| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-12-23 | |

| Update Keyword | Nisha | Mar-20-25 | |

| Content Updated | Ranjeet Kumar | May-23-25 | |

| Add new links | Nisha | Sep-01-25 | |

| Add ETF Landing Page Link | Nisha | Sep-11-25 |

Read Next

- How to Invest in US Stocks from India

- Platinum Price Forecast in India (2026–2030)

- Why Is the Gold Price Going Down?

- Top 10 BESS Stocks in India (2026)

- Why is the Silver Price Going Down?

- Best Construction Stocks in India

- Why Gold Prices Hit ₹1,80,000 – Key Reasons

- List of Best Sensex ETFs in India

- Best Commodities to Trade in India

- Best Cyclical Stocks in India 2026

- How to Check the Purity of 20-Carat Gold: Easy Methods & Tips

- Why Are Silver Prices Rising in India?

- Difference Between Hallmark Gold, KDM Gold and BIS 916

- Why Are Gold Prices Rising in India?

- 1 Tola Gold in India: How Many Grams, Price & Investment Insights

- 22K vs 24K Gold: Which Is Better for Jewellery & Investment?

- Will the Silver Rate Decrease in the Coming Days in India?

- Will the Gold Rate Decrease in the Coming Days in India 2026?

- Best Bond ETFs in India 2026

- Best ETF Platforms for Trading and Investment in India 2026

- Blog

- what are etfs are etfs good for beginner investors

What are ETFs? Are ETFs good for beginner investors?

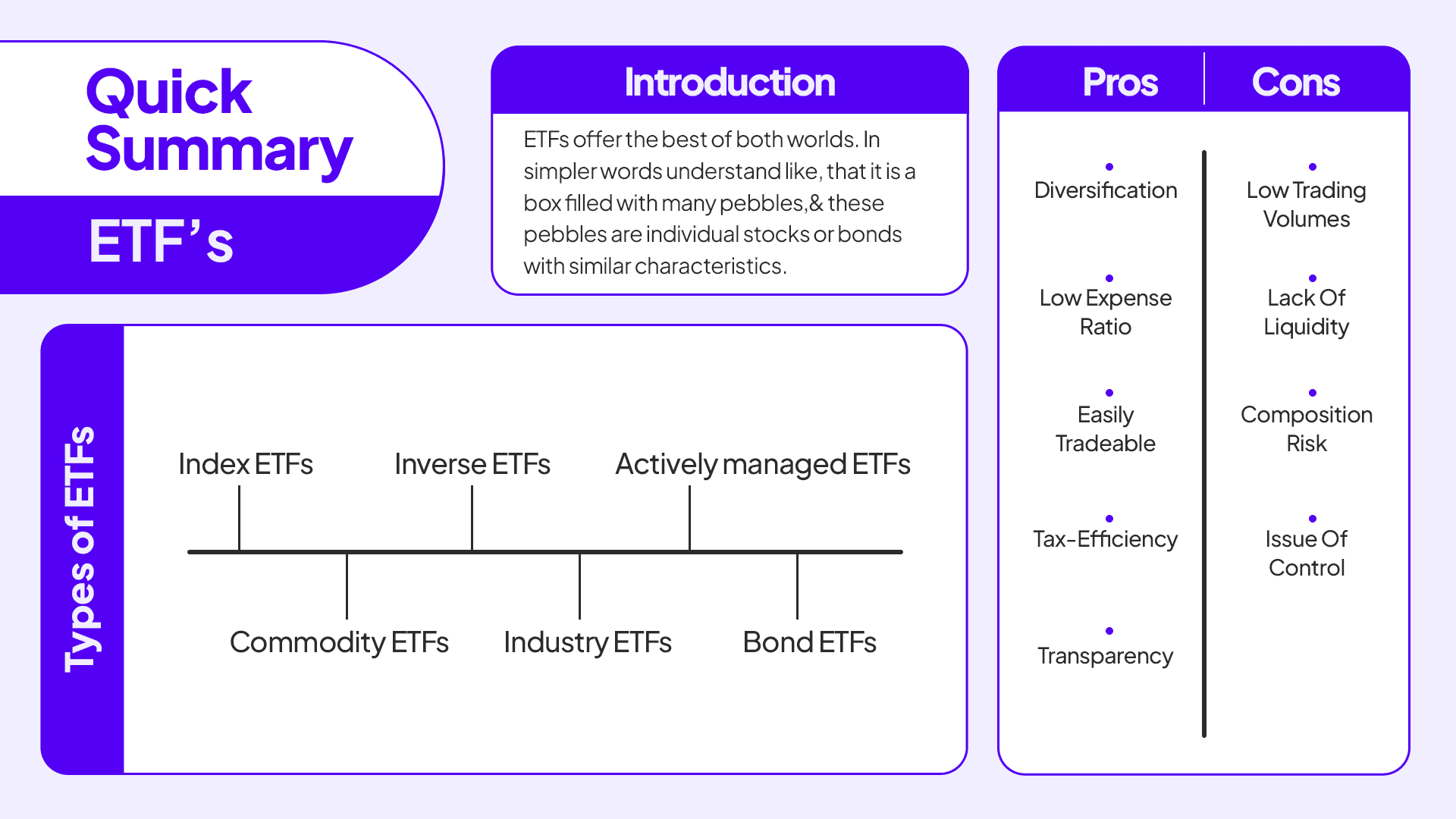

Recently, Exchange Traded Funds abbreviated as ETFs have gained popularity among investors. For the various benefits they offer. ETFs are a good investment option for beginner investors as they offer a collection of stocks with similar characteristics in one place. Investing in ETFs enables investors to have a diversified portfolio without doing research for individual stocks. ETF helps to minimise the risk of the investor & maximise his return on his portfolio.

By the time you finish reading this article. You will have a clear idea of whether you should invest in ETFs or not.

What are ETFs or Exchange- Traded Funds?

In simpler words understand like, that it is a box filled with many pebbles,& these pebbles are individual stocks or bonds with similar characteristics. An interesting fact is that specific ETFs track the movement of indices like NIFTY50, SENSEX, etc. So, you expect the same returns on your investment as the index’s annual CAGR.

Looking into the history of ETFs in India, we see that. The first ETF in India was launched in 2002 by Nippon India Mutual Fund (erstwhile Benchmark Asset Management Company Ltd). Listed on January 8th 2002, it witnessed a trading of 1.30 crores on the first day. The journey to listing of the 100th ETF on NSE took more than 19 years. The last one-year period has seen a lot of activity in the ETF space, with 21 ETFs getting listed on the NSE. The assets under management of ETFs in India are now at Rs. 3.16 lakh crores (end of May 2021), witnessing more than 13.8 times increase in five years, compared to Rs. 23,000 crores (end of April 2016).

ETFs offer the best of both worlds, like Mutual Funds, ETFs represent professionally managed collections or baskets of stocks or bonds. And just like individual stocks, they trade on the stock exchanges, which means you can buy and sell them like individual stocks.

Types of ETFs in India

There are different types of exchange-traded funds (ETFs) available in India, offering investors a variety of options to choose from according to their financial goals and risk tolerance.

- Equity ETFs : Equity ETFs track stock market indices such as Nifty 50, Sensex, or Nifty Next 50. They provide investors with broad market exposure and are suitable for the long term.

- Debt ETFs : Debt ETFs invest in government or corporate bonds, such as Bharat Bond ETFs. These are known for stable income and low risk and are suitable for retirement or capital preservation. Investments in them can generate regular interest income.

- Gold ETFs : Gold ETFs track gold prices and give investors an opportunity to invest in gold without buying physical gold. They are suitable for inflation protection and portfolio diversification.

- International ETFs : International ETFs track stocks or indexes from foreign markets such as the US, China, etc. They offer global diversification and the opportunity to invest in foreign markets but also carry certain risks.

- Smart Beta ETFs : Smart Beta ETFs move away from traditional index tracking and focus on tracking smart beta indices focused on value, growth, etc. They provide investors with an opportunity to earn better risk-adjusted returns.

Investors should consider their investment goals, risk tolerance, and time horizon when choosing among these different types of ETFs. Choosing the right ETF can improve portfolio performance and help achieve financial goals.

What are the pros of investing in ETF?

Investing in ETF has several benefits, some of which are listed below.

1. Diversification:

ETFs enable the investor to diversify their portfolio without the hassle of individually picking out each stock. Investors seeking to invest in a specific type of sector or industry. ETFs are a go-to option for people who do not want to spend their time researching each company individually. They cover most of the asset classes and sectors for the most part.

2. Low expense ratio:

The expense ratio is the operating expense of the Security, divided by the value of that security. In other words, it is the expense that the investor has to bear for the Security. An expense ratio below 1 is good. And ETFs offer an expense ratio below 1.

3. Easily tradeable:

Investors can trade ETFs just like individual stocks, which makes them highly liquid, meaning you can sell and buy them anytime during market hours.

4. Tax-efficiency:

Due to its low turnover, ETF offers tax relief to investors. The investors are charged 15% on short-term equity gains. And 10% on long-term equity hains after the exemption of the first 1 lakh rupees.

5. Transparency:

ETFs typically have the same securities as the index or the benchmark they track. Some ETFs disclose their holdings regularly, while others disclose them on a monthly, or quarterly basis.

What are the cons of investing in ETFs?

Investing in ETF has several disadvantages, some of which are listed below.

1. Low trading volumes:

Even though ETFs have become popular lately, their trading volume is considerably low compared to the other securities listed. Volume is the total buying and selling of a specific security over the trading exchange.

2. Lack of liquidity:

Due to low trading volume, sometimes it becomes hard to sell the ETFs because there is no one willing in the market to buy them at the price you are offering at that time. Therefore, ETFs are not the most liquid asset to hold.

3. Composition risk:

Since ETFs are already tailored-made investment options. Sometimes, they may have some securities in the group that you do not want to hold. Therefore, you do not have a choice for customisation.

4. Issue of control:

ETFs offer less control as the investor does not choose the securities in the ETF by his own will. Also, the portfolio manager swaps or churns the portfolio depending on his expertise.

ETFs vs. Stocks vs. Mutual Funds: Which is Better?

Before starting to invest, it’s important to understand the difference between ETFs, stocks, and mutual funds and which option is suitable for whom.

| Feature | ETF (Exchange Traded Fund) | Stocks | Mutual Funds |

|---|---|---|---|

| Risk | Moderate (Diversified portfolio) | High (Investment in a single company) | Low to High (Depends on type of fund) |

| Returns | Index-based, relatively stable | Can be very high or very low | Depends on fund manager’s performance |

| Cost | Low (Lower expense ratio) | Brokerage charges | Slightly higher (Includes fund management fee) |

| Liquidity | High (Traded throughout the day) | High | Lower (Redeemed at NAV, once daily) |

| Diversification | Yes (Index-based spread across many stocks) | No (Single stock exposure) | Yes (Diversified portfolio by fund manager) |

| Management | Passive (Tracks an index, no active manager) | Self-managed (Investor makes decisions) | Actively managed (By professional managers) |

| Ownership | Indirect (Holds a basket of underlying assets) | Direct (Ownership of shares in a company) | Indirect (Units of pooled fund investments) |

- ETFs are a better choice for those who want low costs and good diversification and are comfortable trading on their own.

- Stocks are suitable for active traders and high risk takers.

- Mutual funds are for investors who like the convenience of professional management and prefer regular SIPs.

Points to keep in mind before investing in ETFs

- First, determine the assets, in which you want to invest. Choose the best possible ETF according to your risk appetite and availability of funds.

- Go for those ETFs that offer a low expense ratio. So, you can save on your operating costs.

- Invest in ETFs with high liquidity so you can sell them without any hassle whenever you want. Otherwise, it would be a hectic task.

- Check the ETF disclosure reports to ensure that your financial goals align with the objectives of that particular ETF.

- Lastly, regularly check the performance of the ETFs and take the required measures according.

Read Also: What is Nifty BeES ETF? Features, Benefits & How to Invest?

Conclusion

From the above article, we can conclude that, as a beginner investor, ETFs could be an adequate option to start your investing journey. Keep in mind that everything has pros and cons & the same applies to ETFs. Keeping a check on a few things and investing with patience and discipline can yield lofty returns for investors.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Mutual Fund vs ETF. Are They Same Or Different? |

| 2 | Best ETFs in India to Invest |

| 3 | ETF vs Stock – Which One is the Better Investment Option? |

| 4 | Gold ETF vs Gold Mutual Fund: Differences and Similarities |

| 5 | ETF vs Index Fund: Key Differences You Must Know |

FAQs (Frequently Asked Questions)

What are ETFs in the stock market?

ETFs or exchange-traded funds are financial securities that resemble the characteristics of both Mutual Funds and Stocks. In simpler words, a collection of different stocks to track the performance of a specified index.

How do ETFs work?

ETFs are like common stocks on the stock exchanges. They track the movement of the underlying asset and perform accordingly.

What are the types of ETFs?

Different types of ETFs are present in the market like index ETFs, sector ETFs, and commodity ETFs.

Which are the best-performing ETFs in India?

Kotak PSU Bank ETF, CPSE Exchange Traded Fund, UTI S&P BSE Sensex ETFETF are the top-performing ETF funds for the past year.

What are CPSE ETFs?

CPSE ETF (Central Public Sector Enterprises Exchange-Traded Fund). An investment instrument that allows you to invest in Central Government public sector enterprise.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle