| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-07-25 |

Read Next

- What Is Quick Commerce? Meaning & How It Works

- Urban Company Case Study: Business Model, Marketing Strategy & SWOT

- Rapido Case Study: Business Model, Marketing Strategy, Financial, and SWOT Analysis

- Trump Tariffs on India: Trade vs Russian Oil

- NTPC vs Power Grid: Business Model, Financials & Future Plans Compared

- Exxaro Tiles Vs Kajaria Tiles

- Adani Power Vs Adani Green – A Comprehensive Analysis

- Blinkit vs Zepto: Which is Better?

- UltraTech Vs Ambuja: Which is Better?

- Tata Technologies Vs TCS: Which is Better?

- Tata vs Reliance: India’s Top Business Giants Compared

- HCL Vs Infosys: Which is Better?

- Wipro Vs Infosys: Which is Better?

- Voltas vs Blue Star: Which is Better?

- SAIL Vs Tata Steel: Which is Better?

- JK Tyre Vs CEAT: Which is Better?

- Lenskart Case Study: History, Marketing Strategies, and SWOT Analysis

- Parle Case Study: Business Model, Marketing Strategy, and SWOT Analysis

- Tata Motors Vs Ashok Leyland: Which is Better?

- Apollo Tyres Ltd. vs Ceat Ltd. – Which is better?

- Blog

- devyani international vs sapphire foods

Devyani International Vs Sapphire Foods – Which is Better?

Fast food has become a huge part of our daily lives, whether it’s a quick lunch at KFC, a pizza party at Pizza Hut with friends, or a cheeky Taco Bell run. But have you ever wondered who runs all these popular chains in India?

That’s where Devyani International and Sapphire Foods come in. These two companies are the powerhouses behind your favourite quick-service restaurants, operating hundreds of outlets across India and even overseas.

In this blog, we’ll break down who they are, how they got started, and how they stack up against each other financially. Think of it as a behind-the-scenes look at the business of burgers, pizzas, and beyond!

Devyani International – An Overview

Devyani International Ltd. (DIL) is one of the biggest names in India’s quick service restaurant (QSR) space. If you’ve ever grabbed a bite from KFC, Pizza Hut, or Taco Bell in India, chances are it was operated by them! They’re one of the largest franchisees of Yum! Brands in the country and also run some homegrown food brands like Vaango, The Food Street, and Masala Twist.

A Quick Look at Their Journey

- Started in 1991, Devyani International is part of the RJ Corp Group, headed by Ravi Jaipuria, a major player in the food and beverages industry.

- They teamed up with Yum! Brands early on, bringing Pizza Hut and later KFC to Indian diners.

- In 2011, they launched Vaango, their own South Indian vegetarian restaurant chain.

- Over the years, they expanded outside India too, you’ll find their outlets in Nepal and Nigeria.

- Currently, the company operates 941 KFC restaurants, 572 Pizza Hut outlets and 179 Costa Coffee stores in India.

- In 2021, they went public with a highly successful IPO, and their shares were listed on the NSE and BSE.

- Since then, they’ve been growing fast, opening new outlets in big cities and small towns alike, and putting a lot of focus on online orders and delivery.

Sapphire Foods – Overview

Sapphire Foods is one of the big names behind some of your favourite quick-service restaurants in India and nearby countries. They run a large number of KFC, Pizza Hut, and Taco Bell outlets across India, Sri Lanka, and the Maldives. So, if you’ve ever enjoyed a crispy bucket of chicken or a cheesy slice of pizza, there’s a good chance Sapphire Foods was behind it.

A Quick Look at Their Journey

- The company was initially incorporated as Samarjit Advisors Pvt. Ltd in 2009, but was later renamed as Sapphire Foods in 2015.

- In 2015, the company made a big move by acquiring over 270 KFC and Pizza Hut stores in India and Sri Lanka.

- Since then, they’ve grown fast, opening restaurants in more than 106 cities and spreading to places like Sri Lanka and the Maldives too.

- Currently, the company operates 429 KFC restaurants and 319 Pizza Hut outlets in India.

- In 2021, they went public, and their shares were listed on the Indian stock markets.

Read Also: Swiggy Vs Zomato: Business Model, Marketing Strategies, Strengths, and Financials Compared

Comparative Study: Devyani International vs. Sapphire Foods

| Particulars | Devyani International | Sapphire Foods |

|---|---|---|

| Current Price | ₹177 | ₹316 |

| Market Capitalization (₹ Crores) | 21,351 | 10,167 |

| 52-Week High | ₹223 | ₹401 |

| 52-Week Low | ₹130 | ₹242 |

| FII Holdings as of March 2025 | 10.46% | 30.42% |

| DII Holdings (as of March 2025) | 16.87% | 38.51% |

| Book Value | ₹9.66 | ₹42.4 |

| PE Ratio | 1,592 | 413 |

Financial Statements Comparison of Devyani International and Sapphire Foods

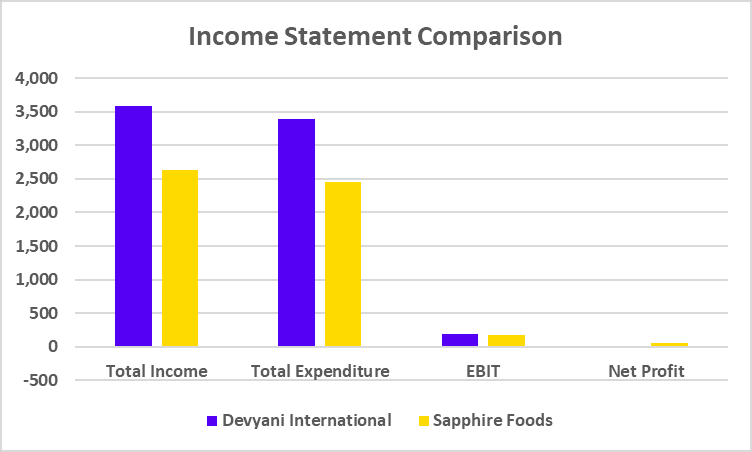

Income Statement

| Particulars | Devyani International | Sapphire Foods |

|---|---|---|

| Total Income | 3,588 | 2,627 |

| Total Expenditure | 3,398 | 2,456 |

| EBIT | 190 | 170 |

| Net Profit | -9 | 51 |

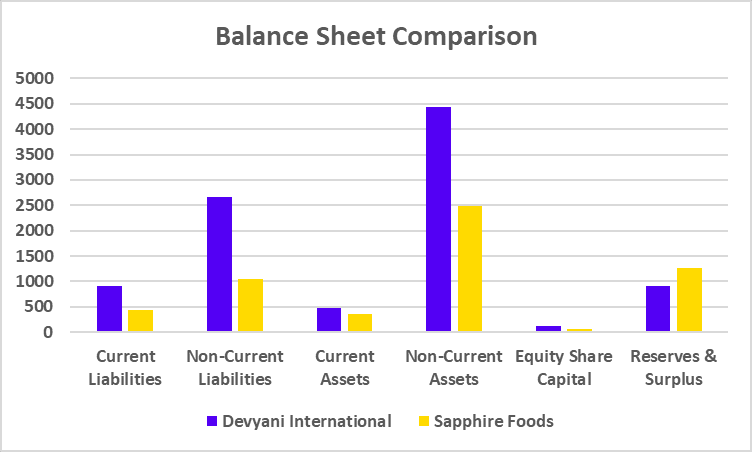

Balance Sheet

| Particulars | Devyani International | Sapphire Foods |

|---|---|---|

| Current Liabilities | 911 | 444 |

| Non-Current Liabilities | 2,673 | 1,056 |

| Current Assets | 486 | 363 |

| Non-Current Assets | 4,446 | 2,477 |

| Equity Share Capital | 120 | 64 |

| Reserves & Surplus | 910 | 1,275 |

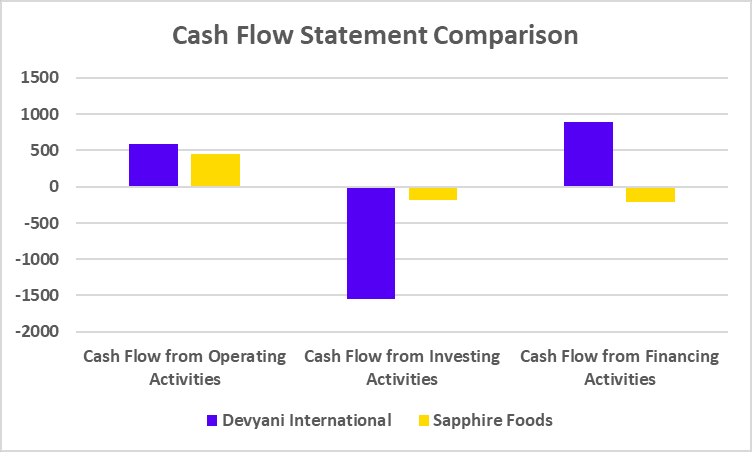

Cash Flow Statements

| Particulars | Devyani International | Sapphire Foods |

|---|---|---|

| Cash Flow from Operating Activities | 592 | 448 |

| Cash Flow from Investing Activities | -1,550 | -186 |

| Cash Flow from Financing Activities | 889 | -212 |

Key Performance Indicators (KPIs)

| Particulars | Devyani International | Sapphire Foods |

|---|---|---|

| Basic EPS (₹) | 0.39 | 8.30 |

| Operating Profit Margin (%) | 8.27 | 6.58 |

| Net Profit Margin (%) | -0.27 | 2 |

| Return on Equity (%) | 4.48 | 3.94 |

| Return on Capital Employed (%) | 7.31 | 7.13 |

| Debt-to-Equity (x) | 0.86 | 0.02 |

Devyani International vs Sapphire Foods: Which Company is Better?

Honestly, it depends on what you’re looking at.

If we’re talking size and revenues, Devyani International definitely has the edge. It runs more outlets, makes more money, and has a few extra brands under its belt. It’s also been in the game longer, which shows in its wider reach and stronger numbers. However, the business reported a net loss in March 2024.

But Sapphire Foods isn’t far behind. It’s growing steadily, runs high-performing outlets, and has a solid presence in international markets like Sri Lanka and the Maldives. It seems to focus more on quality over quantity and is playing the long game.

So, is one better than the other?

Devyani is winning on scale and operating margins, and Sapphire has a significantly higher EPS. It is hard to pick one as both companies have long-term potential if you’re betting on India’s growing appetite for fast food.

Inference:

- Devyani operates more outlets across countries, which reflects in its higher revenue.

- Sapphire is more focused on efficiency and operates stores in select international markets like Sri Lanka and the Maldives.

- Devyani International posted a net loss of ₹9 crores in March 2024, in contrast to a net profit of ₹51 crores for Sapphire Foods.

- Both companies are strong franchise operators for Yum! Brands, but Devyani also operates some in-house brands, which gives the company more diversification.

Based on the above information, deciding between the two companies for investment can be a tough decision and it is advised to consult a financial advisor before investing.

Read Also: ITC vs HUL: Comparison of India’s FMCG Giants

Conclusion

Both Devyani International and Sapphire Foods are doing a great job serving millions of customers across India and beyond. While Devyani is ahead in terms of revenues and number of outlets, Sapphire is playing it smart with a focus on growth and efficient operations.

At the end of the day, whether you’re grabbing a crispy KFC bucket or biting into a cheesy Pizza Hut slice, you’re enjoying the results of two well-run companies working hard behind the scenes. So next time you’re at one of these places, you’ll know a bit more about the business that’s serving you. When it comes to selecting between the two, it can be a tricky decision and it is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

Who owns Devyani International?

It’s part of the RJ Corp group, which is headed by Ravi Jaipuria, a well-known name in the food and beverage world.

Devyani International vs Sapphire Foods: Which company is bigger?

Devyani International is ahead right now since it has more outlets, more revenue, and a higher market capitalization.

Do Devyani International and Sapphire Foods operate outside India too?

Yes! Devyani has a presence in Nepal and Nigeria, while Sapphire is active in Sri Lanka and the Maldives.

Who has more stores in India?

Devyani International, by a good margin. They are operating over 1,600 outlets, while Sapphire has around 700 outlets.

How can I invest in Devyani International and Sapphire Foods?

Both companies are listed and available for retail investors to invest if you’re interested in the food and QSR space. But do not forget to consult your financial expert before making any investment decision.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle