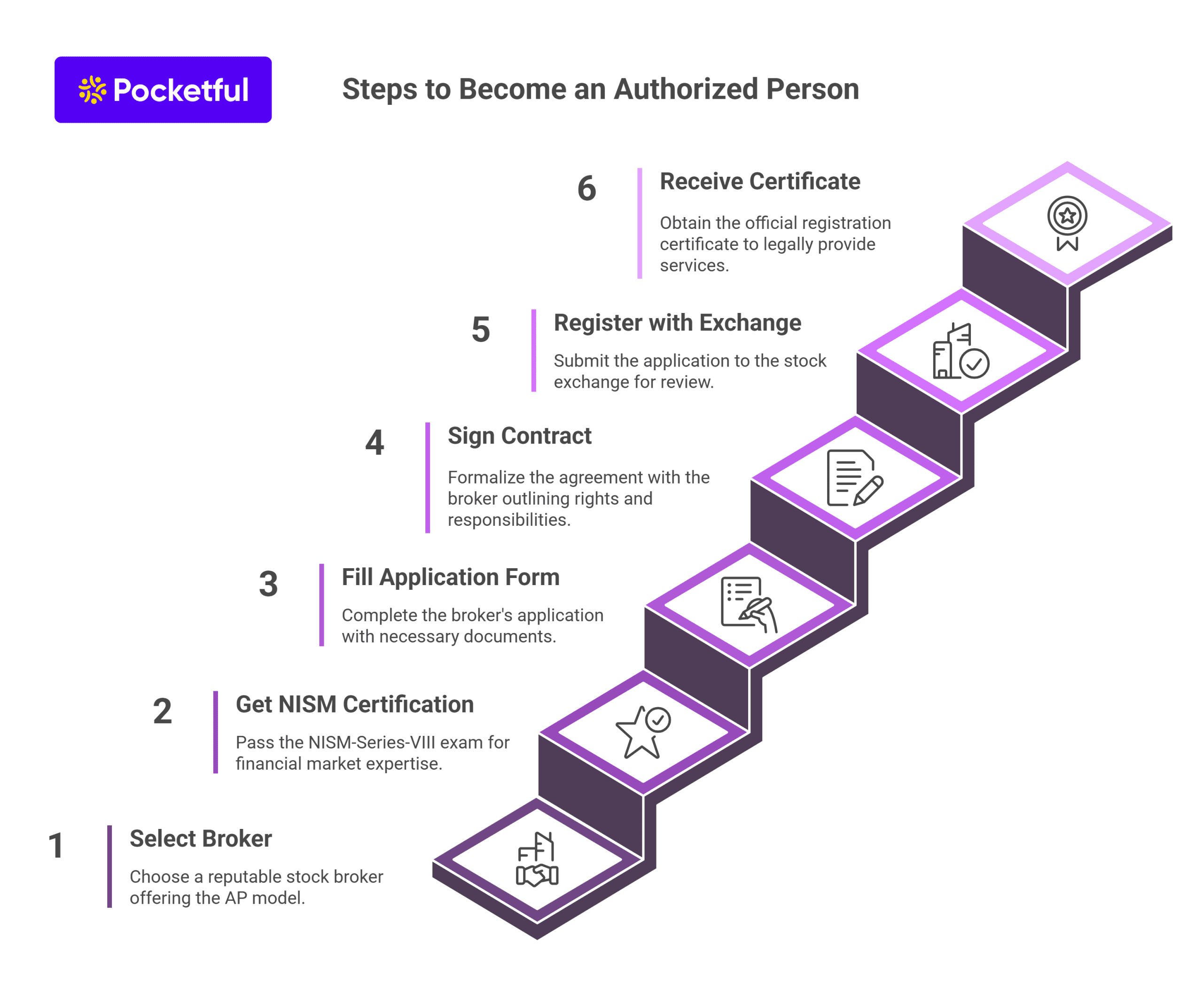

How to Become a Sub Broker in India?

In August 2018, SEBI abolished the sub-broker category. Now, those who were earlier called sub-brokers are known as Authorized Persons (AP). To become an AP, one has to register through the respective stock exchange (such as NSE or BSE) instead of SEBI.

Here is the step-by-step process:

- Select a broker : Choose a reputed stock broker (such as Pocketful) that offers the AP model. Get in touch with the broker and know the requirements.

- Get NISM certification : For some brokers, it may be necessary to pass the NISM-Series-VIII: Equity Derivatives Certification Examination. It is recognized by SEBI and is useful for working in the financial markets.

- Fill the application form : Fill the application form provided by the broker and attach the required documents, such as identity proof, address proof, educational certificates, etc.

- Sign the contract : Sign an authorised person contract with the broker, which clearly describes the rights and responsibilities.

- Register with the stock exchange : The broker will forward your application to the relevant stock exchange (such as NSE or BSE). The exchange will review the application and require you to pay a registration fee.

- Get a registration certificate : After successful registration, you will receive an authorised person registration certificate from the stock exchange, allowing you to legally provide services to investors.

Documents Required for Sub Broker Registration

To become a Sub Broker (Authorised Person) in India, the following documents are required:

Application Form

- Application form duly filled and signed in the format prescribed by the stock exchange.

- Can be obtained from the concerned stock exchange.

Recommendation Letter

- Recommendation letter provided by the concerned stock broker.

- This letter should be on the broker’s letterhead.

Proof of Identity and Address

- PAN Card, Aadhar Card, Passport, Voter ID, Electricity Bill, Telephone Bill etc.

- Certified copies of all documents are required.

Educational Qualification Certificate

- Minimum 10th or 12th class certificate.

- If education is less than 12th, then at least two years of experience in the capital market must be certified.

Bank Reference Letter

- Document issued by the applicant’s bank.

- This letter is helpful in establishing an applicant’s good financial position.

Other Reference Letters

- Reference letter issued by a chartered accountant, company secretary, lawyer or notary.

- This letter certifies the credibility of the applicant.

Agreement

- A contract signed between the stock broker and the sub-broker on a stamp paper.

- This contract clarifies the rights and responsibilities of both parties.

Declarations and Affirmations

- A declaration by the applicant that he is not guilty of any fraud or dishonesty offence.

- This affidavit should be on the applicant’s letterhead.

By preparing these documents correctly and submitting them to the concerned brokerage firm, you can successfully complete the process of registration as a sub-broker.

Read Also: Documents Required to Open a Demat Account

Regulatory Compliance for Sub Brokers

Sub Brokers must fulfill the requirements mentioned below:

- Security of client data : The AP is required to keep every client’s information such as KYC documents and transaction records confidential and secure. Strict action can be taken in case of data leak or misuse.

- Transparency of trade details : It is necessary to send a contract note and trade confirmation to the client after every transaction. This gives the client complete information about his trading activity.

- Grievance redressal system : The AP has to maintain an effective customer complaint resolution system, so that the problems of the clients can be resolved in a timely manner.

- Code of Conduct : It is the responsibility of every AP to follow the rules and ethics set by SEBI and the stock exchanges—such as honesty, fairness and giving priority to client interests.

- Reporting and filing : Although the Annual Compliance Report (ACR) is not directly mandatory for the AP, it is necessary to follow the reporting guidelines of the respective exchange.

Sub Broker Fees and Charges

| Category | Description | Estimated Charges/Range |

|---|---|---|

| Registration Fee | Registration with the Stock Exchange is necessary. | NSE: ₹5,000 + GST BSE: ₹4,000 + GST |

| Infrastructure Investments | Initial expenses for office, systems, internet etc. | ₹50,000 to ₹3,00,000 |

| Maintenance Charges | AMC & Charges for trading platforms/services | ₹1,000 to ₹2,000 each year |

| Commission Share | Brokerage share received on client trades | 40% to 70% of total brokerage |

Difference Between Sub Broker and Stock Broker

| Aspect | Stock Broker | Sub Broker (AP) |

|---|---|---|

| Definition | Registered with SEBI and exchange, does direct trading | An agent associated with a stock broker that provides services to clients |

| Role | Trading, client fund management and risk handling | Dealing with clients, filling out trading forms, providing support |

| Authorisation | Registered with SEBI and Exchange | Approved by Stock Broker, no need of direct license from SEBI |

| Services Provided | Trading, Demat Account Management, Investment Advice | Connecting clients with stock brokers for trading, customer service |

| Fee Structure | Collecting brokerage and other charges directly from the client | Receiving payment in the form of commission or fees from a stock broker |

Skills and Qualities Required for a Successful Sub Broker

The following skills and qualities are helpful if you want to make a successful career as a sub broker:

- Knowledge of financial products : It is important for a sub-broker to have a basic understanding of equity, derivatives, mutual funds and other financial instruments. This will enable him to recommend the right products to clients according to their investment goals.

- Persuasive communication : Just giving information is not enough. A good sub-broker should be able to communicate persuasively to encourage client engagement. Pitching, clarity and listening skills are important in this.

- Understanding of market trends : The stock market is always changing and a professional sub-broker should have an understanding of when the market may fluctuate and how it will affect the client’s portfolio.

- Networking and lead generation skills : Bringing new leads and maintaining trusted relationships with old clients is important. A good client network is the key to consistent earnings.

- Knowledge and compliance of regulations : You must be aware of all the regulatory guidelines prescribed by SEBI and the exchange, to ensure regulatory compliance and avoid penalties.

- Data and report analysis ability : It is necessary to have the ability to read and understand trading reports, customer activity, brokerage generation etc., so that business performance can be evaluated.

- Self-motivation and proactive approach : Sub-brokers face new challenges and deal with new clients every day. In such a situation, keeping yourself updated and thinking of continuous improvement is important for success.

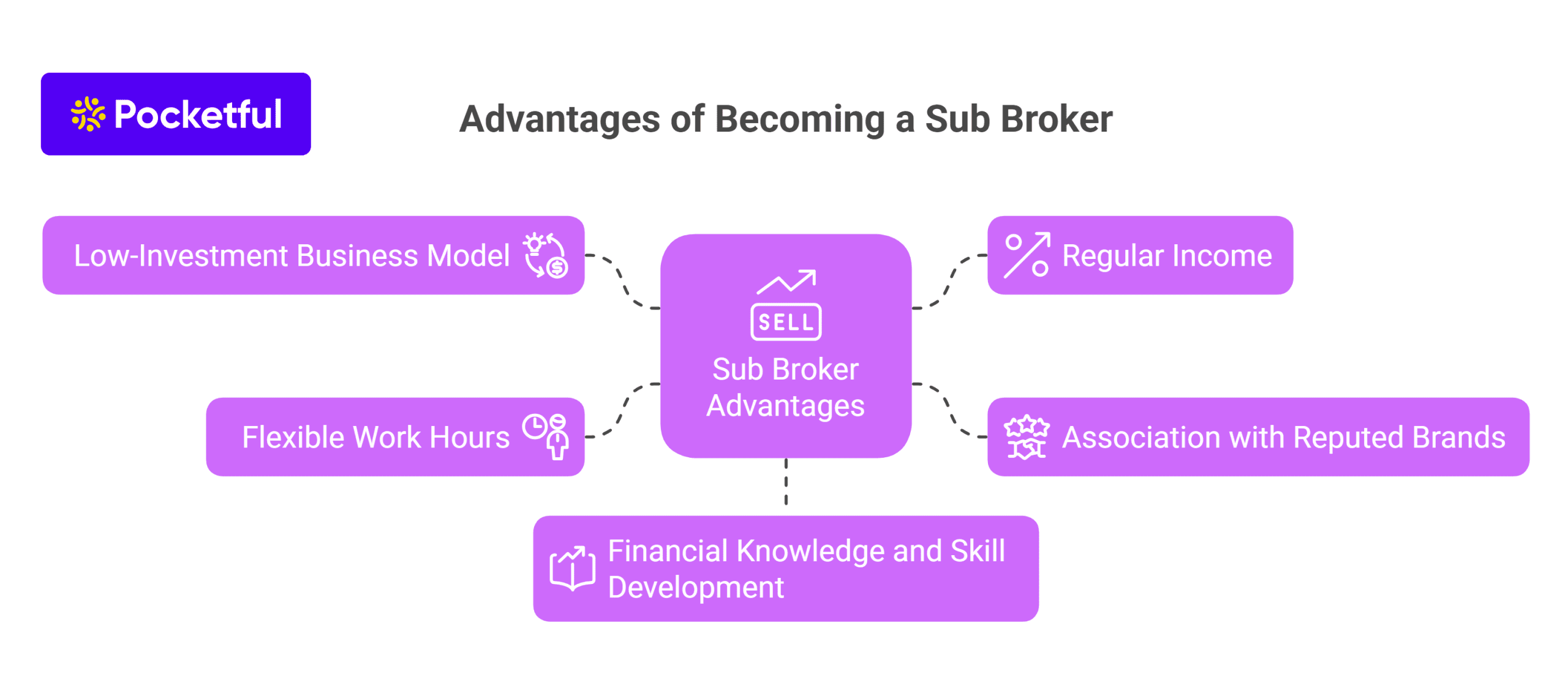

Advantages of Becoming a Sub Broker

The advantages of becoming a sub broker are listed below:

- Low-investment business model : Starting as a sub-broker does not require significant capital. Most brokerage firms provide virtual infrastructure support, which makes it possible to start at a low cost.

- Regular income from brokerage sharing : The sub-broker receives a certain percentage of brokerage on each client’s trading activity. Income possibilities increase manifold when there is a more active client base.

- Association with reputed brands : Association with companies like Angel One, Zerodha, Motilal Oswal, ICICI Direct gives the sub-broker a strong identity and credibility in the market, making client onboarding easier.

- Flexible work hours and freedom : This business is free from the constraints of location or time as services are provided to the client through digital platforms, ensuring flexibility in work operations.

- Financial Knowledge and Skill Development : Constant exposure to the market leads to continuous improvement in skills such as financial literacy, client handling, and product knowledge, opening up more avenues for growth in the future.

Challenges Faced by Sub Brokers

Challenges faced as a sub-broker are:

- Adding and retaining new clients : This industry is based on trust and constantly adding new clients and keeping them satisfied for a long time is a big challenge, especially when there are plenty of options.

- Intense and growing competition : Today, almost every major brokerage firm has its own channel partner network. In such an environment, it is not easy to create a different identity and prove yourself with service quality.

- Following the rules and staying updated from time to time : It is important to follow the guidelines issued by SEBI and the exchange. Understanding and implementing the rules changing with time is a continuous process.

- Market volatility directly affects income : The volatility of the stock market affects not only the investors but also the income of the sub-broker. There is a direct impact on income in a recession or low trading period.

Read Also: Best Demat Account in India

Tips for Success as a Sub Broker

Key tips to become a successful sub-broker are:

- Choose the right brokerage partner : Partnering with a reliable stock broking firm with a robust trading platform is beneficial in the long run. Getting better platforms, support and training increases the quality of work.

- Build long-term relationships with clients : Just adding new clients is not enough, but it is also important to maintain a continuing relationship with them. Regular communication and honest advice strengthens the relationship.

- Stay updated on the market and regulations : It is important to stay informed about changing regulations, tax rules and investment products so that every client can be given correct and up-to-date information.

- Differentiate yourself with personalized service : Every investor has different financial needs. Providing customized advice keeping in mind their risk profile and goals increases both trust and satisfaction.

- Focus on special segments : Targeting segments such as HNIs (High Net-worth Individuals), retired persons or new investors can help build a stable and loyal client base.

Conclusion

Becoming a sub-broker is a great option for those who understand the stock market and want to turn it into a profession. The best part is that it does not require a huge investment, but hard work and trustworthy operations can help you achieve success. Understanding the financial needs of clients, giving them the right advice and working according to the regulations is the backbone of this profession. If service quality and learning are given priority, then a career as a sub broker has endless growth opportunities.

FAQs

What is a sub broker?

A sub-broker is a person who acts as an agent of the stock broking company and provides trading services to clients.

How to become a sub broker in India?

To become a sub-broker, one has to register as per the rules specified by stock exchanges and the brokerage company, submit the required documents and undergo training.

What documents are required to become a sub broker?

Identification proof, address proof, PAN card, passport size photo and filling of brokerage company’s application form are required.

Is there any minimum educational qualification for becoming a sub broker?

According to recent news, SEBI has proposed that the applicant should at least be a graduate and have at least three years of experience in the financial markets.

What are the eligibility criteria to become a sub broker?

It is necessary to be a citizen of India, minimum age should be 18 years, and follow the rules set by stock exchanges and SEBI-registered brokers.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle