| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-24-25 |

Read Next

- Future Industry in India 2026

- What is Auction Market?

- Top Green Hydrogen Stocks in India

- Ashish Dhawan Portfolio : Top Holdings, Strategy & Lessons

- Top 10 Wind Energy Stocks in India

- Aluminium Price Predictions for Next 5 Years in India

- Zinc Price Predictions for Next 5 Years in India

- Best Sectors to Invest in Next 10 Years in India

- Why Tobacco Stocks Are Falling in India: ITC, Godfrey Impact

- Copper Price Predictions for the Next 5 Years in India

- Book Value vs Market Value of Shares: Meaning, Formula & Key Differences

- Why Share Market is Down Today? Reasons Behind Stock Market Fall

- Steel Price Predictions for the Next 5 Years in India

- What are Bond ETFs?

- Best ULIP Plans in India

- Difference Between Shareholders and Debenture Holders

- Nifty 50 vs Nifty 500: Which Is Better

- Big Bulls of Indian Stock Market: The Complete List

- Best Sugar Stocks in India

- What Is a Ponzi Scheme? Meaning, Scam & India Laws

- Blog

- how to invest in silver in india

How to Invest in Silver in India?

The process of building a diversified portfolio is incomplete until you invest in assets like gold and silver. Where gold has been a pioneer in the field of investing yielding consistent returns, silver has recently received much attention due to its increasing demand in the industrial sector. This is one of the reasons for the rising value of silver as an investment.

But the question is, how can you invest in silver? Well, there are innumerable options that you can select from. Here’s a simple guide to help you invest in silver with ease. Starting from the physical silver to how to buy Silver ETF, we will cover every single point in the guide here.

Ways to Invest in Silver

There are various ways you can invest in silver. From the traditional method of buying physical silver to SIP in Silver ETF, the options are many. So, to start with, let us briefly understand the investment choices that you have:

1. Physical Silver

This is the most traditional method of investing in silver. You can buy coins, bars, and jewelry. Bars and coins are preferred due to their purity and high resale value. Jewelry is usually selected for adornment and value.

This physical silver is tangible in nature and needs proper storage. Usually, people store them in lockers at home or banks. This can add to the overall cost as well. Also, one important thing to know here is that physical silver offers you liquidity. In case of need, you can sell and raise funds in no time.

2. Silver ETFs (Exchange-Traded Funds)

Silver ETFs are a new form of investment. Here, you invest in the funds that are traded on stock exchanges and track the silver price. When an investor buys a Silver ETF, they gain the benefit of silver’s price movement without actually owning it physically.

These are highly liquid and offer ease of trading. There is no issue with the safekeeping or storage, which makes them a better investment choice than the rest. Since the trading happens on exchanges, ETFs offer you better transparency. One important thing to note here is that you would need a demat and trading account to invest in Silver ETFs.

3. Silver Futures

These are the standardized contracts that are traded on the commodity exchange, such as the MCX. Traders use these contracts to benefit from silver’s price movements. So, the primary aim of this is to realize short-term gains and not invest for the long run.

Futures trading requires margin payments (fraction of the contract value) due to which volatile price movement can result in significant losses. Make sure to square off existing positions to avoid the contracts getting exercised and physical settlement.

4. Digital Silver or E-Silver

Digital silver allows investors to buy and own silver in fractional quantities through online platforms. The purchased silver is backed by physical metal stored securely by the scheme provider. This investment option offers convenience.

Through this, investors can buy or sell even small amounts without the hassle of storage. So, if you are looking for a flexible and secure investment in silver, this is a great choice.

5. Silver Mutual Funds

Instead of going for the physical silver, you can invest in silver MFs as well. This involves investing in silver ETFs and other Exchange-Traded Commodity Derivatives (ETCDs). It can be viewed as an indirect form of investing in silver ETFs with an advantage of fixing monthly SIPs.

6. Silver Mining Equities

It is when you directly invest in companies that work in the field of extraction, exploration, or production of silver. This allows you to benefit from an increase in silver prices and the company’s growth at the same time. Hindustan Zinc Ltd and Vedanta Ltd are a few companies in this sector.

So, when it comes to how to buy silver in India, these are some of the prominent options available. Of these, Silver ETFs stand out. So, let us now explore the Silver ETF in detail over here.

Why Choose Silver ETFs Over Other Silver Investment Options?

Modern investors usually look for safe and low-maintenance investment options. Silver ETFs are a better choice because they are traded on the exchange, and no physical storage is needed.

But there are other reasons as well that make Silver ETFs a better choice. So, here are the top ones that you should be aware of:

1. High Purity Standards

Silver ETFs in India invest only in silver with 99.99% purity. This ensures that your investment is backed by top-grade metal, which reduces quality risks. This makes the investment more reliable compared to buying silver physically from unverified sources.

2. Direct Correlation with Silver Prices

When you invest in Silver EFT, you can track its prices easily as it follows the price of the silver, which makes it a transparent investment. Also, you can observe the price movements in real-time, which allows you to adjust your investment strategies and avoid losses.

3. Elimination of Physical Storage Concerns

Unlike physical silver, ETFs don’t need lockers or safes. The fund houses store the metal securely in accredited vaults, reducing the hassle and cost associated with personal storage, theft risk, or insurance for the investor.

4. Regulated by SEBI

Investors usually seek investments that are regulated. This is where Silver ETFs stand out as the rules of SEBI govern these financial instruments. This ensures authenticity and trust and further ensures that the interest of the investors is safeguarded throughout the investing journey.

5. Liquidity and Ease of Trading

Silver ETFs are listed on stock exchanges, which allows the investors to buy and sell them online during trading hours easily. This allows you to make an entry or exit quickly as needed. This way, you can quickly liquidate your investment by selling due to high transaction volume. Hence, this is a good choice for both short-term traders and long-term investors.

6. Cost-Effective Investment

There are no making charges, storage fees, or hidden premiums like with jewelry or coins. Apart from a nominal management fee, Silver ETFs are economical, offering better value for money when compared to physical silver purchases.

7. Accessibility for Small Investors

Silver ETFs allow you to start investing with a small capital, making them ideal for beginners or those wanting to build exposure gradually. Some of the silver ETFs are priced below ₹100, unlike physical silver, which often requires substantial capital to invest.

8. Diversification Benefits

Various global factors impact your portfolio such as geopolitical events, interest rates, etc. So, when you add the Silver ETFs to your portfolio, you are not just buying silver, but you are also reducing the overall risk of your investment portfolio. There are chances that silver might outperform other asset classes during certain market phases, which will work in your favor too.

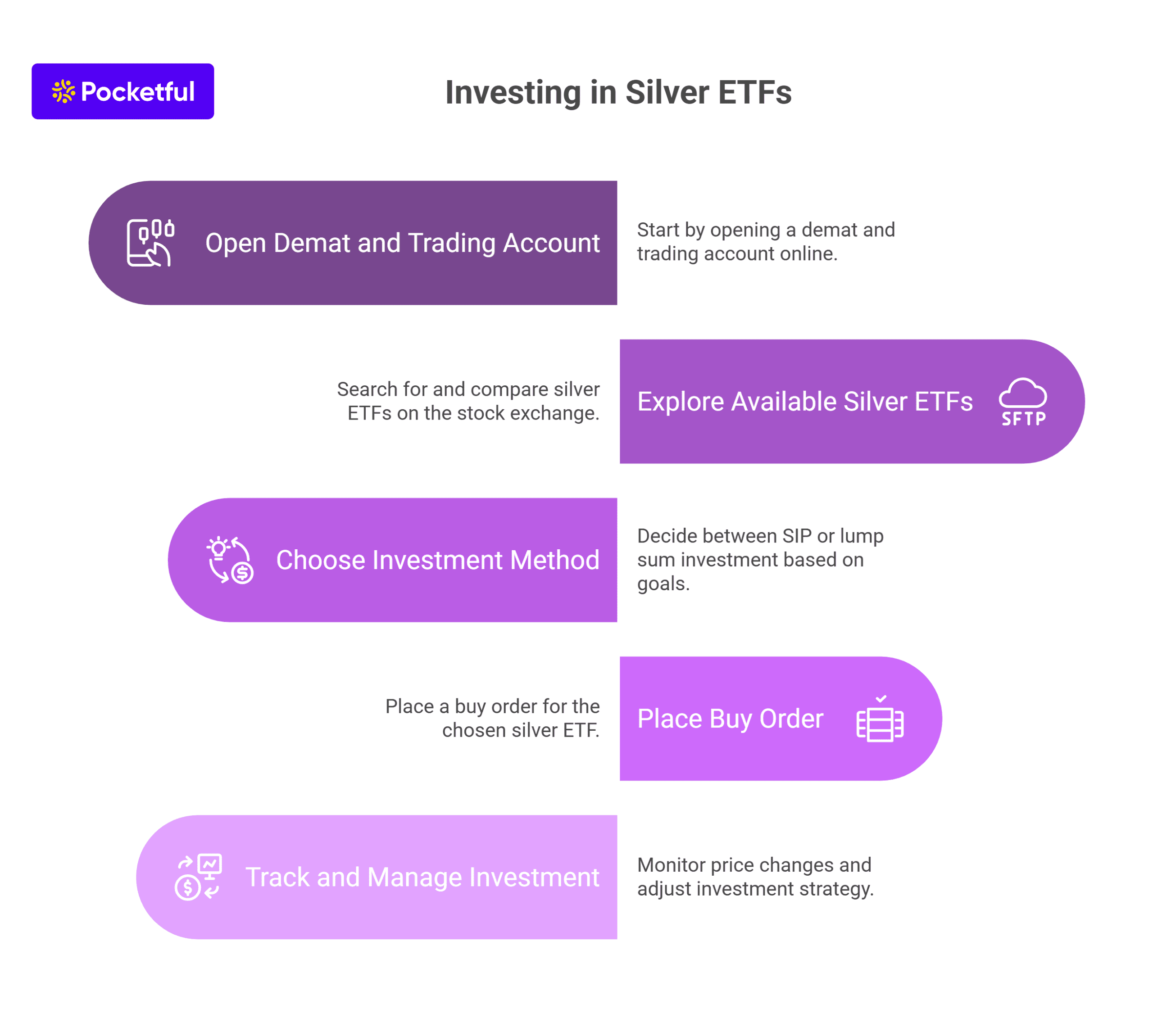

How to Invest in a Silver ETF?

There is no doubt that Silver ETFs are a great choice for investment. But the question that arises over here is how can you invest in Silver ETF. Well, here is the stepwise guide to help you invest.

1. Open a Demat and Trading Account

Start by opening a demat and trading account. You can open this for free on a platform like Pocketful, which offers a hassle-free online process. Just submit the basic KYC requirements along with documents, and your account will be created shortly after verification.

2. Explore Available Silver ETFs

Once your account is opened, search for the silver ETF listed on the stock exchange. There are many issuers that offer silver ETFs and it is necessary to compare them on the basis of tracking error, expense ratio, etc. to select the best one among them.

3. Invest via SIP or Lump Sum

You have the option to invest in a lump sum or SIP in the Silver ETF. The choice is based on your investment goals and disposable income. For beginners, SIP is a great choice that offers the benefit of rupee-cost averaging and builds discipline.

4. Place Your Buy Order

Once you’ve chosen your silver ETF, place a buy order. You can either use a market order or limit order, enter the quantity, and click on buy.

5. Track and Manage Your Investment

One of the most important aspects of investing in Silver ETF is to keep track of price changes and adjust your investment strategy as needed. You can track it directly online through Pocketul’s user-friendly mobile app.

While investing, ensure to keep an eye on economic trends and stay updated with market events. This will help you make the right investment decision.

SEBI Rules for Silver ETFs

SEBI regulates Silver ETFs to ensure investor safety, price accuracy, and fund transparency. The rules to know are:

- Minimum Asset Allocation: At least 95% of the ETF’s net assets must be invested in physical silver or silver-linked exchange-traded commodity derivatives (ETCDs).

- Tracking Error Limit: The tracking error must not exceed 2%, ensuring the ETF closely mirrors actual silver price movements.

- Expense Ratio Cap: The total expense ratio is capped at 1%. This keeps the fund management costs low for investors.

- Purity Standards: All silver held must comply with London Bullion Market Association (LBMA) standards, ensuring a purity of 99.9%.

Taxation on Silver ETF in India

When you invest in a Silver ETF, it is important that you are aware of the taxation part as well. So, here is a brief overview of the taxation that you should be aware of when investing in silver:

| Holding Period | Type of Gain | Tax Rate |

|---|---|---|

| Less than or equal to 1 year | Short-Term Capital Gains (STCG) | As per the tax slab with 4% cess and surcharge, if any |

| More than 1 year (before 1/April/2025) | Long-Term Capital Gains (LTCG) | As per the tax slab with 4% cess and surcharge, if any |

| More than 1 year (starting 1/April/2025) | Long-Term Capital Gains (LTCG) | Taxed at 12.5% with applicable surcharge and 4% cess |

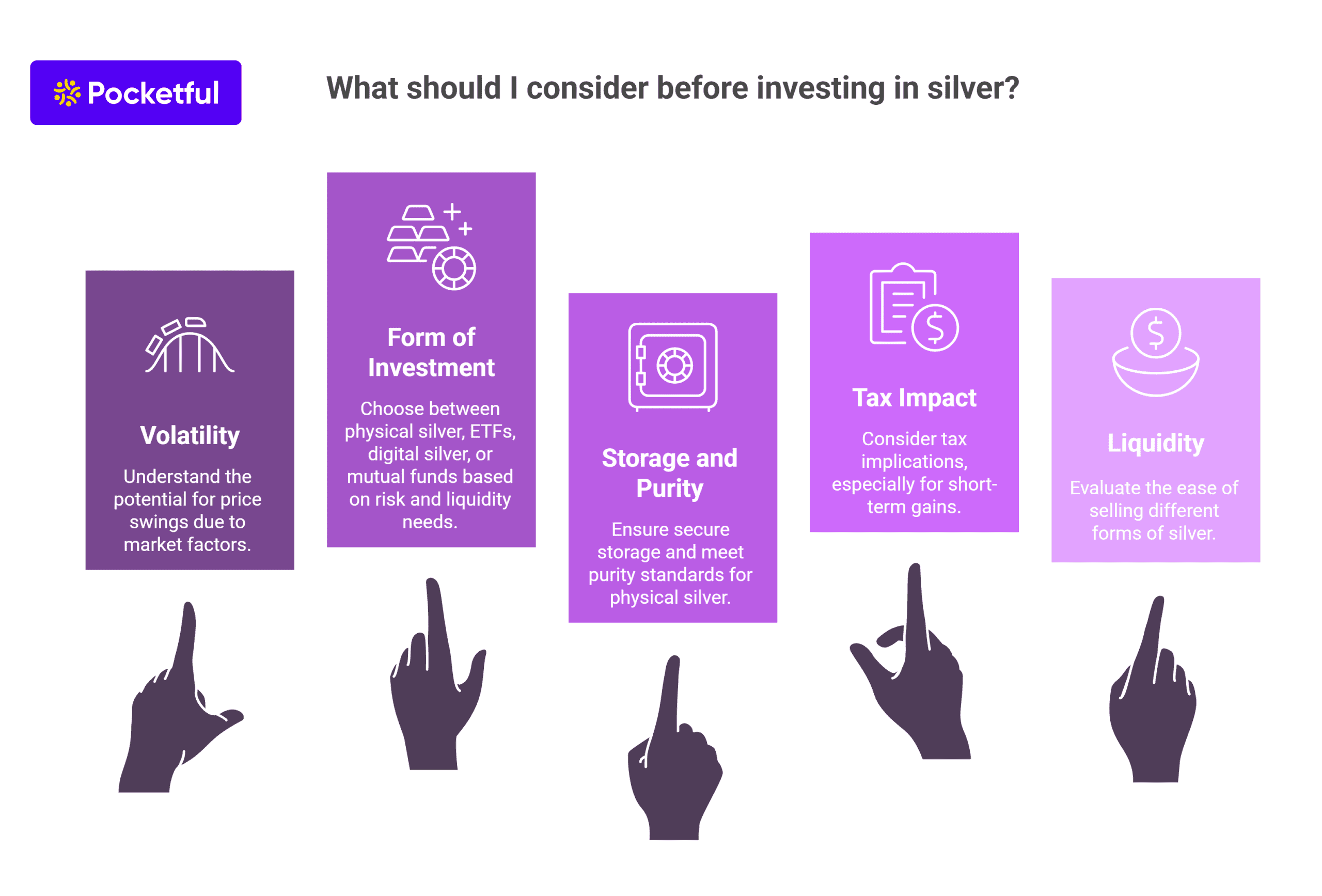

Things to Consider Before Investing in Silver

Once you have decided to invest, there are certain things that you must consider. So, here are the key points to know:

- Volatility: Silver prices can fluctuate sharply due to changing industrial demand and global economic conditions. Be prepared for short-term price swings.

- Form of Investment: Choose between physical silver, ETFs, digital silver, or mutual funds based on your risk appetite, liquidity needs, and investment goal.

- Storage and Purity: Physical silver needs secure storage and may not fulfill purity standards. ETFs and digital silver address these concerns.

- Tax Impact: Short-term gains can attract higher taxes; holding silver for a longer duration is more tax-efficient and offers you the benefit of appreciation in silver prices, too.

- Liquidity: While ETFs and digital silver offer easy exit, selling physical silver might need a bit more time.

Conclusion

Investing in silver is a great way to diversify a portfolio and gain a hedge against inflation. Also, with options like Silver ETFs, you can invest in silver without the worry of storage. This way, you can benefit from the appreciation in silver prices easily. This is where platforms like Pocketful can help. They make investing simple, secure, and beginner-friendly.

Frequently Asked Questions (FAQs)

Is Silver ETF a good investment option?

Yes, these are good investment options as they offer exposure to silver without worrying about storing it physically. Moreover, these are regulated by SEBI, ensuring safety and transparency.

Can I invest in a Silver ETF without a demat account?

No, you need both a demat and a trading account to invest in Silver ETFs.

What is the benefit of using Pocketful for silver investments?

Pocketful offers an easy-to-use mobile application and lets you track, invest, and manage Silver ETFs all in one place.

Can I start investing in Silver ETFs with a small amount?

Yes, you can start investing in Silver ETFs with a small amount as most of them trade below ₹100.

What is the tax on silver investments?

Gains from Silver ETFs held for more than 1 year are treated as LTCG and taxed at 12.5%. If sold within a year, gains are treated as short-term capital gains and taxed as per your income tax slab.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle