| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-19-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Bajaj Finserv and Bajaj Finance: Which is Better?

- Blog

- sail vs tata steel

SAIL Vs Tata Steel: Which is Better?

India’s steel industry is growing rapidly and the total steel production capacity of the country has reached about 205 million tonnes. The biggest reason for this is the increasing focus on the country’s infrastructure, including development of new cities, new expressways, etc. Experts believe that in the coming times, the demand for steel can grow at a rate of about 8–9% every year.

In this case study, we will discuss the business models, financial performance, and future plans of both the companies, i.e. SAIL and Tata Steel to help investors make informed decisions.

Steel Authority of India (SAIL) : An Overview

SAIL Steel Authority of India Limited was started on 24 January 1973. It is a Maharatna public sector company, which works under the Ministry of Steel, Government of India. For the last several decades, SAIL has remained the backbone of the country’s infrastructure projects and industrial development. Today it is counted among the largest steel manufacturing companies in India.

Steel Plants and Production Capacity : SAIL’s operational network is spread across the country. It has five main steel plants located in Bhilai in Chhattisgarh, Rourkela in Odisha, Bokaro in Jharkhand, and Durgapur in West Bengal. Apart from this, there are also three specialized steel plants: Salem (Tamil Nadu), Bhadravati (Karnataka) and another in Chandarpur. SAIL has a total crude steel production capacity of 20.3 million tonnes per annum, which the company aims to take to 35 million tonnes by 2031.

Business Model

The business model of SAIL can be described as follows:

- Earnings Structure: SAIL earns a major part of its revenue from the sale of flat and long steel products. About 50% of the revenue comes from flat steel and about 40% from long steel.

- Raw Material Arrangement: One of its biggest strengths is that SAIL sources most of its iron ore requirement from its own mines. This keeps the cost of raw materials low and reduces risk of supply disruption.

- Delivery and Distribution: SAIL’s distribution network is spread across India, helping the company deliver high-quality products to its customers on time.

- Environment and Innovation : SAIL’s focus is not limited to just making steel, but is also serious about environmental conservation. The company has adopted a 4R (Reduce, Reuse, Recycle, Recover) policy and is working towards making fertilizers from steel slag.

So far, the company has commissioned solar projects of 12.58 MW and plans to add up to 135 MW of solar capacity in the coming time. This clearly shows SAIL’s focus – towards sustainable development and green energy.

Tata Steel : An Overview

Tata Steel was founded in 1907 and is India’s oldest and largest private sector steel company. Headquartered in Mumbai, the company has a long history in the Indian steel industry. The business provided steel to the defense sector during the Second World War. To expand its business operations globally, the company bought Singapore-based NatSteel Holdings in 2004. The company has since completed several domestic and foreign acquisitions. The most recent occurred when it bought Bhushan Steel Limited in 2018. The headquarters of the company are located in Mumbai.

Steel Plants and Production capacity : Tata Steel’s major plants are located in Jamshedpur (Jharkhand) and Rourkela (Odisha). The company has a production capacity of around 35 million tonnes per annum in India. Tata Steel also has international plants, which reflect its plans to expand globally.

Read Also: Tata Steel Case Study: Business Model, Financial Statements, SWOT Analysis

Business Model

The business model of Tata Steel can be described as follows:

- Key Products and Revenue Sources : The biggest chunk of Tata Steel’s revenue comes from the sale of flat steel products, which are mainly used in automobiles, construction and heavy industries.

- Raw Material Management : The company sources most of its raw material requirement from its own mines. Apart from this, the global supply chain is also effectively used to maintain consistent quality.

- Marketing and Distribution Network : Tata Steel’s distribution network is spread across the country as well as internationally. This ensures that customers receive steel products on time and of the best quality.

- Sustainable development and innovation : Tata Steel has given priority to environmental protection and has set a target to be net zero by 2045 across its operations. The company’s initiative aligns with the Tata Group’s ‘Project Aalingana’, an ambitious initiative towards achieving sustainability. Also, Tata Steel has increased investment in solar and wind power and implemented energy efficiency measures. The company is also active in recycling and green technology.

Tata Steel remains a leading player in the steel industry due to its long operating history, strong technological base and commitment to green energy. Its global client base and distribution network along with an approach to grow their business sustainably make it a preferred investment choice.

Read Also: Tata Steel vs. JSW Steel: A Comparative Analysis Of Two Steel Giants

Comparative Analysis: SAIL Vs Tata Steel

| Particulars | SAIL | Tata Steel |

|---|---|---|

| Current Price (₹) | 127 | 152 |

| Market Cap (₹ Crores) | 52,462 | 1,89,812 |

| 52-W High (₹) | 159 | 183 |

| 52-W Low (₹) | 99.2 | 123 |

| FII Holdings as of March 2025 | 3.20% | 18.78% |

| DII Holdings (as of March 2025) | 15.75% | 24.68% |

| Book Value (₹) | 143 | 73.0 |

| PE Ratio | 20.2 | 57.2 |

Financial Statements Analysis

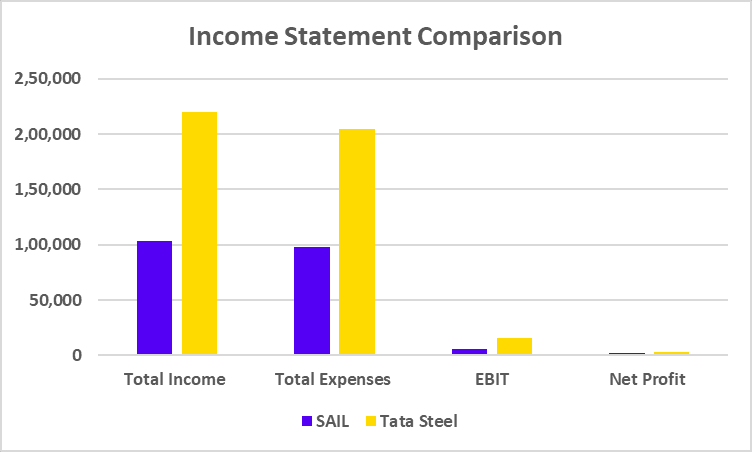

Income Statement Comparison

| Particulars | SAIL | Tata Steel |

|---|---|---|

| Total Income | 1,03,354 | 2,20,083 |

| Total Expenses | 97,796 | 2,04,520 |

| EBIT | 5,557 | 15,563 |

| Net Profit | 1,885 | 2,982 |

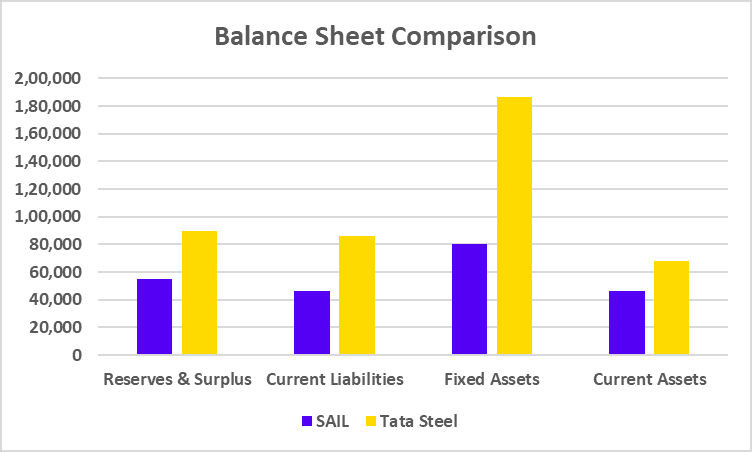

Balance Sheet Comparison

| Particulars | SAIL | Tata Steel |

|---|---|---|

| Reserves & Surplus | 54,775 | 89,922 |

| Current Liabilities | 46,190 | 86,093 |

| Fixed Assets | 80,532 | 1,86,577 |

| Current Assets | 46,480 | 68,391 |

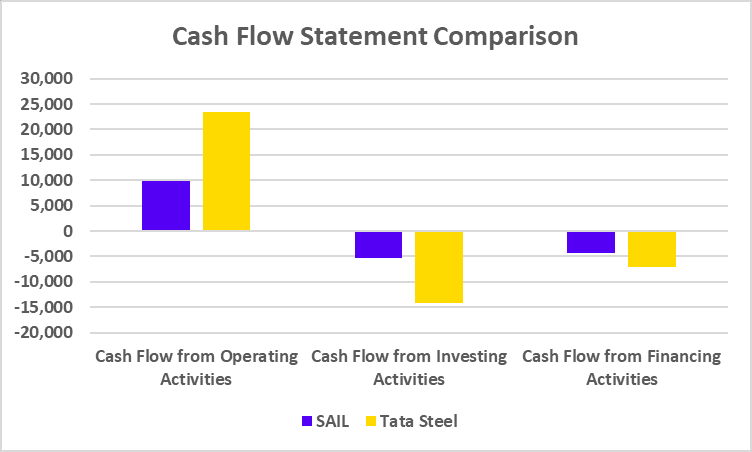

Cash Flow Statement Comparison

| Particulars | SAIL | Tata Steel |

|---|---|---|

| Cash Flow from Operating Activities | 9,914 | 23,511 |

| Cash Flow from Investing Activities | -5,268 | -14,172 |

| Cash Flow from Financing Activities | -4,423 | -7,002 |

Key Performance Ratios (KPIs)

| Particulars | SAIL | Tata Steel |

|---|---|---|

| Operating Profit Margin (%) | 5.72 | 7.51 |

| Net Profit Margin (%) | 1.83 | 1.36 |

| ROE (%) | 4.02 | 3.75 |

| ROCE (%) | 6.50 | 8.49 |

| Debt to Equity (x) | 0.51 | 0.98 |

Read Also: Tata Power Vs Adani Power: Comparison Of Two Energy Giants

Future Plans of SAIL

The future business plans of SAIL are listed below:

- Major expansion in production capacity : SAIL has set a clear target to increase its production capacity to 35 million tonnes per annum by 2031. For this, the company is carrying out large-scale modernization of its major plants like Bhilai, Rourkela, Bokaro, Durgapur and Ispat Nagar. SAIL is increasing the capacity of old plants through installing new machinery, energy-efficient technology and automation, so that both domestic demand and exports can be better met.

- Investment in green energy : Keeping in mind environmental protection, SAIL has also taken steps towards green energy. The company has set a target of solar energy production up to 135 MW, out of which work has already begun on several projects. Along with this, investing in wind energy and energy production from waste are also being considered in the future. This step will not only reduce carbon emissions but will also reduce the energy costs of the company.

- Sustainable development and recycling : SAIL is now moving its business model towards manufacturing of ‘sustainable steel’. The company has planned to reduce the consumption of raw materials and water by adopting the 4R strategy (Reduce, Reuse, Recycle, Recover). New initiatives are also being taken regarding the reuse of scrap steel, water purification plants and efficient consumption of energy, so that production increases but the environmental impact is reduced.

Future Plans of Tata Steel

The future business plans of Tata Steel are listed below:

- International restructuring and expansion : Tata Steel has started a major restructuring to make its business operations more competitive and profitable in Europe. Technological changes and cost reductions are being made in the plants located in Britain and the Netherlands. At the same time, the construction of the second phase of the Kalinganagar plant has started in India, which will significantly increase the domestic production capacity of the company. This will enable Tata Steel to further strengthen its market share in India.

- Long-term goal of net-zero : The company has committed to achieve net-zero carbon emissions by 2045. Under this initiative, Tata Steel has already invested in projects focused on developing alternative energy sources like green hydrogen, solar and wind energy. Apart from this, work is also being done on the use of eco-friendly fuel like biochar in place of coking coal.

- Digital transformation and smart manufacturing : Tata Steel is making its manufacturing process more efficient through the use of advanced technologies. This is not only reducing the manufacturing costs but also helping in manufacturing steel of superior quality.

Read Also: Mahindra & Mahindra vs Tata Motors: Which is Better?

Who is Better: SAIL or Tata Steel?

Both SAIL and Tata Steel are among India’s oldest and largest steel companies, with their own strengths and business plans. SAIL, being a PSU company, plays a crucial role in the country’s major infrastructure projects and has a strong production capacity. The company’s plans to increase its production capacity will help it cater to its customer base on a timely basis.

On the other hand, Tata Steel has a good presence at the global level and is far ahead in terms of sustainability and technology. Both companies are strengthening the Indian steel industry in their own way. SAIL has many big plants in the country, while Tata Steel is known for its innovation and strong hold in the international market. So it is difficult to say who is better as the strengths of both depend on their future business plans and how well they execute them. It is advised to consult a financial advisor before investing in any of them.

Read Also: Tata Motors vs Maruti Suzuki? Analysis of Auto Stocks

Conclusion

Both SAIL and Tata Steel are pillars of the Indian steel industry, contributing to its growth in different ways. SAIL has been largely focussing on increasing its production capacity to cater to the demand of steel required to accomplish national infrastructure projects, while Tata Steel has taken key steps towards technological innovation and environmental protection. It would be wise to consult a financial advisor before making any investment investment.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | JK Tyre Vs CEAT: Which is Better? |

| 2 | Apollo Hospitals vs Fortis Healthcare |

| 3 | ITC vs HUL: Comparison of India’s FMCG Giants |

| 4 | IndiGo vs SpiceJet: Which is Better? |

| 5 | Tata Motors Vs Ashok Leyland: Which is Better? |

FAQs

Which company leads in production capacity?

Tata Steel’s production capacity in India is slightly more than that of SAIL.

Do both companies prioritize eco-friendly practices?

Yes, both companies focus on sustainability and have invested in various initiatives.

Is Tata Steel government-owned?

No, Tata Steel is a private company, SAIL is a government company.

Who has better international reach?

Tata Steel has a strong presence overseas.

Is investing in both companies advisable?

Investing in both companies depends on through analysis of the company’s fundamentals, knowledge of your risk profile and financial goals.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle