| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-27-25 |

Read Next

- Why Are Steel Share Prices Increasing in India?

- Top Nifty Metal ETFs in India 2026

- Best Gold Investment Schemes in India 2026

- How to Build a Portfolio With Exchange-traded Funds (ETFs)

- How to Invest in US Stocks from India

- Platinum Price Forecast in India (2026–2030)

- Why Is the Gold Price Going Down?

- Top 10 BESS Stocks in India (2026)

- Why is the Silver Price Going Down?

- Best Construction Stocks in India

- Why Gold Prices Hit ₹1,80,000 – Key Reasons

- List of Best Sensex ETFs in India

- Best Commodities to Trade in India

- Best Cyclical Stocks in India 2026

- How to Check the Purity of 20-Carat Gold: Easy Methods & Tips

- Why Are Silver Prices Rising in India?

- Difference Between Hallmark Gold, KDM Gold and BIS 916

- Why Are Gold Prices Rising in India?

- 1 Tola Gold in India: How Many Grams, Price & Investment Insights

- 22K vs 24K Gold: Which Is Better for Jewellery & Investment?

- Blog

- corporate bonds

What Are Corporate Bonds?

In today’s dynamic investment landscape, investors have access to a wide range of opportunities, from equities to cryptocurrencies. However, these investments are not the most ideal for investors who want as little volatility in their portfolio as possible. Therefore, for such investors, corporate bonds are becoming a popular investment choice, as they have a moderate risk-return profile.

In this blog, we will explain all the concepts related to corporate bonds, including their types, advantages, risks, etc.

What is a Corporate Bond?

A Corporate Bond is a debt instrument that is issued by firms to raise funds. Investors can buy bonds from the firm and can lend money to the firm for a particular purpose. In exchange, the company will give periodic interest payments or coupon payments, and at the end of the period, the company returns the bond’s principal.

In other words, we can also say that whenever you buy a bond, it means you are lending money to the company, and in return for this, the company will repay you regular interest at a pre-determined interval along with return of principal at the end of the loan tenure. Moreover, corporate bonds yield a higher interest rate compared to government bonds.

Read Also: What are Bond Yields?

Features of Corporate Bonds

The key features of corporate bonds are as follows:

- Higher Returns: Corporate bonds generally offer higher returns when compared to government bonds.

- Liquidity: Corporate bonds are listed on the stock exchange but may have low liquidity.

- Interest: Corporate bonds offer a fixed interest rate, which can be a regular source of income for investors.

- Risk: Corporate bonds generally carry credit risk, which means the company may delay or default on interest and principal payments.

- Maturity: The duration of corporate bonds ranges from short-term to long-term.

Types of Corporate Bonds

There are various types of corporate bonds available in the market; a few of these types are mentioned below:

1. Secured Bonds

These bonds are backed by certain assets which are kept as collateral. If the issuing company defaults, the assets can be claimed by the investors.

2. Unsecured Bonds

These are bonds that are not secured against any form of collateral. Hence, they are riskier than the secured bonds, as they are dependent on the issuer’s creditworthiness.

3. Fixed Interest Rate

These bonds offer a fixed interest rate and pay a fixed amount of interest throughout the term.

4. Floating Interest Rate Bonds

The interest rates of these bonds fluctuate with the market rates and are reset periodically.

5. Convertible Bonds

The bonds which can be converted into the equity shares of the company after a defined period are known as convertible bonds.

6. Non-Convertible Bonds

The bonds which cannot be converted into equity shares are known as non-convertible bonds.

7. Callable Bonds

In this kind of bond, the company has the privilege to redeem the bonds before maturity. This facility is usually availed by companies when the overall interest rates declines.

9. Putable Bonds

These bonds provide investors the right to sell the bond back to the issuer before maturity.

10. Zero Coupon Bond

These bonds do not pay periodic interest; they are issued at a discount to their face value and redeemed at face value at maturity

Benefits of Investing in Corporate Bonds

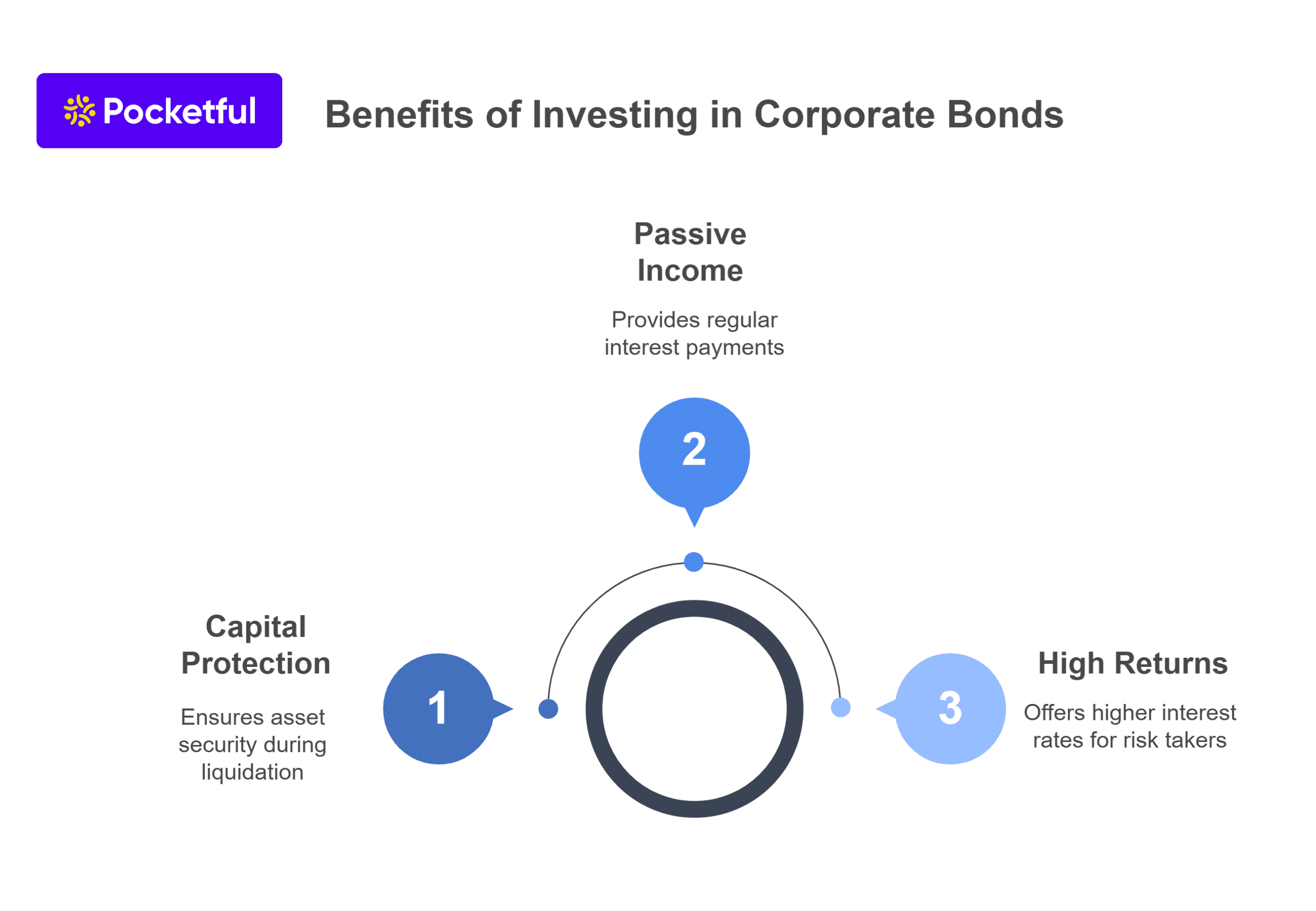

The significant benefits of investing in corporate bonds are as follows:

- High Returns: Corporate bonds generally offer higher interest rates than any other government bond, compensating for the higher credit risk. Hence, investors who are willing to take risks in order to get the extra returns can opt for investing in such bonds.

- Passive Income: The issuer pays interest payments in the form of coupons to the investors at regular intervals, usually semi-annually to annually. It can be a good source of passive income for investors.

- Capital Protection: Investing in corporate bonds is usually safer than investing in equity as in the event of liquidation bondholders have a higher claim on assets than equity shareholders.

Risk of Investing in Corporate Bonds

There are several risks involved while investing in corporate bonds, a few of which are mentioned below:

- Credit Risk: This is the most prominent risk when investing in a corporate bond as the issuer might fail to make the interest or principal payment because of any financial trouble.

- Liquidity Risk: Most of the corporate bonds have extremely low liquidity, which makes it difficult for buyers and sellers to execute their trade in the secondary market.

- Inflation Risk: If inflation rises over time then the coupon payments based on lower interest rate offered by your corporate bond will not be able to beat inflation.

- Reinvestment Risk: When the corporate bond matures, you will get the redemption amount, including the principal and interest. Reinvestment risk refers to the possibility that proceeds from a maturing bond may have to be reinvested at a lower interest rate. This generally happens when the interest rates have dropped.

Read Also: Detailed Guide on Bond Investing: Characteristics, Types, and Factors Explained

Factors Influencing the Price of Corporate Bonds

There are various factors which significantly impact the prices of corporate bonds; a few of such factors are as follows:

- Credit Rating: There are various credit rating agencies which regularly monitor the creditworthiness of the issuer; hence, if they downgrade their rating because of any financial trouble in the company, the prices of the corporate bond will fall.

- Interest Rate: The market interest rates play a major role in determining the price of a corporate bond. If the interest rate rises, the prices of the existing bonds will decrease.

- Inflation: An increased inflation rate can decrease the real return of the bonds, thereby making them less desirable to invest in; thus ultimately resulting in a decline in prices of such corporate bonds.

How to Invest in Corporate Bonds?

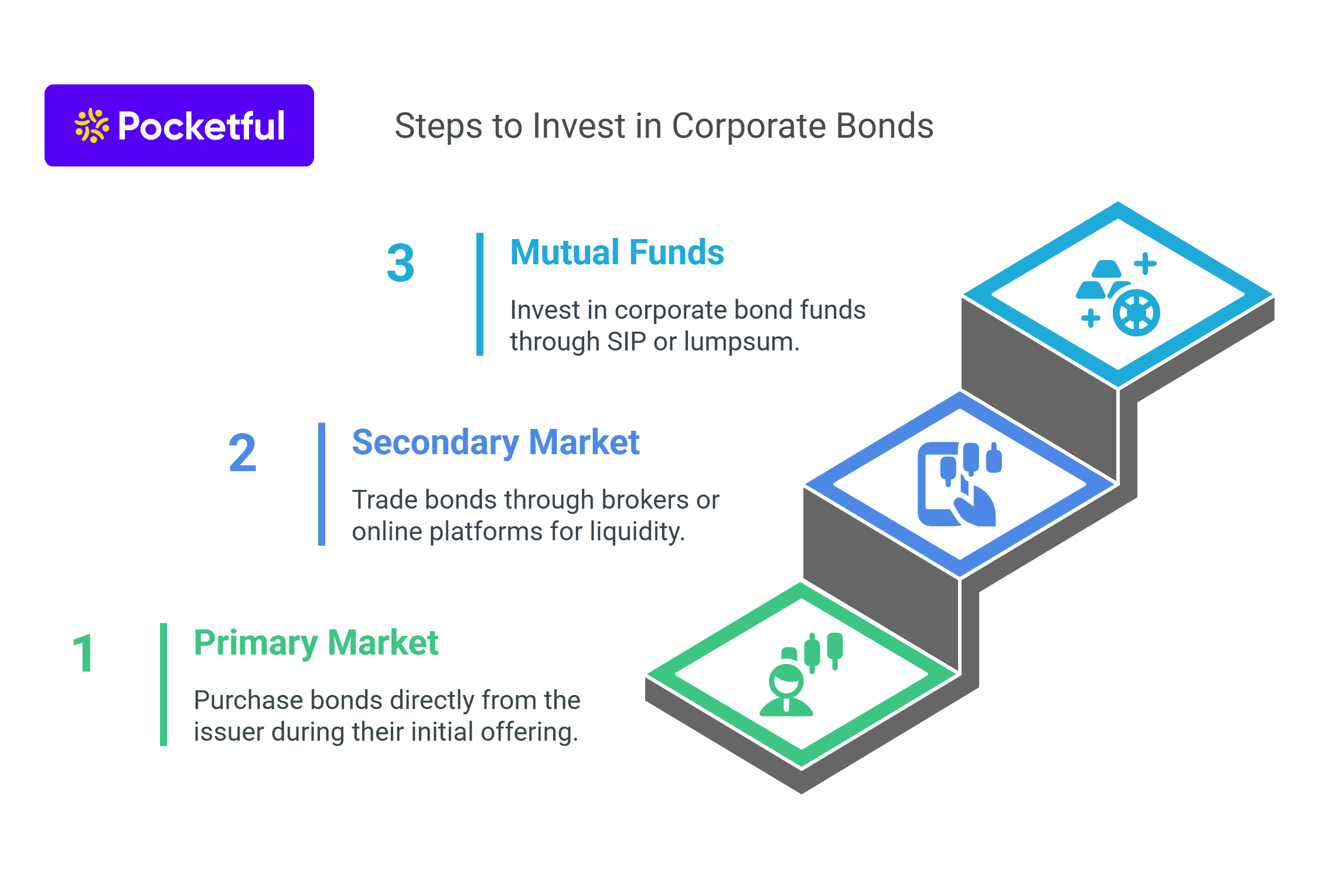

There are various ways through which one can invest in corporate bonds; a few of such ways are mentioned below:

- Primary Market: Bonds are issued for the first time in the primary market, hence, an investor can purchase them directly from the issuer.

- Secondary Market: You can sell your corporate bonds in the secondary market through brokers, financial institutions or online platforms. Some of the corporate bonds are listed on the stock exchange by the issuing company to provide liquidity to the investors. However, due to low liquidity it may be difficult to purchase them easily.

- Mutual Funds: Debt mutual funds invest in corporate bonds and are known as corporate bond funds. One can easily invest in these funds through SIP and Lumpsum.

Read Also: Stocks vs Bonds: Difference Between Bonds and Stocks

Conclusion

On a final note, corporate bonds are suitable for investors who want less volatility in their portfolios and want regular income. However, the corporate bonds are not completely safe. There are factors such as interest rates, credit ratings, and economic conditions which may have an impact on the returns of corporate bonds. Hence, before making any investment decision, one should consult his/her financial advisor, investment horizon, as well as risk profile.

Frequently Asked Questions (FAQS)

Who is allowed to invest in corporate bonds?

Anyone can invest in corporate bonds; however, investment in corporate bonds is appropriate for risk-averse investors who are looking for a steady source of income.

What risks are involved with corporate bond investment?

Investment in corporate bonds involves several risks, like liquidity risk, credit risk, inflation risk, etc.

How can I sell a corporate bond before maturity?

Some of the corporate bonds are listed on the Indian Stock Exchange but have low liquidity. You can sell your corporate bonds in the secondary markets through brokers, financial institutions and other online platforms.

Which is the safest corporate bond based on credit ratings?

Based on the credit ratings, AAA-rated bonds are generally considered safest, followed by AA, A, etc.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle