| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-20-25 |

Read Next

- Why Are Steel Share Prices Increasing in India?

- Top Nifty Metal ETFs in India 2026

- Best Gold Investment Schemes in India 2026

- How to Build a Portfolio With Exchange-traded Funds (ETFs)

- How to Invest in US Stocks from India

- Platinum Price Forecast in India (2026–2030)

- Why Is the Gold Price Going Down?

- Top 10 BESS Stocks in India (2026)

- Why is the Silver Price Going Down?

- Best Construction Stocks in India

- Why Gold Prices Hit ₹1,80,000 – Key Reasons

- List of Best Sensex ETFs in India

- Best Commodities to Trade in India

- Best Cyclical Stocks in India 2026

- How to Check the Purity of 20-Carat Gold: Easy Methods & Tips

- Why Are Silver Prices Rising in India?

- Difference Between Hallmark Gold, KDM Gold and BIS 916

- Why Are Gold Prices Rising in India?

- 1 Tola Gold in India: How Many Grams, Price & Investment Insights

- 22K vs 24K Gold: Which Is Better for Jewellery & Investment?

- Blog

- government bonds in india

Government Bonds India – Types, Advantages, and Disadvantages of Government Bonds

For conservative investors looking for stable returns, investing in government bonds can be a viable investment option as they offer predictable returns. These financial instruments are issued by the Central and State Governments and they provide a secure way to invest and contribute toward the nation’s development.

In this blog, we will discuss the various types of Government bonds in India and discuss its benefits and drawbacks. Moreover, we will highlight key factors an investor should consider before purchasing them.

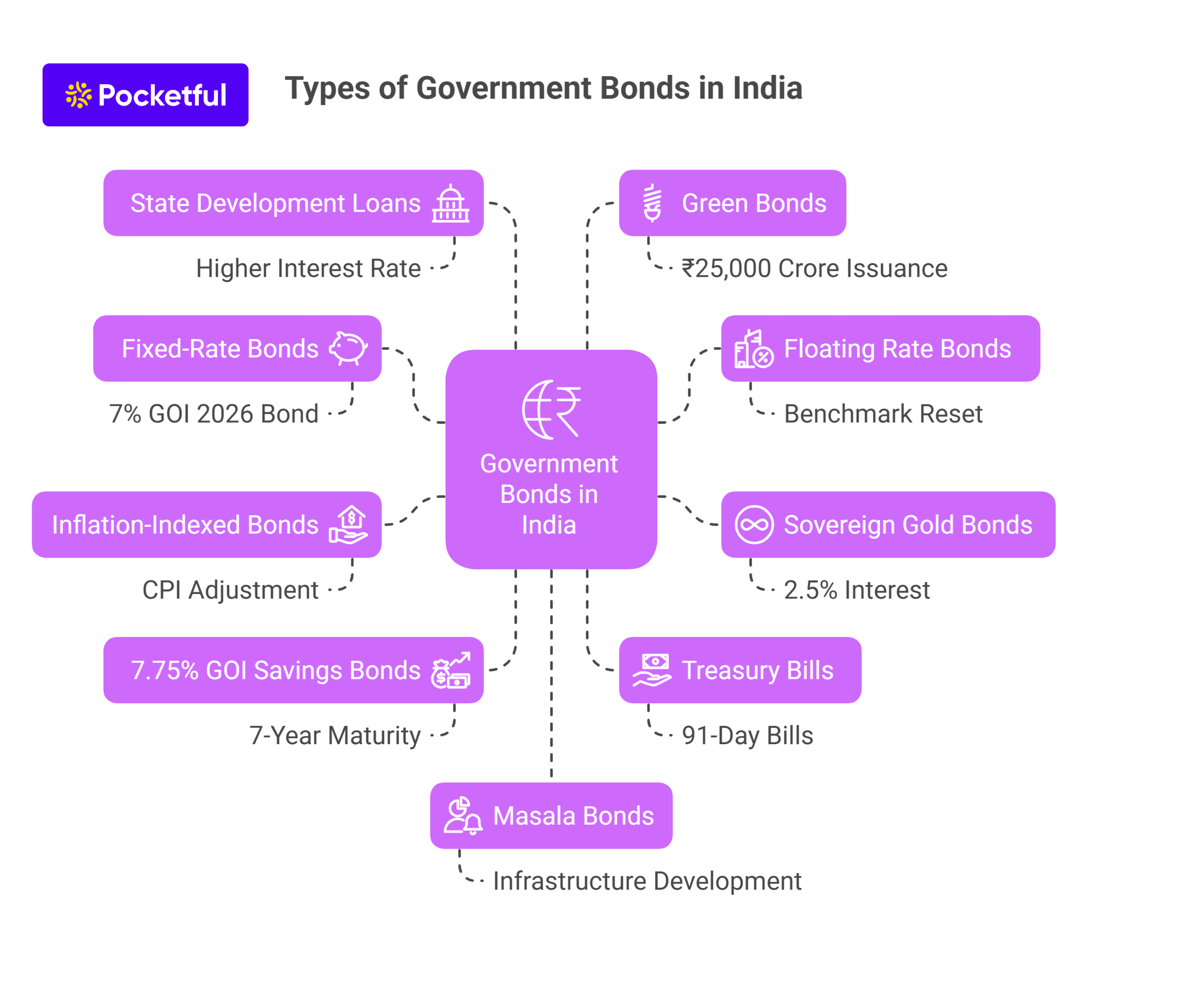

Types of Government Bonds in India

The Indian government offers a diverse range of bonds tailored to meet distinct investment objectives, such as:

1. Fixed-Rate Bonds

These bonds guarantee a set interest rate for the duration of the bond’s life. For example, a 7% GOI 2026 bond will continue to pay 7% annually until maturity. Such bonds are beneficial for conservative investors focusing on earning a steady income stream.

2. Floating Rate Bonds (FRBs)

FRBs offer variable interest payments as its interest rate is reset according to a specific benchmark at specified time intervals, usually every six months. These types of bonds are beneficial in situations in which the investors are anticipating an interest rate rise.

3. Sovereign Gold Bonds (SGBs)

SGBs offer investors an opportunity to invest in gold without possessing the physical asset itself. Additionally, SGBs give a 2.5% interest per year and are linked to market gold prices. They have a maturity period of 8 years with an exit option available after 5 years. As of 2025, the scheme has been stopped but existing bonds can still be bought in the secondary markets.

4. Inflation-Indexed Bonds (IIBs)

These bonds are structured in a way where they protect the investment from inflation by adjusting the principal amount and interest payments, here inflation is measured by the Consumer Price Index (CPI). They assist investors by offering returns that are above inflation in order to sustain purchasing power.

5. 7.75% GOI Savings Bonds

These Bonds were introduced in 2018, they come with a 7.75% annual interest rate and a maturity period of 7 years. They are ideal for a medium-term investment strategy.

6. Treasury Bills (T-Bills)

Treasury Bills are for short-term periods of 91,182, or 364 days. They are bought at a discount and redeemed at their full value. Designed for investors with a short-term focus, Treasury Bills are often seen as a reliable investment option.

7. State Development Loans (SDLs)

Issued by State Governments, SDLs are very similar to G-Secs, but these have a bit higher interest rate because of additional risk. They are borrowed to fund the state’s fiscal deficit and utilized to finance state level projects and other expenditures. Recent innovations like the introduction of bond forwards are expected to increase the demand for SDLs and thus lower the borrowing costs for Indian states.

8. Green Bonds

These bonds are usually issued to finance projects that are environmentally eco-friendly. The Government of India is paying more attention to green bonds or other assets that fund environmentally friendly projects that help in mitigation of climate change. For example, there are plans to issue green bonds worth ₹25,000 crore in the financial year 2025.

9. Masala Bonds

Masala bonds are those which are issued outside India and denominated in Indian Rupees. Hence Indian entities can raise capital from foreign investors without currency risk. The term Masala was initiated by the International Finance Corporation and these bonds have been issued to fund infrastructure development.

Read Also: Detailed Guide on Bond Investing: Characteristics, Types, and Factors Explained

Factors to Consider Before Investing in Government Bonds

Investing in government bonds might give the impression that it is relatively simple, however, making the correct investment requires some understanding of the following elements. Before investing your money in govt bonds, consider the following questions:

1. Investment Horizon

The duration of your investment is extremely important. In India, government bonds are available in different tenures, some are short term (like Treasury Bills) while others, including the 7.75% GOI Savings Bonds, can take 7 years or more. If your goals are short-term (like purchasing a laptop or paying for a class), then short-duration bonds will be more useful. For long-term goals (like financing a college education, or saving for a business), opt for long-term duration bonds.

2. Interest Rate Environment

As is the case with all financial instruments, bonds are also affected by interest rate changes. If the economy is going through a period of rising interest rates, it means that new bonds pay a higher coupon rate. The older bonds with lower rates will become less popular, causing their prices to dip in the secondary market. On the contrary, when interest rates drop, older bonds become more valuable. If you are expecting a rise in interest rates, avoid long-term fixed-rate bonds. Instead, opt for Floating Rate Bonds or short-term instruments.

3. Inflation

Returns are affected by the rising inflation. Suppose you have invested in a fixed-rate bond with an interest return of 6% per annum while inflation is at 7%, your real return will be negative 1%. In the long term, this can adversely affect your financial position.

Inflation-Indexed Bonds (IIBs) counteract this problem. They are designed to adjust the income yield to inflation so the purchasing power is maintained.

4. Liquidity

Not all government bonds have the same ease of sale. Some bonds ( for example, G-Secs) can be sold in the secondary market, while others (for example, 7.75% GOI Bonds) restrict the bond holder until maturity or payment of penalties for early surrender.

Should you find yourself in need of accessing the funds prior to the bonds’ set maturity date, make sure to select bonds with more favorable secondary market liquidity or consider bond mutual funds and ETFs which have more straightforward exit strategies.

5. Tax Consequences

Like all other gains realized on financial assets, the interest payment you receive from government bonds will be added to your taxable income and taxed accordingly. If your income falls in the higher income tax slab then your net earnings may be greatly reduced.

Read Also: Sources of Revenue and Expenditures of the Government of India

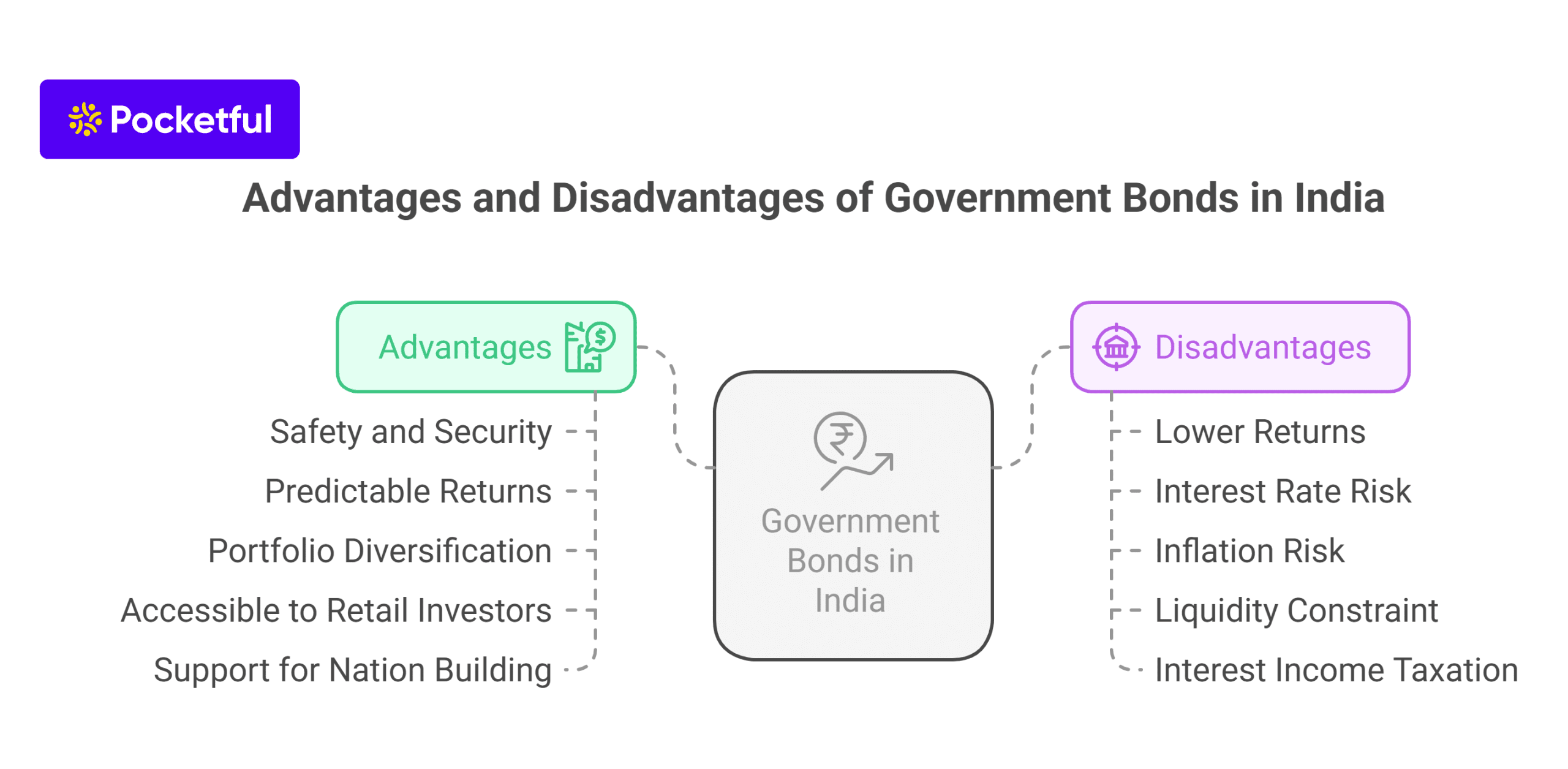

Advantages and Disadvantages of Government Bonds in India

Like any other investment, government bonds in India have their own set of advantages and disadvantages. Let’s dig deeper into each one:

Advantages

1. Safety and Security: Government bonds are one of the safest investment options. They carry full government guarantee, which means the Reserve Bank of India (RBI), and the Central/State Government back these, thus significantly reducing the chances of default.

2. Predictable Returns: Fixed-rate bonds make certain returns readily available over the bonds period of maturity. This means that you will have a clear understanding on how much you are earning on an annual basis, which aids in making better financial decisions.

Example: Market fluctuations have no impact on a person who invests ₹1 lakh on a 7% fixed rate GOI bond, as the amount will remain the same at ₹7,000 every year till maturity.

3. Portfolio Diversification: Including government bonds in an investment portfolio diversifies the risk. Equities and mutual funds do yield stronger returns, but their unpredictability is off the charts. Consequently, bonds do help in lowering the overall portfolio risk along with providing consistent returns.

4. Accessible to Retail Investors: In the past, bonds issued by the government were primarily targeted at institutional investors. Now, through direct platforms such as RBI Retail Direct, individuals can easily purchase and sell bonds online without the use of brokers. The low minimum investment makes it more attractive starting at ₹1,000.

Investors are able to gain exposure to government bonds through mutual funds or ETFs that exclusively invest in G-Secs.

5. Support for Nation Building: Purchasing government bonds serves as a ticket for indirect participation in public projects such as constructions, educational institutions, and health care systems. Hence, it becomes an appropriate investment which comes with a sense of responsibility.

Disadvantages

1. Lower Returns: If you want the security of government bonds, you will receive less of a reward in the form of returns when compared to corporate bonds or equities. Equity mutual fund investments may deliver returns of 12% annually while governmental bonds yield approximately 6% to 7%

2. Interest Rate Risk: When interest rates change, bond prices fluctuate. This means that long term bonds are much riskier due to this capital loss if you are planning to sell before the bond matures.

3. Inflation Risk: Certain bonds don’t change their value based on inflation. As we know, inflation is a detrimental result of an economy overheating and down the road, inflation may drastically diminish the value and purchasing power of money in terms of goods and services.

4. Liquidity Constraint: Unlike other bonds, a subset of government bonds cannot be easily traded on secondary markets and certain bonds cannot even be sold due to penalties. Bonds that are tradeable may have low liquidity in the secondary market which may lead to delays, price drops, or even diminished demand completely.

5. Interest Income Taxation: Most government bonds with interest attached to them suffer the consequence of being fully taxable. This is particularly true if you are in a higher tax bracket, as it lowers the effective return you receive.

Read Also: Electoral Bonds Explained: What Are They and Why Did Supreme Court Ban It?

Conclusion

The government bonds in India are reliable investment options as they guarantee predictable returns making them suitable for more conservative investors. It is important to know the different types of bonds, their characteristics, and the risks that come with them in order to invest appropriately and achieve your financial objectives. However, it is advised to consult a financial advisor before investing.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | Benefits of Investing in Bonds |

| 2 | Stocks vs Bonds: Difference Between Bonds and Stocks |

| 3 | What Is Bowie Bond (Music Bonds) : History, Features, Advantages & Disadvantages |

| 4 | CAT Bonds: An Easy Explainer |

| 5 | What is Coupon Bond? |

Frequently Asked Questions (FAQs)

What is the minimum amount one can invest in government bonds in India?

The minimum investment amount differs from one type of bond to another.

Are government bonds subject to tax?

Interest earned from government bonds comes under tax liabilities, but some bonds like the Sovereign Gold Bonds give tax relief on capital gains if claimed after a certain period of time.

In what ways am I able to procure government bonds in India?

Bonds are available for purchase through the RBI Retail Direct, NSE, BSE, or through licensed banking and financial institutions.

Are Non-Resident Indians (NRIs) permitted to invest in bonds issued by the government of India?

NRIs can invest in Government bonds but they must comply with certain rules and eligibility parameters defined by the Reserve bank of India.

What is the effect of selling a government bond before its maturity date?

Selling a bond prior to its maturity date in the secondary market can lead to profits or losses depending on the market price in the secondary market.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle