| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-24-25 |

Read Next

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

Commodity vs Forex Trading: Key Differences, Pros & Cons

Trading has become increasingly popular in recent times, with commodity and forex trading emerging as prominent options. The major difference between the two is the assets being traded. However, apart from underlying assets, many people do not fully understand the technical details of both.

In this blog, we will explain the differences, advantages and disadvantages of these two types of trading in simple language so that you can decide which option is better for you.

Understanding Commodity Trading

Commodity trading is a process that involves buying and selling commodities in either physical form or through complex financial instruments with underlying assets as commodities.

These commodities are usually divided into two categories:

- Hard commodities: such as gold, silver, crude oil, and metals

- Soft commodities: such as wheat, cotton, coffee,e and other agricultural products

The main objective of commodity trading is to make a profit by predicting future price changes. Commodity trading is usually done through futures and options contracts on regulated commodity exchanges. Futures contracts can be used to fix a price at which the commodity will be bought or sold at a certain date.

Futures contracts of commodities are standardized and are traded on regulated exchanges such as MCX (Multi Commodity Exchange) or NCDEX (National Commodity & Derivatives Exchange). This ensures transparency and security in transactions. Commodity trading gives traders a good option to diversify their portfolios and hedge against inflation.

Read Also: Types of Commodity Market in India

Understanding Forex Trading

Forex trading means buying and selling of currency pairs, which means buying one currency and selling another currency. In India, you can trade in USD/INR, EUR/INR, GBP/INR and JPY/INR pairs. It is the largest and most liquid market in the world, where transactions worth more than $7.51 trillion take place daily.

The forex market is completely decentralized and trading takes place around the clock, which gives traders opportunities at any time. However, in India forex trading is regulated by SEBI and can be done between 9 am and 5 pm from Monday to Friday.

Commodity vs Forex Trading – Key Differences

Commodity trading and forex trading are both popular among new market participants. In terms of market size, forex is the world’s largest and highly liquid market, with transactions worth over $7.5 trillion daily. In contrast, the commodity market is smaller in size and mostly exchange-based. A detailed comparison is shown below:

| Factor | Commodity Trading | Forex Trading |

|---|---|---|

| Market Size | Significantly large but smaller than Forex. Traded on commodity exchanges like MCX, NCDEX. | Largest financial market in the world. As per BIS data (2025), the daily volume exceeds $7.5 trillion. Traded under the Currency Derivatives Segment (CDS) at NSE. |

| Underlying Assets | Futures and Options contracts have underlying assets such as gold, silver, crude oil, wheat, coffee, etc. | Currency pairs such as EUR/INR, USD/INR, etc. |

| Leverage | Generally moderate and defined by the exchange. | Offers very high leverage. In India, major currency pairs allow up to 50x. |

| Volatility | Influenced by geopolitical events, weather, supply-demand dynamics due to which sudden price movements are common. | Driven by central bank policies, interest rate decisions, economic indicators, and global news. Can be highly volatile. |

| Liquidity | High liquidity for major commodities like gold and crude oil. Some agricultural commodities may have low liquidity. | Extremely liquid. High trading volumes in popular currency pairs ensure easy entry and exit at almost any time. |

| Trading Hours | Limited trading hours based on exchange rules. For instance, MCX in India operates from 9:00 AM to 11:30 PM. | Opens 9 am to 5 pm, 5 days a week (Monday to Friday). |

| Regulation | Heavily regulated by governing bodies. In India, it’s overseen by SEBI. Trades are transparent and exchange-based. | Comparatively less regulated. Being primarily an OTC (Over-the-Counter) market, the volumes on futures contracts on currency pairs have low trading volume on NSE. |

| Instruments | Futures and Options contracts traded on MCX and NCDEX. | Multiple financial instruments available: Forwards, Futures, Options. Flexible instruments tailored for traders and institutions. |

| Suitability | Suitable for hedgers looking to protect against price fluctuations in physical commodities. | Best for day traders, scalpers, and those seeking short-term profit opportunities in a fast-paced market. |

Based on these key differences, you can decide which option is better as per your investment strategy and risk tolerance.

Pros and Cons of Commodity Trading

The pros and cons of commodity trading are explained below so that you can begin your trading journey with all the required information.

Pros

- Diversification: Trading in commodities in addition to stocks helps reduce overall portfolio risk.

- Hedge against Inflation: Commodity prices usually rise when inflation rises, making it a good hedge against inflation.

- Leverage: Commodity trading requires a small margin to begin and thus allows speculators to take advantage of the price fluctuations.

Cons

- High Volatility: International events, natural disasters, and changes in supply-demand can cause commodity prices to change rapidly.

- Complex Process: Financial instruments such as futures and options and knowledge about settlement processes are not easy to understand; so experience is a must.

- Storage and Transportation Costs: Storage and transportation costs for physical commodities (such as oil, grains) add to transaction costs.

Read Also: Tax on Commodity Trading in India

Pros and Cons of Forex Trading

Forex trading, i.e. currency trading, is one of the most liquid and accessible financial markets in today’s time. But it has as many risks as opportunities.

Pros

- High liquidity: The forex market is one of the most liquid markets in the world, making it easy to enter and exit at any time.

- Low transaction costs: Spreads (difference between buy-sell prices) are very low, making trading cheaper.

- Advantage of leverage: It allows you to take a much larger position with less capital. Leverage up to 1:50 is available on major currency pairs in India.

Cons

- High risk: While profits can be higher due to leverage, losses can also be as big.

- Constant monitoring required: The prices of currency pairs can be impacted by major global events, interest rate changes, etc. This can cause volatility due to which forex trading requires constant attention.

- Risk management is important: Heavy losses are possible if you trade without a strategy and stop-loss.

Which Market is Better for Traders?

Both commodities and forex are attractive options for trading, but your choice should be based on the following points:

- Risk tolerance: If you can handle higher volatility, commodity trading is better. Forex trading is more suitable for those seeking lower risk.

- Margin Required: Forex offers high leverage and thus a lower margin, while commodities require a relatively higher margin.

- Experience and knowledge: Those with a good understanding of central bank decisions, interest rate changes, and other economic factors can trade in forex. Whereas, trading in commodities requires in-depth knowledge about the demand and supply factors affecting a particular commodity.

- Trading Objective: Manufacturers typically hedge the price of their raw material using the futures contract of a specific commodity. On the other hand, companies with foreign currency exposure might want to protect themselves from adverse price fluctuations using forward contracts.

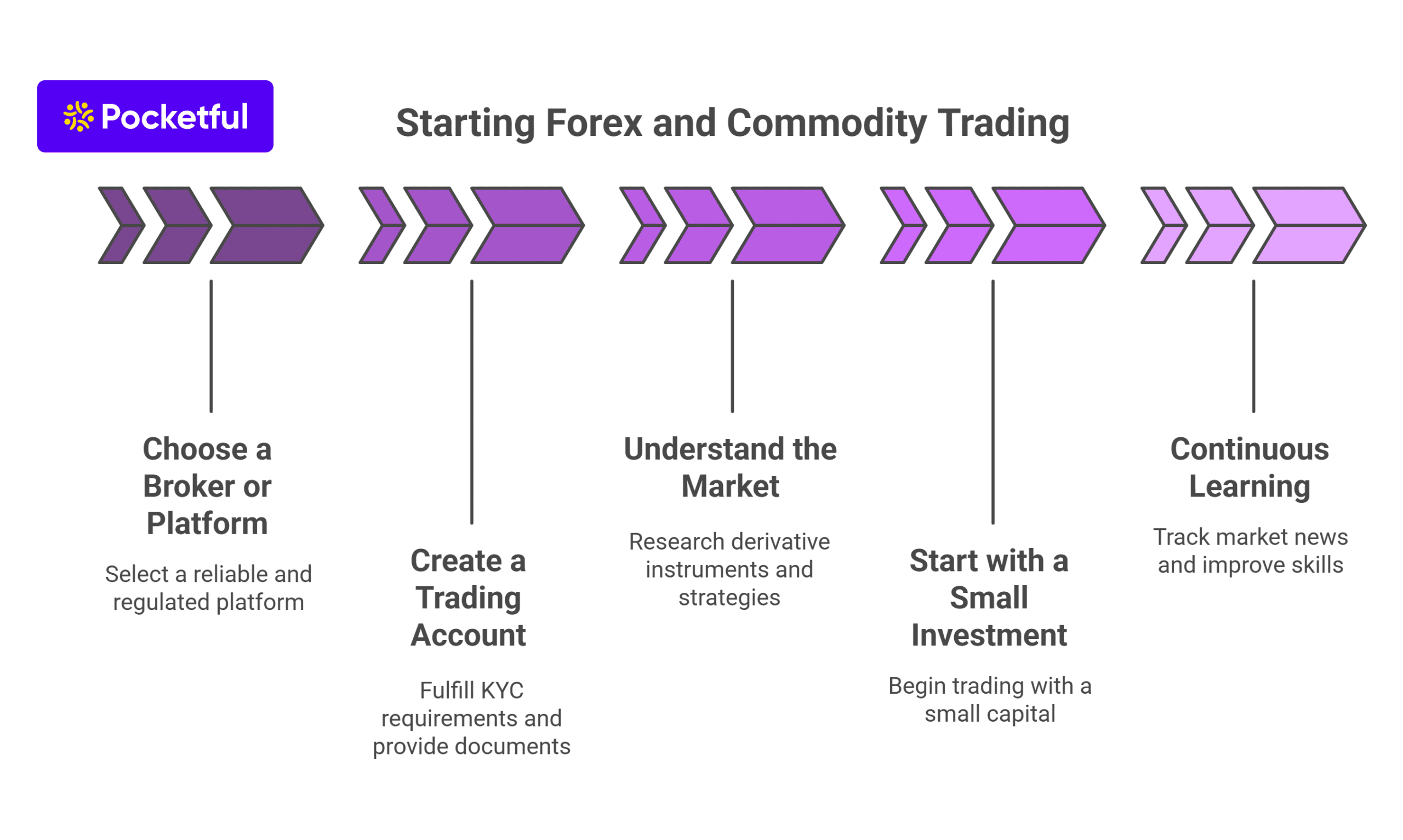

How to Start Trading in Forex and Commodity Markets?

You can start trading in Forex and Commodity markets by following the steps below:

- Choose a broker or platform: First of all, choose a platform that is reliable and follows all the necessary regulations.

- Create a trading account: Go to their website or mobile app and fulfill KYC requirements and provide all the required documents.

- Understand the market: Do some research before trading, such as learning about the derivative instruments and strategies, paper trading, etc.

- Start with a small investment: Avoid using large amounts at the beginning and try to learn the practical side of trading by practising with a small capital.

- Continuous Learning: Track market news, try out new strategies and keep improving your trading skills.

Read Also: Best Online Commodity Trading Platforms in India

Conclusion

Commodity and forex trading both offer good earning potential, but they operate quite differently. Forex markets are highly liquid and majorly impacted by central bank’s interest rate decisions, whereas commodity trading tends to be more volatile and can be used as a hedge against inflation. If you’re unsure which market to pick, take time to consider how much risk you’re comfortable with, what your goals are, etc. Gaining a deeper understanding of the market, learning from experience, and managing risk carefully at every step can make a big difference. With the right mindset and discipline, both markets can offer solid trading opportunities.

Frequently Asked Questions (FAQs)

What is the difference between commodity and forex trading?

Commodity trading involves trading of commodities such as gold, silver, oil, etc., primarily through futures and options contracts whereas forex trading involves trading of currency pairs such as USD/INR, EUR/INR, etc.

How can I start trading in forex and commodity markets?

You need to open a trading account with a SEBI-registered broker by completing the KYC process.

Which is more volatile: forex or commodity trading?

Commodity trading is typically more volatile as it is influenced by global economic events.

Can I make money from commodity or forex trading?

Yes, but it requires the right strategy, risk management and experience.

Is forex trading safe?

Forex trading involves risk and you must have the right strategy and risk management to trade currencies successfully.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle