| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-08-25 |

Read Next

- FIFO in Demat: Meaning, Rules & Tax Impact

- Difference Between Individual and HUF Demat Accounts

- Demat Account: Fees & Charges

- What is Ledger Balance in a Demat Account?

- What is Demat Debit and Pledge Instruction (DDPI)?

- What is Non-Repatriable Demat Account? Meaning and Definition

- जानिए 15 भारत का बेस्ट डीमैट अकाउंट

- HUF Demat Account: Benefits, Documents & How to Open

- How to Buy Shares through a Demat Account?

- Can a Demat Account Be Opened Without a PAN Card?

- How to Open an NRI Demat & Trading Account in India

- Joint Demat Account: Meaning, Features, Benefits, and Steps

- Top 10 Demat Account in India 2026 – Top Picks for Traders & Investors

- Demat Account Charges Comparison 2026

- How Do You Open a Demat Account Without a Broker?

- Top Brokers Offering Lifetime Free Demat Accounts (AMC Free)

- BSDA – What is a Basic Service Demat Account?

- How to Find Demat Account Number from PAN?

- Tax Implications of Holding Securities in a Demat Account

- Eligibility Criteria to Open a Demat Account

What is Corporate Demat Account? Features, Benefits, and Eligibility

In today’s digital age, participation in the stock market has become extremely important for companies looking to increase their overall profitability. However, for a company to begin investing, a corporate demat account is a must.

Corporate demat account refers to an account in the name of the company where shares and securities are kept in electronic form. At the same time, companies can buy and sell shares through a corporate trading account.

In this blog, we will understand in detail what is a corporate demat account, what are its benefits, who can open it, what are the necessary documents and what is the process of opening it.

What is a Corporate Demat Account?

A Demat Account, or “dematerialized account”, is an account where your shares and other securities are kept in electronic form. Just like a Demat account is opened in the name of an individual, when a company opens an account to keep its investments and shares in digital form, it is called a corporate Demat account.

This account is specifically for registered companies such as Private Limited (Pvt. Ltd.) Companies, Public Limited Companies, LLPs (Limited Liability Partnerships), Trusts, etc.

The major difference between an individual Demat account and a company Demat account is that a company account can have multiple authorized signatories and it is opened in the name of the company, not in the name of any individual.

The main purpose of this account is to keep all the shares, bonds, mutual fund units and other securities of the company safely and systematically on a single digital platform.

Read Also: Types of Demat Accounts in India

Differences Between Individual Demat Account and Corporate Demat Account

| Particulars | Individual Demat Account | Corporate (Company) Demat Account |

|---|---|---|

| Account Holder | An individual person | A registered company or institution |

| Purpose | For personal investments | For company investments, ESOPs, IPO participation, etc. |

| Authorized Signatory | Single person (account holder) | One or more authorized signatories as per board resolution |

| Document Requirements | Basic KYC documents | Statutory company documents + KYC + Board Resolution |

| Control & Management | Managed by the individual | Managed by company representatives |

| Nomination Facility | Available | Limited or controlled via board decision |

| Processing Time | Fast and simple process | Detailed verification, may take more time |

Features of a Corporate Demat Account

A corporate demat account is a digital account for companies to store their shares, debentures, mutual funds, and other securities in electronic form. This account is designed not just to store investments but also to manage them smartly.

- Digital Holding: All securities in this account are held in electronic form, eliminating the need for paperwork and physical storage.

- Multiple Authorized Signatories: Companies can nominate multiple authorized signatories through their board resolutions who can operate this account.

- Nomination and Power of Attorney: A nominee or power of attorney holder can also be appointed if required, making account operations more flexible.

- Link to Corporate Trading Account: This account is directly linked to the corporate trading account, allowing companies to buy and sell shares easily.

- Accessible Platforms: The account can be easily accessed from the Depository Participant (DP) website or mobile apps.

Corporate Demat Account Benefits

In today’s times, when companies engage in activities like investments, IPOs, and stock options, a corporate demat account helps them manage all these operations in a smart and secure manner.

- Improved transparency and accountability: All investment activities are recorded through a demat account, making internal audits and regulatory auditing easier. It enhances the financial transparency of the company.

- Faster settlement: Transfer of shares happens digitally, making the trading and settlement process faster and more convenient.

- Investment security: Holding shares and other securities in electronic form eliminates the risk of theft, loss, or fraud.

- Helpful for IPO, ESOP, and M&A: When a company launches an IPO, or offers ESOPs to employees, or acquires another company, a demat account makes the entire process simple and efficient.

- Scalable solution for large transactions: Corporate Demat Accounts can easily handle large volumes of securities.

Advantages Over Individual Demat Accounts

When a company has to make substantial investments, a corporate demat account becomes a better option, especially when compared to an individual demat account.

- Centralized Investment Management: All the investments of the company are managed on a single platform, making reporting, tracking, and analysis easier.

- Professional and Regulatory Compliance: Companies need to ensure that their investments are compliant with the rules and regulatory guidelines (SEBI, ROC, etc.). A corporate account supports this.

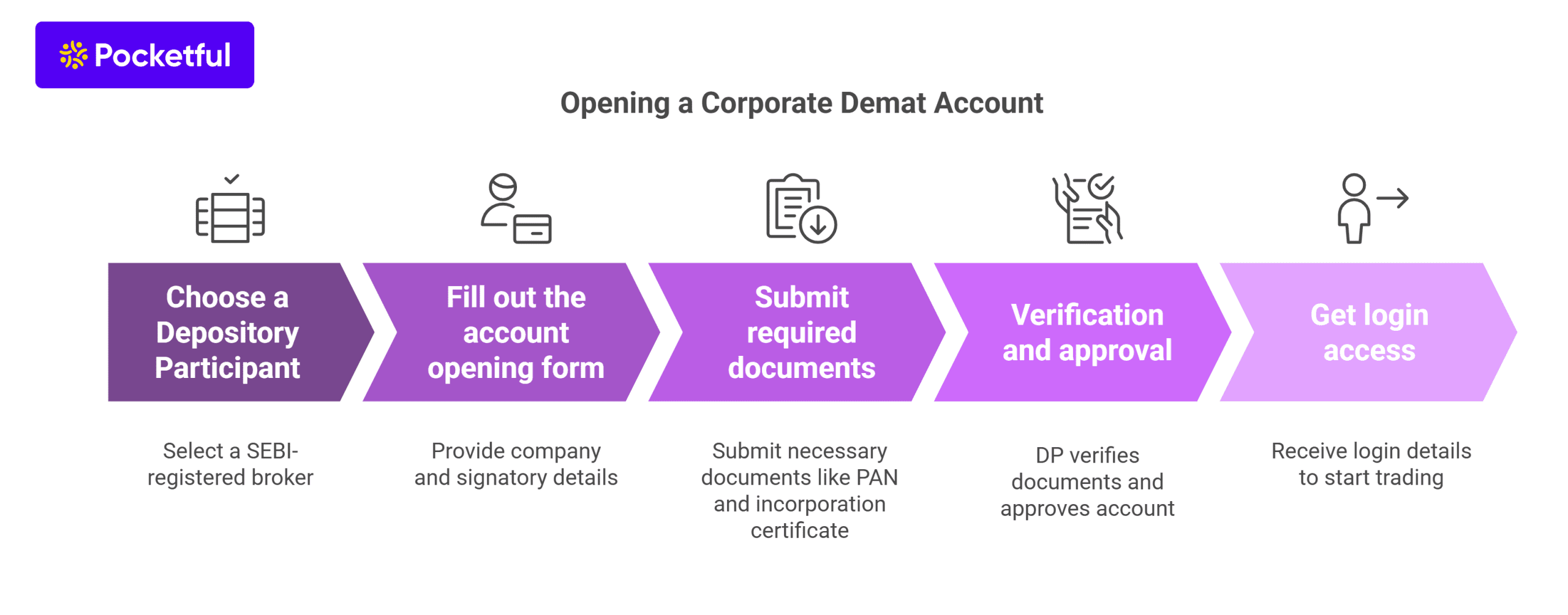

How to Open a Corporate Demat Account?

If your company wants to participate in investment or stock market-related activities, opening a corporate demat account is the first step. The process of opening it is easy; just follow a few important steps:

- Choose a Depository Participant (DP): Choose a SEBI-registered broker, such as Pocketful.

- Fill out the account opening form. Fill the form with the company details and authorized signatory information.

- Submit the required documents: Company PAN, Certificate of Incorporation, board resolution, etc. (the full list is in the next section).

- Verification and approval: After verification of documents by the DP, the account will be approved.

- Get login access: After approval, login details are sent to you, through which you can start trading.

Read Also: How To Find Demat Account Number and DP ID?

Documents Required for Company Demat Account

To open a corporate demat account, a company needs to submit certain documents. These documents reflect the legal identity of the company, permission to operate and validity of authorized signatories. Below is the list of required documents:

- Board Resolution: An official resolution issued on the company’s letterhead, allowing the opening of a corporate demat account.

- List of Authorized Signatories: Complete list of all authorized signatories on the company’s letterhead.

- Directors’ Details: List of all Directors on the company’s letterhead.

- Financial Records: Copies of the balance sheets of the last two financial years, Memorandum of Association (MOA), and Articles of Association (AOA).

- Identity Proof: Self-attested copies of PAN and Aadhaar cards of authorized directors and signatories.

- Bank Details: A valid cancelled cheque from the company’s bank account.

- Registration Documents: Company’s registration certificate and other required registration documents.

Corporate Demat Account Eligibility

A corporate demat account can only be opened by entities that fulfil certain eligibility criteria:

- Must be a registered company: The account can only be opened by private limited companies, public limited companies, LLPs, trusts or other registered entities.

- Valid PAN Card: It is mandatory to have a valid PAN in the name of the company.

- Bank Account: It is mandatory to have a current bank account in the name of the company.

- Regulatory Compliance: The company must be registered and compliant with the Companies Act 2013 and SEBI (Securities and Exchange Board of India) rules.

- Board Resolution: A resolution passed by the board of the company authorising the person to open and operate a demat account.

Read Also: Best Demat Accounts in India

Conclusion

In today’s fast-changing business environment, a corporate demat account has become an extremely important financial tool. It not only allows to digitally track and manage company investments but also facilitates smooth conduct of corporate actions such as IPOs, bonuses, share transfers and ESOPs. If you run a private limited, public limited or registered entity, now is the time to start investing through a corporate demat account.

We, Pocketful, as a registered stockbroker, help you open a corporate demat account with a fast, transparent and cost-effective process. Contact us today and take your investing game to new heights!

Frequently Asked Questions (FAQs)

Who can open a Corporate Demat Account?

Any registered company or organization like Pvt Ltd, LLP, Trust etc. can open a corporate demat account.

What documents are required to open a Corporate Demat Account?

PAN, MOA, AOA, Board Resolution, Directors details, Bank details and Address Proof.

Can a company have multiple Corporate Demat Accounts?

Yes, a company can have multiple Demat accounts with different Depository Participants (DPs).

Is it mandatory to have a Corporate Demat Account for a company?

If the company wants to invest in shares or IPO, then yes.

Are there any charges associated with a Corporate Demat Account?

Yes, like account opening fees, AMC and transaction fees.

Can a foreign company open a Corporate Demat Account in India?

Yes, they can open a corporate demat account after fulfilling all the requirements.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle