| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-09-25 | |

| Content Updated | Ranjeet Kumar | Aug-28-25 | |

| Add new links | Nisha | Sep-01-25 | |

| Add new link | Nisha | Sep-03-25 | |

| Add new Link | Nisha | Nov-25-25 |

Read Next

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

Best Trading Apps in India 2026

In recent years, there has been a substantial increase in the number of individuals participating in online trading in India. When it comes to trading, picking the best trading app in India can set you on the path to success. There has been a surge in the number of discount brokers in recent years and a multitude of them claim to have the best trading app in India. But the question remains: ‘Which app is best for trading?’ or ‘Which one is best suited for you?’

In this blog, we are going to give you an overview of the best trading apps in India and factors to consider to select the best trading app according to your needs.

What are the Best Trading Apps in India 2026?

Trading applications are mobile-based platforms that facilitate the buying and selling of stocks, commodities, mutual funds, and other investment products through smartphones and tablets. In India, these apps are provided by registered brokers and financial institutions.

With the advancement of technology, the best trading apps in India have incorporated useful innovations and offered the following features such as:

- No or very little commission fees

- Quick stock market updates

- Instant order execution

- Intuitive apps that are easy to navigate

- Technical analysis tools

Now, if you’ve ever wondered, “Which app is best for trading?” stay with us while we unveil the best choices for 2026.

| Broker | Account Opening Fees | AMC | Futures | Options |

|---|---|---|---|---|

| Pocketful | Free | Free | ₹20 per executed order or 0.03% of turnover, whichever is lower | ₹20 per executed order |

| Zerodha Kite | Free | ₹300 + GST | 0.03% or ₹20, whichever lower | ₹20 per executed order |

| Upstox Pro | Free | Free for first year, ₹300 + GST from second year | 0.05% or ₹20, whichever lower | ₹20 per executed order |

| BlinkX by JM Financial | 0-Brokerage Subscription plans start from ₹249* *T&C Applied | Zero | Brokerage on NSE F&O (per lot) is ₹0 for 50 lots /daily post lot limit: 0.01%/₹40 per lot Brokerage on BSE F&O (per lot) 0.01%/₹40 per lot *T&C Applied | Same as Futures |

| Angel One | Free | ₹60 + GST per quarter | ₹20 per executed order | ₹20 per executed order |

| 5Paisa | Free | ₹25 + 18% GST per month | ₹20 per executed order | ₹20 per executed order |

| ICICI Direct | Free | Free for first year, ₹700 + GST from second year. ₹300 + GST for iValue clients | ₹20 per executed order | ₹20 per executed order |

| Groww | Free | Free | ₹20 per executed order | ₹20 per executed order |

| Paytm Money | ₹200 | Free | ₹20 per executed order | ₹20 per executed order |

| Dhan | Free | Free | ₹ 20 or 0.03% per executed order whichever is lower | ₹20 per executed order |

Read Also: Best Demat Account in India

Best Trading Apps in India 2026 Overview

1. Pocketful

Pocketful is an emerging stock broking firm and is a subsidiary of Pace Stock Broking Services. Pocketful has been developed by professionals with more than 27 years of experience and offers free equity delivery and zero account opening fees, making it the best option for both traders and investors.

Features

- Advanced features for technical analysis

- Zero account opening charges and zero AMC

- Pockets feature to invest in a specific theme

- All-in-one platform for both novice and seasoned traders

Advantages

- Advanced Option Chain: Helps you trade quickly and efficiently.

- Innovative Features: Includes Pockets, Superstar Portfolios, and daily and weekly Paper to track stock market events.

- Free Trading APIs: Enables automated execution of custom strategies at no extra cost.

Disadvantages

- New Market Entrant: Still building trust and brand recognition.

- Limited Research Reports: Fewer analysis reports and insights compared to more established brokers.

2. Zerodha Kite

Kite by Zerodha is considered one of the top trading apps in India. Zerodha’s low-cost brokerage model combined with Kite’s exceptional reliability make it an ideal choice for novices and seasoned investors. Zerodha supports investing and trading in equity, commodity, F&O, and currency segments. Kite’s sleek and fast interface with advanced charts and real-time data makes it easier for traders to make informed trading decisions.

Features

• No brokerage charges on equity delivery

• ₹20/order for intraday and F&O

• Zerodha trading app Kite can be linked with Coin (mutual funds app)

• In-app charting with more than 100 indicators

Advantages

- Affordable Brokerage Fees: Intraday and F&O trades attract a flat fee of ₹20 per executed order, while equity delivery trades for Zerodha attracts no brokerage at all.

- Intuitive Design: Simple and easy to use interface

- Technical Analysis Tools: More than 100 indicators available for advanced chart analysis.

- Complete Investment Experience: Coin for investing in mutual funds, Kite for trading and Console for generating in depth reports and analytics.

Disadvantages

- Limited Customer Support: Customer support teams may take longer than expected to resolve issues.

- Relative High Fees: It charges high fees for call & trade services and auto square off making it costly for some traders.

3. Upstox Pro

Upstox is among the top 10 stock trading apps in India because of its quick trading platform and low pricing. It allows trading in stocks, commodities, mutual funds, and IPOs and is backed by Tata Group. Upstox is best suited for active traders due to its advanced order types and charting tools.

Features

• ₹20/order flat brokerage

• Margin trading facility

• Live market data and alerts

• Customizable watchlists

Advantages

- Affordable Pricing: No commission charges on equity delivery trades; additionally, ₹20 per order for intraday, F&O, and commodity trades.

- Advanced Charting: Offers TradingView and ChartIQ charting facilities, containing over 100 technical indicators.

- Quick Account Opening: Users can open accounts digitally and effortlessly through KYC.

Disadvantages

- Technical Glitches: Mobile App might experience technical glitches during peak market volatility.

- Limited Customer Support: Responding to customer’s issues promptly has been flagged as an area the business does poorly in.

- No Personalized Advisory: The absence of investment advisory reports.

4. BlinkX

BlinkX, powered by JM Financial, is an advanced trading platform specifically designed for active traders. It offers a comprehensive suite of tools to support high-frequency trading and strategy optimization. BlinkX is redefining affordability through its innovative subscription-based pricing models. With its focus on high-volume options trading, BlinkX uses a trader-first mindset, offering premium features and fast execution. With a design tailored specifically for professional traders, BlinkX’s robust mobile and desktop platforms provide reliability and speed even during peak market hours.

Features

- Basket Orders from Option Chain

- Buy/sell F&O using Flash Trade

- Option trading research recommendations

- Readymade and pre-built strategies

- 0-brokerage subscription plans start @ ₹249 / 2 months. To get started, 2-month Silver Plan worth ₹249 is now FREE*

Advantages

- Features designed for Advanced Traders like Option Chain, Flash Trade, and Chart-based Trading

- Get Options Trading and Equity Recommendations by JM Financial

- Pricing made for traders

- Access all features on the desktop and mobile applications

Disadvantages

- The web trading platform is currently in development, with ongoing upgrades being made to its features.

- While BlinkX, a new initiative by JM Financial, is still in the process of empowering new traders, it is gradually working towards integrating cutting-edge technologies to shape the future of trading.

*T&C Applied

5. Angel One (Previously Angel Broking)

Angel One started as a full service broker and has also been offering discount brokering services from quite some time through its easy to use mobile application. It also offers ARQ Prime, an AI-powered advisory tool, which makes it a combination of traditional and discount broking services.

Features

- Flat ₹20 brokerage

- ARQ Prime recommendations

- Smart API integration

- Real time notifications

Advantages

- Wide Range of Investment Opportunities : Offers equities, derivatives, commodities, mutual funds, and IPOs.

- No Charge for Equity Delivery : No brokerage charge for delivery of equity trades.

- AI-driven recommendations : Features like ARQ Prime that provides customized investment recommendations using big data analytics.

Disadvantages

- Customer Support : Long waiting time or delayed responses is one of its disadvantages.

- Annual Maintenance Charges (AMC): Loses appeal to traders who do not actively trade as the account attracts AMC meant for account upkeep.

6. 5paisa

5paisa offers competitive brokerage prices complemented by smart tools. The company was launched as a subsidiary of the IIFL Group and was later demerged and listed on the stock exchange. It offers online trading, mutual funds, insurance, and loans all in one app.

Features

- For every order, there will be a flat fee of ₹20

- Offers robo-advisory services for beginners

- Provides auto investor packs

- Offers multiple plans for professional users

Advantages

- Very Low Brokerage Cost: Charges are lower than average and set as a flat rate of ₹20 per executed order in all segments.

- Multiple Types of Investment Products: Provides investment options in equities, derivatives, commodities, currencies, mutual funds and IPOs.

- Superior Trading Options: Other than standard trading options, 5paisa allows algo trading through trading APIs and offers real-time market information.

Disadvantages

- Freezing Issues on the App: Users face issues such as unresponsive and sluggish order execution while submitting orders or navigate through the app during busy periods or high market volatility.

- Needs Better Customer Support: Replies via email and chat take a long time especially during volatile market hours.

7. ICICI Direct Markets

ICICI Direct needs no introduction as it is a well-established brand across the finance domain. Its app is best suited for existing ICICI customers, but its functionality is sophisticated and dependable.

Features

- Seamless integration with ICICI Bank

- One-click IPO applications

- Research backed investment ideas

- Margin funding options

Even though the brokerage is higher, the service and research tools offered makes it worth it for serious investors.

Advantages

- Complete account offering for clients: Provides 3 in 1 account comprising banking, trading and Demat for ICICI Bank customers.

- Advisory and Research Services: Provides detailed research and recommended stocks to advise.

Disadvantages

- Increased Brokerage Charges: ICICI Direct charges higher brokerage fees. With this full-service broker, these fees are much higher than those of discount brokers.

- Complex Fee Structure: New investors may find the differing tier leveled fees structure much more complex than other discount brokers.

- Restricted Clientele: Only for existing account holders of ICICI bank.

8. Groww

Groww has a user-focused trading app that lets investors buy stocks, mutual funds, IPO, etc. It is an easy to use app where opening a Demat account and trading account is online and paperless, also comes with zero maintenance fee making it one of the prominent trading apps in the Indian market. It offers real time market data, advanced chart for you to make informed trading decisions.

Features

- No account opening charges

- Simple mutual fund and SIP investment

- Free delivery trades

- Blogs and vlog educational content

Advantages

- User-Friendly Interface: Design blueprint aiding stock market novices by lowering entry barriers.

- Cost-Effective Trading: A flat fee of ₹20 is charged per trade, while mutual fund services are offered without fees.

- KYC-verified Account Opening: Integrated KYC process allowing for quick account creation.

Disadvantages

- Technical Problems: Users experience app crashes and sluggishness during peak volatility periods.

- Lack of Commodities and Currency Trading: Has no trading options in commodities and currencies.

9. Paytm Money

As a branch of the well-known Paytm app, Paytm Money is simple to use and combines several services like banking, mutual funds, and stock trading.

Features

- User-friendly registration process

- Allows direct mutual fund purchases

- Easy portfolio tracking

Advantages

- Low Brokerage Costs: Has ₹20 per executed order in charges for options trading that is affordable for traders.

- Choice of Investments: Supports investments in stocks, derivatives, mutual funds, ETFs, IPOs, NPS and digital gold from a single application.

- App Interface: Clean and easy-to-use interface that accommodates those who have just started and is fluid across trading in different investment products.

Disadvantages

- Limited features: Doesn’t have advanced charts and analytics compared to other trading applications.

- Occasional App Crashes: There appear to be reports of the app crashing, slower response time, login issues from some users particularly in volatile markets.

10. Dhan

Dhan is a brand new company but has gotten popular very quickly due to its order execution speed and simple user interface. Catering to today’s investors, Dhan allows trading in equities, F&O, ETFs, etc.

Features:

- Flat fee of ₹20

- Allows advanced options for trading

- API is available for traders

- Can trade directly on charts

- A fast rising star which is worth monitoring.

Advantages:

- Zero account opening : Dhan provides free account opening and zero annual maintenance charges.

- Feature loaded : Comprehensive features like advanced trading view chart, basket and iceberg orders, instant pledge/unpledge options, and a quick platform for options trading.

- Low cost : Dhan charges no brokerage for investing in mutual funds and equity delivery, also it only costs Rs.20/executed order for F&O and Intraday trades.

Disadvantages:

- Not ideal for beginners : It does not have easy to understand mobile application tutorials, making it challenging for beginners.

- Improper customer support : Users criticize the application for unresponsiveness during peak market volatility.

Read Also: Best Online Commodity Trading Platforms in India

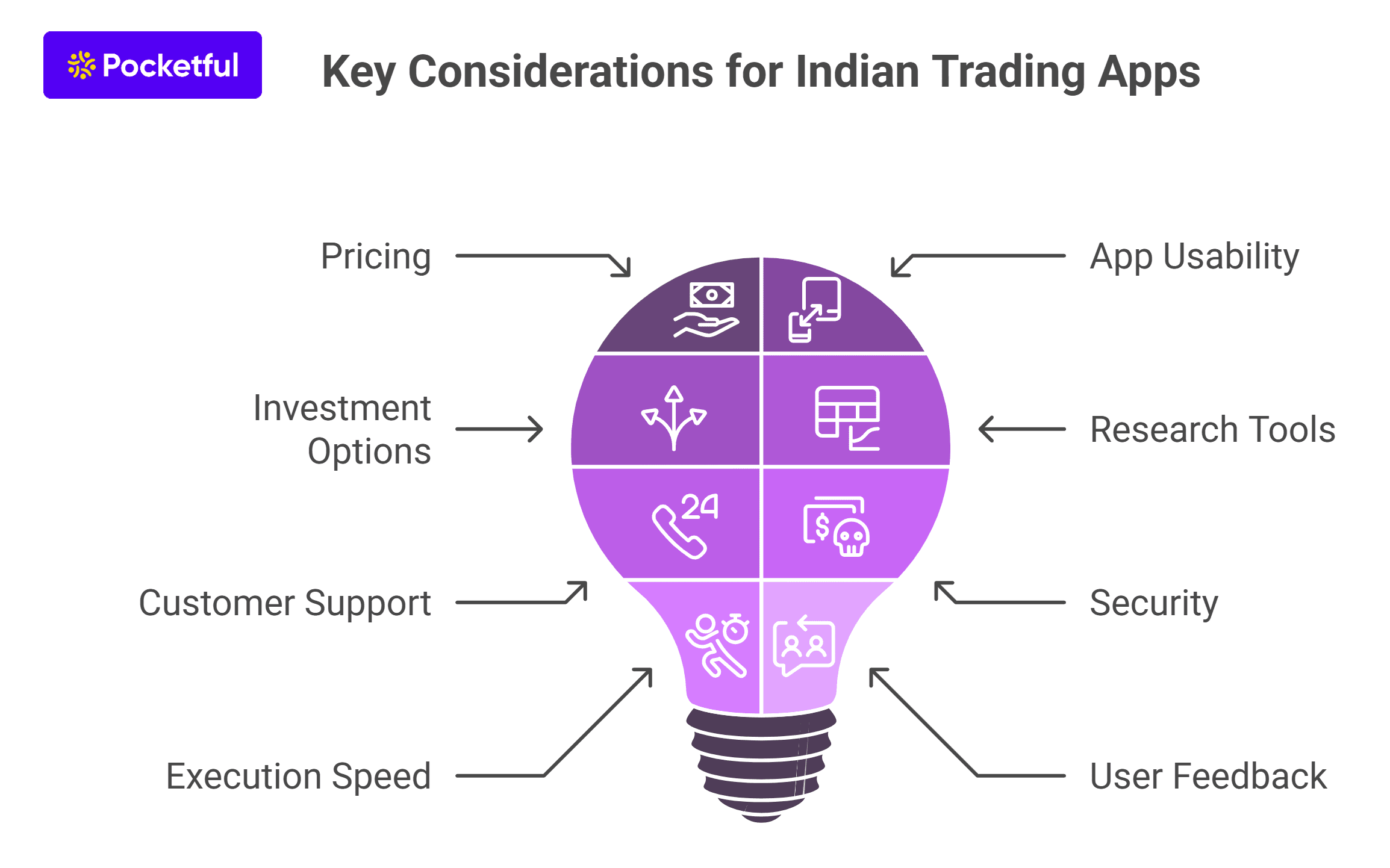

Factors To Keep In Mind Before Looking Into Indian Trading Apps 2026

Before using any trading apps, here are some considerations you want to look into:

- Pricing: Trading apps such as Pocketful, Zerodha, Upstox, etc. have a simplified fee structure, whereas brokers such as ICICI, Kotak, etc. have a complicated pricing structure.

- App: One should look for a trading app that is easy to use, fast, and user friendly as you will spend all your trading time on these apps.

- Available Investment Options: Not all assets are supported by each trading application. Check whether you can invest in the assets which interest you: shares, mutual funds, and commodities.

- Research Tools and Alerts: Some applications provide advanced investment insights and technical charts which make decision-making easier. Make sure your application provides analysis and updates in real-time.

- Customer Support: Customer support can help you resolve your issues promptly. Prefer those trading apps which offer 24×7 customer support or live chat bots.

- Security: Always select brokers that are SEBI registered and have powerful encryption along with biometric login and other safety features.

- Speed of Execution: Every second counts for intraday or F&O traders. Real-time execution with very minimal lag is indispensable.

- Reviews and Ratings: Always consider user feedback and ratings on the Play Store or App Store. Feedback from users can help you judge the trading application appropriately.

Read Also: Lowest MTF Interest Rate Brokers in India | Top 10 MTF Trading Apps

Conclusion

Selecting the best trading app in India in 2026 depends on personal requirements, past experience, and financial objectives. Various new age brokers such as Pocketful, Groww, Upstox, BlinkX, etc. have built user-friendly mobile apps that enable even beginners to start their trading journey effortlessly. These features include zero brokerage on equity delivery, latest market information, an intuitive interface, and flat brokerage on F&O orders. Answering the question of which is the best app is simple. It’s the one that resonates with your investment strategy and financial goals.

Frequently Asked Questions

Which is the No.1 trading app in India in 2026?

The definition of the no.1 trading app in India varies across users due to different trading styles. For example, people doing delivery trading may not be concerned with F&O charges. However, in general, the trading app should be easy to use and have a competitive pricing structure to be categorized as the no. 1 trading platform.

Which is the best app for beginners?

For novice users, Pocketful is a top recommendation due to its simple interface, zero AMC, zero account opening fees, and competitive brokerage charges.

Are these apps safe to use?

Definitely, as all these apps are provided by SEBI-registered brokers which have advanced security measures like encryption, authentication protocols, etc.

Can I open a Demat account through these apps?

Yes, you can open a Demat account using these apps. All of them offer the option to open Demat accounts online.

Which app is best for intraday trading?

Pocketful is the best for intraday trading due to high-speed execution, flat brokerage rates and zero AMC.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle