| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jul-17-25 | |

| Add MTF Calculator Link | Nisha | Sep-12-25 |

Read Next

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

What is MTF (Margin Trading Facility)?

In the world of investing, investors are always looking for ways to maximize their returns. One such powerful option is Margin Trading Facility (MTF). With MTF, you can buy more shares than your cash would normally allow by borrowing funds from your broker. This leverage can amplify your profits, but it also increases risk if the market moves against your position.

In this blog, we will explain to you what Margin Trading Facility (MTF) is and how it works.

What is a Margin Trading Facility?

Margin Trading Facility is a service provided by a stockbroker in which a trader can purchase shares by paying only a portion of the total transaction value. It is like paying an upfront amount for entering the trade, and the remaining amount is paid by the broker. The amount which is paid by the trader is known as “Initial Margin”, and the remaining amount paid by the broker is called the funded amount. Margin trading generally carries high risk.

Features of Margin Trading Facility

The key features of the margin trading facility are as follows:

- High Purchasing Power: Through margin trading, the buyer can purchase more securities than they could afford; helping investors increase their purchasing power.

- Upfront Margin: The investor is required to pay only the upfront margin, not the entire amount of the transaction value.

- Interest: The investor will have to pay interest on the amount borrowed from the broker.

- Regulated Stocks: Only the stocks which are approved by SEBI and your stockbroker are eligible for margin trading.

Check Out – Stocks Available for MTF

How Does Margin Trading Facility Work?

The margin trading facility works in the following manner:

- Margin Money: The investor will have to deposit a margin amount, which is a certain percentage of the total trade value. Margin percentage is pre–defined and generally ranges from 20 to 50%.

- Funding: The remaining amount of the trade value is funded by the broker.

- Interest Charges: The broker charges interest on the funded amount, and the rate of interest varies from broker to broker.

- Collateral: The shares purchased by the investor are pledged or kept as collateral by the broker.

- Square Off Position: Once you square off the position after a certain period, you have to pay the dues to the broker.

Read Also: Lowest MTF Interest Rate Brokers in India | Top 10 MTF Trading Apps

Example of Margin Trading Facility

Let’s understand the concept of Margin Trading Facility with an example.

Suppose you wish to purchase 100 shares of a company with a share price of ₹1000. Then the total traded value is ₹1,00,000. Suppose, you are required to pay 25% of the trade value as the upfront margin. Then, the total amount payable as upfront margin by you will be 25% of ₹1,00,000, which is equal to ₹25,000. And the remaining 75% or ₹75,000 will be paid by the broker. Suppose the broker charges 14% per annum on the funded amount paid by the broker for the duration for which you hold the trade.

If you hold the stock for one month or 30 days, then you will have to pay the interest on the borrowed amount for 30 days. Which will be calculated as follows:

Interest = ₹75,000 * (14%/365) * 30 = ₹863

Try our MTF Interest Calculator

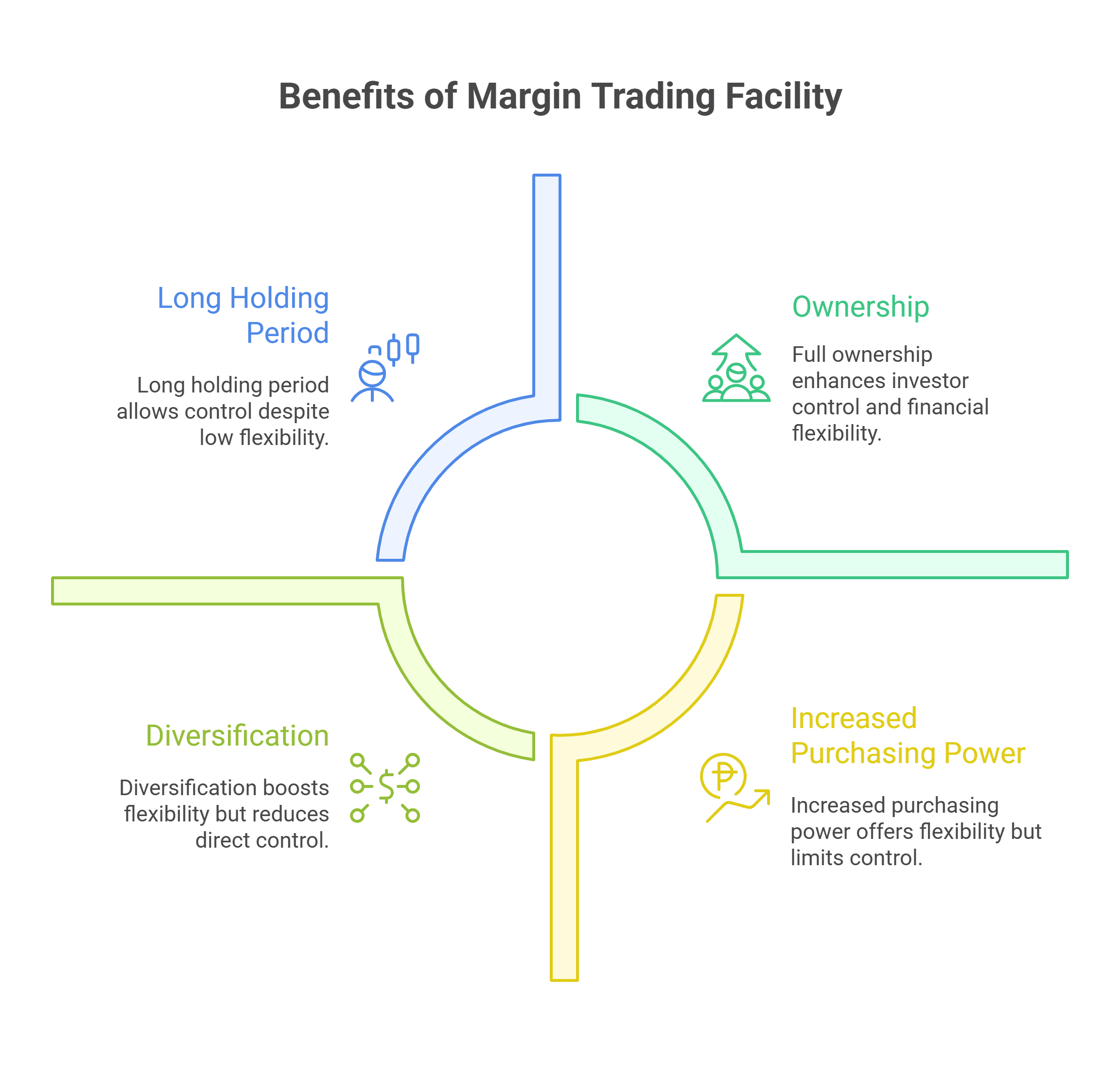

Benefits of Margin Trading Facility

The significant advantages of using Margin Trading Facility are as follows:

- Increased Purchasing Power: Using MTF increases the purchasing power of the investor, which potentially increases profits if the stock moves in a favorable direction.

- Long Holding Period: One can easily hold their position for a longer period of time, say one week or one month, allowing them to generate good returns on their investments.

- Diversification: MTF helps investors use their capital more efficiently by leveraging it to buy stocks. This frees up funds to invest in other opportunities, enabling a more diversified portfolio.

- Ownership: Shares purchased through MTF are held in the investor’s name, meaning they enjoy full ownership. As a result, investors are entitled to participate in all corporate actions, such as dividends, bonuses, rights issues, and voting.

Read Also: Top Tips for Successful Margin Trading in India

Risks of Margin Trading Facility

The risks related to using the Margin Trading Facility are as follows:

- High Risk: Shares bought using MTF can result in significant losses if the stock price moves unfavourably.

- Interest Cost: The interest rates charged by the broker on the MTF are generally very high due to which your profits can be significantly reduced.

- Margin Calls: In case of high volatility, the broker can ask you to deposit additional margin, or else they can sell the shares pledged by you.

- Limited Stocks: The facility to use the margin trading is not available for every stock.

How to use Margin Trading Facility on Pocketful?

Pocketful also provides you with an opportunity to use the margin trading facility. To use it on Pocketful, one can follow the steps mentioned below:

- In the first step, the investor is required to open a trading and demat account with Pocketful, which can be opened for free online.

- The next step is to transfer the funds to your trading account.

- Once the account is opened successfully, you need to identify the stock which you wish to buy.

- Go to the order window, switch to the “Pay Later” option and enter the quantity and price.

- Click on Buy with MTF and your order is executed.

- Once the stock is purchased, these are automatically pledged, and your transaction is completed.

Note: Make sure that your DDPI is enabled to buy stocks using MTF.

Conclusion

On a concluding note, the margin trading facility allows an investor to earn significant profits with a limited amount of capital. The investor is required to pay interest on the amount which is borrowed from the broker. However, using MTF comes with various risks, such as interest rate cost, potential for higher losses. Therefore, it is advisable to use the MTF facility only after consulting your investment advisor.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Margin Against Shares: How Does it Work? |

| 3 | Margin Pledge: Meaning, Risks, And Benefits |

| 4 | What is Intraday Margin Trading? |

| 5 | What is Operating Profit Margin? |

| 6 | What is Stock Margin? |

| 7 | Key Differences Between MTF and Loan Against Shares |

| 8 | What is Margin Funding? |

Frequently Asked Questions (FAQs)

What is the full form of MTF?

MTF refers to Margin Trading Facility offered by brokers to their clients, in which one can use the funds provided by their broker to take a much larger buy position in the equity market.

Can I trade in every stock using MTF?

No, only selected stocks can be bought using MTF. You can find the list of eligible stocks on your stockbroker’s website.

Is interest charged by the broker for using the Margin Trading Facility?

Yes, the stockbroker charges interest on the borrowed amount.

What is Upfront Margin?

Upfront Margin is also known as initial margin, which is paid by the investor before buying using MTF.

Can I hold shares using MTF for the long term?

Yes, you can hold shares using MTF for the long term; however, the policies related to the holding period vary from broker to broker.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle