| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-19-24 | |

| Add new links | Nisha | Mar-20-25 |

Read Next

- Future Industry in India 2026

- What is Auction Market?

- Top Green Hydrogen Stocks in India

- Ashish Dhawan Portfolio : Top Holdings, Strategy & Lessons

- Top 10 Wind Energy Stocks in India

- Aluminium Price Predictions for Next 5 Years in India

- Zinc Price Predictions for Next 5 Years in India

- Best Sectors to Invest in Next 10 Years in India

- Why Tobacco Stocks Are Falling in India: ITC, Godfrey Impact

- Copper Price Predictions for the Next 5 Years in India

- Book Value vs Market Value of Shares: Meaning, Formula & Key Differences

- Why Share Market is Down Today? Reasons Behind Stock Market Fall

- Steel Price Predictions for the Next 5 Years in India

- What are Bond ETFs?

- Best ULIP Plans in India

- Difference Between Shareholders and Debenture Holders

- Nifty 50 vs Nifty 500: Which Is Better

- Big Bulls of Indian Stock Market: The Complete List

- Best Sugar Stocks in India

- What Is a Ponzi Scheme? Meaning, Scam & India Laws

- Blog

- what are bond yields

What are Bond Yields?

People often ask how investing in bonds works and what the term “bond yield” means. If you are looking to invest into fixed-income securities such as bonds, understanding bond yields is fundamental. In essence, bond yield is the return that an investor would receive from a bond over a period of time.

In this blog, we are going to explain the meaning of bond yield in detail and its importance. Moreover, we will walk you through the different types of bond yield.

What are Bonds?

Bonds are fixed-income investment instruments that corporations or governments issue to collect money from investors. These institutions borrow the funds at a fixed interest rate for a defined period to finance their projects and activities.

What is Bond Yield?

A bond yield is the return an investor earns from a bond investment, typically expressed as a percentage. It includes income from coupon payments and any capital gain or loss due to changes in the bond’s market price. Bond yields help the investors to compare the returns or risk associated with different bonds.

Buying a bond means you are lending money to the issuer in exchange for coupon payments based on a set interest rate. The return from price increase or decrease depends whether the bond has been bought at a discount or a premium as the bond price moves towards face value as it matures. The yield is inversely proportional to the bond’s market price as when prices of bond rises the yield decreases and vice versa.

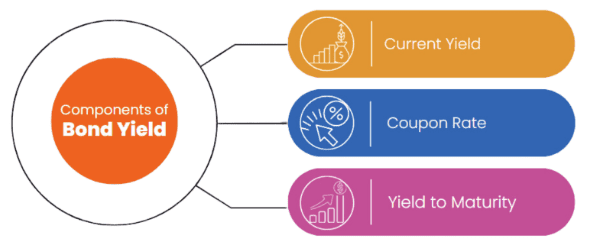

Types of Bond Yield

Various types of bond yields are:

- Coupon Yield: It is the annual interest received by the bondholder from the issuer and is expressed as a percentage of the bond’s face value.

- Current Yield: It is calculated as annual interest received divided by current market price of the bond.

- Yield to Maturity (YTM): It is the total return expected if a bond is held to maturity.

Overview of Different Types of Bond Yield

Based on these explanations, let us see the fundamental types of bond yield which helps us in comparing different bonds. Every type reveals a different story regarding how much you may anticipate earning from a bond investment. Let’s look at them more closely.

1. Coupon Yield

Of all the yields, coupon yield is the simplest. It has a fixed rate that the bond issuer must pay during the lifespan of the bond.

Coupon Yield = (Annual coupon payment / Face Value) * 100

Suppose you purchase a bond with a face value of ₹1000 and it pays an annual interest of ₹100. The coupon yield becomes: 100/1000* 100 = 10%

The coupon yield remains static for the entire duration of the bond. Regardless of the price movement of the bonds, which could be upwards or downwards, coupon yield will always remain stagnant and is always positive.

2. Current Yield

Current Yield is the yearly interest (coupon) payments received from the bond divided by the bond’s current market price.

Current Yield = (Annual Coupon Payment / Current Market Price) X 100

Consider that a bond with a ₹1,000 face value and a ₹100 coupon that is currently selling for ₹900.

Current Yield = (₹100 / ₹900) x 100 = 11.1%

Current Yield tells us about the actual interest return the investors will get based on today’s market price. This metric can be either greater or lesser than the coupon yield and changes as bond market price changes.

3. Yield to Maturity (YTM)

Yield to Maturity or YTM calculates the total return that a bondholder can expect to earn if the bond is held till maturity, it is regarded as the best way to measure your returns as it is based on the following:

- The market price of the bond at current price,

- Coupon payments,

- The remaining time until the bond matures,

YTM = [ Annual Coupon payment + (FV – PV) ÷ T ] ÷ [(FV + PV)÷ 2]

Where,

FV = Face value

PV = Present value

T = Years to Maturity

For instance: If you purchase a bond today for ₹950, it has a face value of ₹1,000 with a ₹100 annual coupon and it will mature in 5 years, then the YTM is 11.37%.

Why Does It Matter?

- YTM allows a more accurate assessment of your returns as it takes into account future price changes, the time to maturity, and reinvestments as well.

- It is considered best for long term investors that intend to hold onto the bonds until they mature.

Read Also: Detailed Guide on Bond Investing: Characteristics, Types, and Factors Explained

Real-world Implications of Bond Yield

Increasing Interest Rates = Decreasing Bond Price = Increasing Yield

- When the market’s interest rate goes up, the existing bonds are sold at lower prices hence their yield increases as they will be trading at a discount to face value and increase in value with time.

Decreasing Interest Rate = Increasing Bond Price = Decreasing Yield

- Older bonds with higher coupons payment become more attractive and therefore their price increases.

Things To Consider Before Investing in Bonds in India

You should consider the following points before investing in Bonds in India:

1. Consider The Coupon Rate: Look for reputed companies offering bonds with higher coupon rates. Moreover, investors must purchase bonds with coupon payments that align with their passive income targets.

2. The Credit Rating of the Issuer: Bonds with a higher rating are less prone to default, although they typically have lower yields. Junk bonds or lower-rated bonds carry greater risk, but they also have higher yields.

3. Inflation: If inflation exceeds the bond yield, the real return is negative. Always measure the yields against expected inflation before investing.

4. Maturity Period: Bonds with longer durations typically offer higher yields but are more vulnerable to interest rate fluctuations.

5. Liquidity: Some bonds are more liquid than others, which makes them easier to sell and buy. Therefore, they are more desirable and less risky. Less liquidity may translate to higher yields due to liquidity premium.

6. Reinvestment Risk: It is relevant in situations where coupon payments received may have to be reinvested at a lower rate, thus reducing overall yield.

7. Taxation: Different bonds incur different tax obligations. Tax-free bonds, for example, may have lower yields, but provide better returns than taxable bonds after tax is applied.

8. Market Sentiment: Bond prices and consequently yields can be affected by economic news, geopolitical issues, and the activities of other investors.

9. Type of Bond: Government-issued bonds such as debentures, corporate bonds, and municipal bonds come with different levels of risk and return.

The Advantages and Disadvantages of Bond

Advantages

- Predictable Income: Bonds provide coupon payments at regular intervals, which benefits the income-dependent investors.

- Risk Diversification: When bonds are combined with equities in an investment portfolio, volatility is significantly reduced.

- Variety: Investors have the freedom to select from a broad spectrum of bond issuers, based on their financial goals and risk tolerance.

- Market Indicator: Yields indicate the average investor’s perception regarding interest rates and inflation.

Disadvantages:

- Interest Rate Risk: When the interest rates increase, it directly affects the bond’s prices negatively.

- Credit Risk: There is always a possibility that the bond issuer may default.

- Inflation Risk: The nominal returns may be greatly reduced in the event of extremely high inflation.

- Complexity: For novice investors, distinguishing different types of yields (YTM, YTC, etc.) can present a steep learning curve.

The Importance of Bond Yields for Indian Investors

There are people who seek low-risk investments in bonds and must carefully analyze bond yield metric as.

- Government securities or G-Secs provide low returns but maximum security.

- Corporate bonds provide high risk and better returns.

For instance, in early 2025, a 10 year Indian Government Bond had a yield of approximately 7.15% and AAA rated corporate bonds yield between 7.8%-8.5%.

Who Should Invest in Bonds Based on Yield?

- Elderly people in retirement seeking constant cash flow.

- Risk-averse investors

- Investing in bonds can diversify the investment portfolios.

Read Also: What Is Bowie Bond (Music Bonds) : History, Features, Advantages & Disadvantages

Bond Yield Trends in 2025

Due to a decrease in repo rate and stability in Indian equity markets, bond yields have decreased since the beginning of 2025. Other factors like the dollar index and economic indicators also play a huge role.

Investors are now looking closely at:

– Shorter-term G-Sec bonds (6.8-7.2% returns)

– Long-term corporate bonds (up to 8.5% returns)

Conclusion

So, what is bond yield really about? In simple words, bond yield is simply the annualized income you gain from a bond investment. Understanding the bond yield and rating helps you determine if investing in a particular bond is beneficial or not compared to other investment options available.

Some of the factors affecting bond yields include interest rates, credit rating of the issuer and inflation. Understanding and comparing yields will grant you the opportunity to make more strategic investment decisions. It is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

What factors determine the yield on government bonds in India?

The yield on government bonds in India is determined by market demand and supply, interest rates set by the Reserve Bank of India (RBI), and the overall economic conditions.

What is the difference between bond yield and interest rate?

Bond yield is the expected return on investment considering both the coupon payments and any change in bond prices. On the other hand, interest rate refers to the cost of borrowing the money that the issuer pays to bondholders.

How does bond yield change over time?

Market demand, interest rates, and credit ratings heavily influence bond yield.

Is higher bond yield always better?

Not always as higher yields could mean higher risk. Always consider the issuer’s credit rating.

Can bond yields go negative?

Rarely, but in scenarios of deflation or extreme demand, it’s possible.

In what ways can I invest in bonds in India?

You can invest in bonds through online platforms, debt mutual funds, etc.

Why do government bond yields act as a benchmark for other interest rates in India?

Government bond yields are considered risk-free and reflect the government’s borrowing cost. They serve as a benchmark for setting interest rates on other loans and securities in the market.

How do I invest in Bonds?

Government bonds in India can be purchased directly from the RBI Retail Website. Corporate bond investments can be made through a financial institution or trusted broker. ETFs and other mutual funds are also a good option for investing in bonds in India.

What is the significance of the yield curve in the Indian financial market?

The yield curve represents the yields of bonds of different maturities. A normal upward-sloping yield curve indicates healthy economic growth, while an inverted curve may signal a potential recession.

What are the risks involved in investing in G-Sec bonds?

G-sec are generally referred to as risk-free instruments, as sovereigns rarely default on their payments. However, market, liquidity, and reinvestment risks exist even in G-sec bonds.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle