| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-28-25 | |

| Add new links | Nisha | Sep-01-25 | |

| Add new links | Nisha | Sep-01-25 | |

| Add ETF landing page link | Nisha | Sep-11-25 |

Read Next

- Future Industry in India 2026

- What is Auction Market?

- Top Green Hydrogen Stocks in India

- Ashish Dhawan Portfolio : Top Holdings, Strategy & Lessons

- Top 10 Wind Energy Stocks in India

- Aluminium Price Predictions for Next 5 Years in India

- Zinc Price Predictions for Next 5 Years in India

- Best Sectors to Invest in Next 10 Years in India

- Why Tobacco Stocks Are Falling in India: ITC, Godfrey Impact

- Copper Price Predictions for the Next 5 Years in India

- Book Value vs Market Value of Shares: Meaning, Formula & Key Differences

- Why Share Market is Down Today? Reasons Behind Stock Market Fall

- Steel Price Predictions for the Next 5 Years in India

- What are Bond ETFs?

- Best ULIP Plans in India

- Difference Between Shareholders and Debenture Holders

- Nifty 50 vs Nifty 500: Which Is Better

- Big Bulls of Indian Stock Market: The Complete List

- Best Sugar Stocks in India

- What Is a Ponzi Scheme? Meaning, Scam & India Laws

- Blog

- etf vs stock

ETF vs Stock – Which One is the Better Investment Option?

Investment decisions today require more thought than ever before. There are many options in the market, but the right choice depends on investment goals, risk tolerance, and current economic conditions. Recently, due to volatile market conditions, investors have been interested in building safe and diversified investment portfolios. In such an environment, it has become important to know which option, ETF or stock can prove to be better in the current times.

In this blog, we will compare ETF and stocks as investment options and decide on which one is best, along with their advantages and disadvantages.

What is an ETF?

ETFs or exchange-traded funds are investment instruments that represent a mix of shares of several companies, bonds or other assets. They can be bought and sold on the stock exchange like a common share. The biggest advantage of investing in an ETF is that it is diversified – that is, investments are made in several companies or sectors simultaneously, which reduces the risk. Apart from this, it is easier to trade as they can be bought and sold throughout the day in the stock market at market prices.

Know More: Calculate returns on ETF investments.

There are several types of ETFs, such as:

- Equity ETF: which invests in stocks of several companies.

- Debt ETF: which invests in government or corporate bonds.

- Gold ETF: which tracks the price of gold

- Sectoral/Thematic ETF: which invests in a specific sector (e.g. IT, banks)

- International ETF: which tracks foreign markets.

ETFs can be a better option for long-term investors, especially when low risk and stable returns are preferred.

Read Also: How to Invest in ETFs in India – A Beginner’s Guide

What is Stock?

Stocks are a part of the investment world that gives investors an opportunity to directly take a stake in a company. When an investor buys shares of a company, he becomes a small owner of that company. This ownership makes him a partner in the company’s profits, losses and other important decisions.

Investing in stocks has the potential to deliver good returns, but it also carries a higher risk, as a company’s financial performance can have a direct impact on the share price and thus your investment. Market movements, economic conditions and the company’s internal strategy can affect stock prices.

There are many types of stocks, such as:

- Blue-Chip Stocks: Large, stable, and reliable companies

- Mid-Cap and Small-Cap Stocks: Fast-growing but relatively more risky companies

- Growth Stocks: Companies which have the potential for rapid expansion

- Dividend Stocks: Companies which regularly distribute a share of profits with its shareholders.

With all these options, it is important to start wisely in the stock market.

ETF vs Stock: Key Differences

When it comes to ETFs vs Stocks, there are fundamental differences between the two investment options and selecting between the two is impacted by the investor’s experience, goals, and risk appetite. Here are some key differences between the two that can help you make a better decision:

| Parameter | Exchange traded Fund (ETF) | Stocks |

|---|---|---|

| Diversification | The investment is divided among many companies, so ETFs are well-diversified. | Your investment performance is dependent on a single company’s financial performance, which keeps the risk more concentrated. |

| Risk and Volatility | ETFs are less volatile, especially index-based ETFs. | Depends on the performance of the company, hence volatility is high. |

| Management | Most ETFs are passive, which do not require much monitoring. | Research and tracking are important while investing in individual stocks. |

| Liquidity | ETFs have high liquidity. | Some Stocks are directly affected by the performance of the individual company. |

| Ownership | Buying an ETF gives you ownership of units of ETF, not of a specific company. | Buying stock gives you a direct stake in the company concerned. |

| Expenses and Fees | It has a small expense ratio and brokerages and transaction charges apply. | Brokerage and transaction fees are charged. |

| Voting Rights | ETF holders generally do not have voting rights in companies. | Stockholders have the right to vote on company decisions. |

It is clear from this comparison that both stocks and ETFs have their own strengths and limitations. While ETFs are about instant diversification, stocks offer the potential for higher returns.

Pros and Cons of Investing in ETFs

| Pros of ETF | Cons of ETF |

|---|---|

| Having multiple stocks in a single ETF provides diversification, which reduces risk. | The potential for high returns is limited. |

| Low expense ratios, making them especially beneficial for passive investors. | The investor does not have complete control to decide which stocks to include. |

| A good option for the long term as there is no need for constant buying, selling and research. | Some thematic or sector ETFs may be more volatile. |

| Easy way to invest in international markets, gold, bonds etc. | Less popular ETFs may have higher buy-sell spreads, which increases costs. |

Pros and Cons of Investing in Stocks

| Pros of Stock | Cons of Stock |

|---|---|

| Investing in the right company can provide good returns in the long term. | Poor performance of the company may result in a sharp decline in the value of the investment. |

| Shareholders get ownership and voting rights in the company. | The risk is higher compared to ETFs because there is less diversification. |

| There is a possibility of getting returns from both dividends and capital gains. | Company reports, market and sector information have to be constantly monitored. |

| You have complete control over your investments in stocks, buy or sell whenever you want. | Price volatility is high, which may cause stress or confusion among new investors. |

Stocks or ETFs: Which is Better?

Which is better between ETFs vs Stocks depends entirely on the investor’s preferences and strategy. If your investment goal is stable growth and low risk over the long term, ETFs are the preferred investment option. They offer instant diversification at low cost, which is beneficial for beginner investors.

On the other hand, if an investor understands the market movements, has the time to do research, and wants the higher returns, then investing in individual stocks is a better option. However, investing in individual stocks can be risky and one has to face higher volatility.

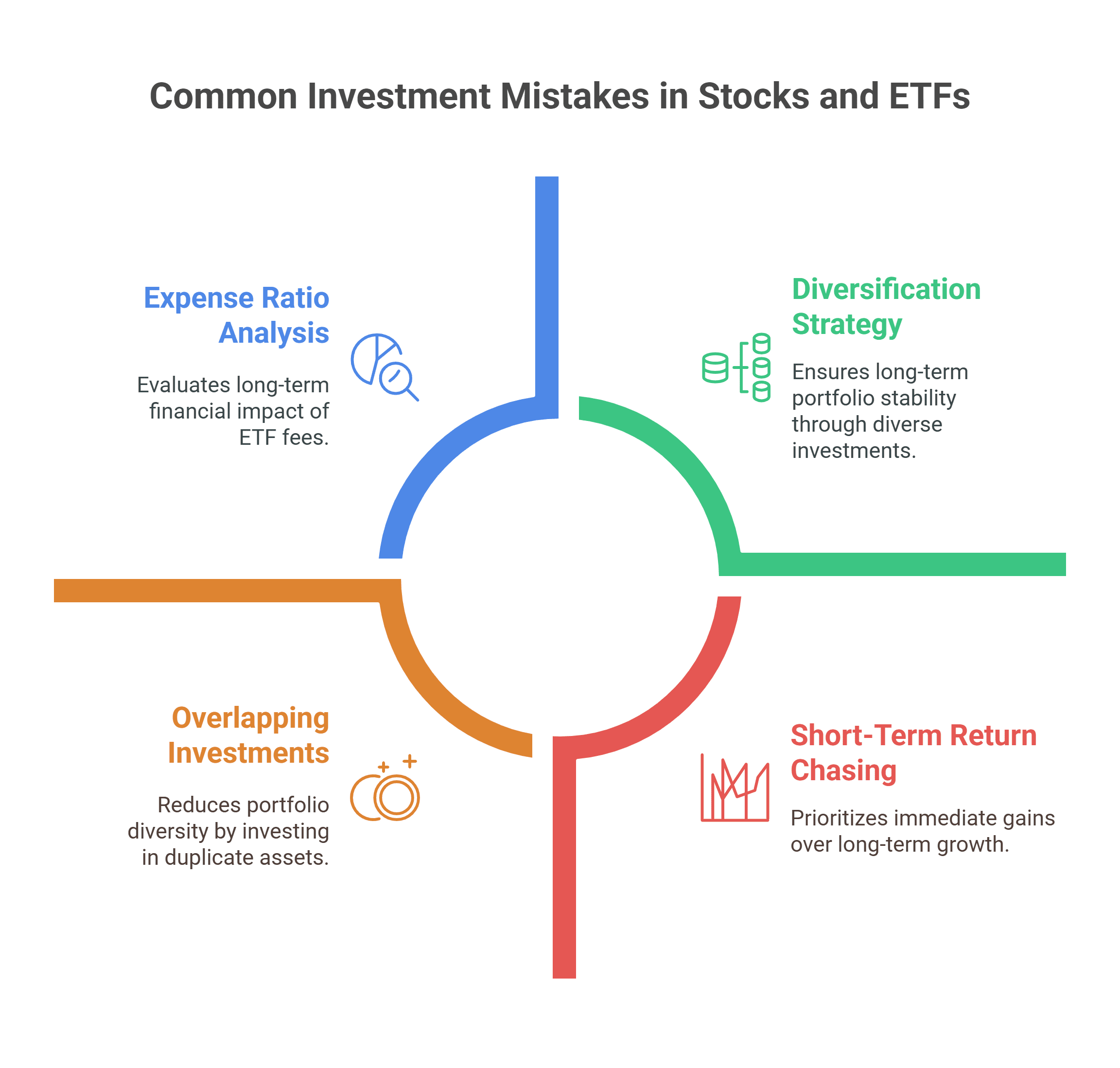

Common Mistakes to Avoid While Choosing Between Stock and ETF

Common mistakes made while investing in stocks and ETFs are mentioned below:

- Making decisions based only on short-term returns: Many investors invest only by considering the recent performance or chart patterns and ignore long-term potential and risk. Whether it is a stock or an ETF, it is important to pay attention to future growth along with the tracking error in the ETF and past financial performances for stocks.

- Ignoring expense ratio and fee structure: Investing in ETFs incurs fees known as expense ratio, which can affect returns over time. At the same time, frequent trading in stocks can increase brokerage charges.

- Overlapping in portfolio: Investing in both ETFs and stocks is good, but at times investors invest in the same company through ETFs as well purchase their shares, which reduces diversity and increases risk.

- Investing on Unverified Investment Tips: Investing on the advice of a friend, social media or an influencer without understanding your financial situation and goals can be risky. Conduct your own research or speak to a financial advisor before investing in ETFs and stocks.

Conclusion

Both ETFs and stocks have their own advantages and risks. While ETFs come with lower risk, diversification, and less effort, stocks offer more control with the potential for higher returns.

Deciding which option is better depends on the investor’s risk appetite, financial goals, and availability of time. It is important to evaluate your financial position and goals before investing. With the right strategy and information, good returns can be obtained from both the options.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Mutual Fund vs ETF. Are They Same Or Different? |

| 2 | Best ETFs in India to Invest |

| 3 | ETF vs Stock – Which One is the Better Investment Option? |

| 4 | Gold ETF vs Gold Mutual Fund: Differences and Similarities |

| 5 | ETF vs Index Fund: Key Differences You Must Know |

Frequently Asked Questions (FAQs)

Which is safer: an ETF or Stock?

ETF is considered more safe because it invests in many companies, which reduces the risk.

Can beginners start with ETFs?

Yes, ETFs are a good option for beginners as they require less research and provide diversification.

Is it possible to have both an ETF and stocks in a portfolio?

Absolutely, balancing the portfolio by investing in both is a wise move.

Are ETFs suitable for long-term investment?

Yes, ETFs are stable and low-risk investment options for the long term.

Can I trade ETFs like regular stocks?

Yes, ETFs can be traded on an exchange just like stocks.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle