| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-02-26 |

Read Next

- What Is Leverage in the Stock Market?

- Common Trading Mistakes Beginners Make (And How to Avoid Them)

- How to Pledge ETFs for Margin in India

- What Is Expiry Day Trading?

- Best ETF Platforms for Trading and Investment in India 2026

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

What Is Strike Price in Options Trading?

In India, investors are focusing on option trades, but they have to incur losses because of a limited understanding of the concept related to option terminology. One of such concepts is known as the strike price. This plays an important role in the profitability and risk of an option trade.

In today’s blog post, we will give you an overview of the strike price, along with its key importance in option trading.

What is the Strike Price of an Option?

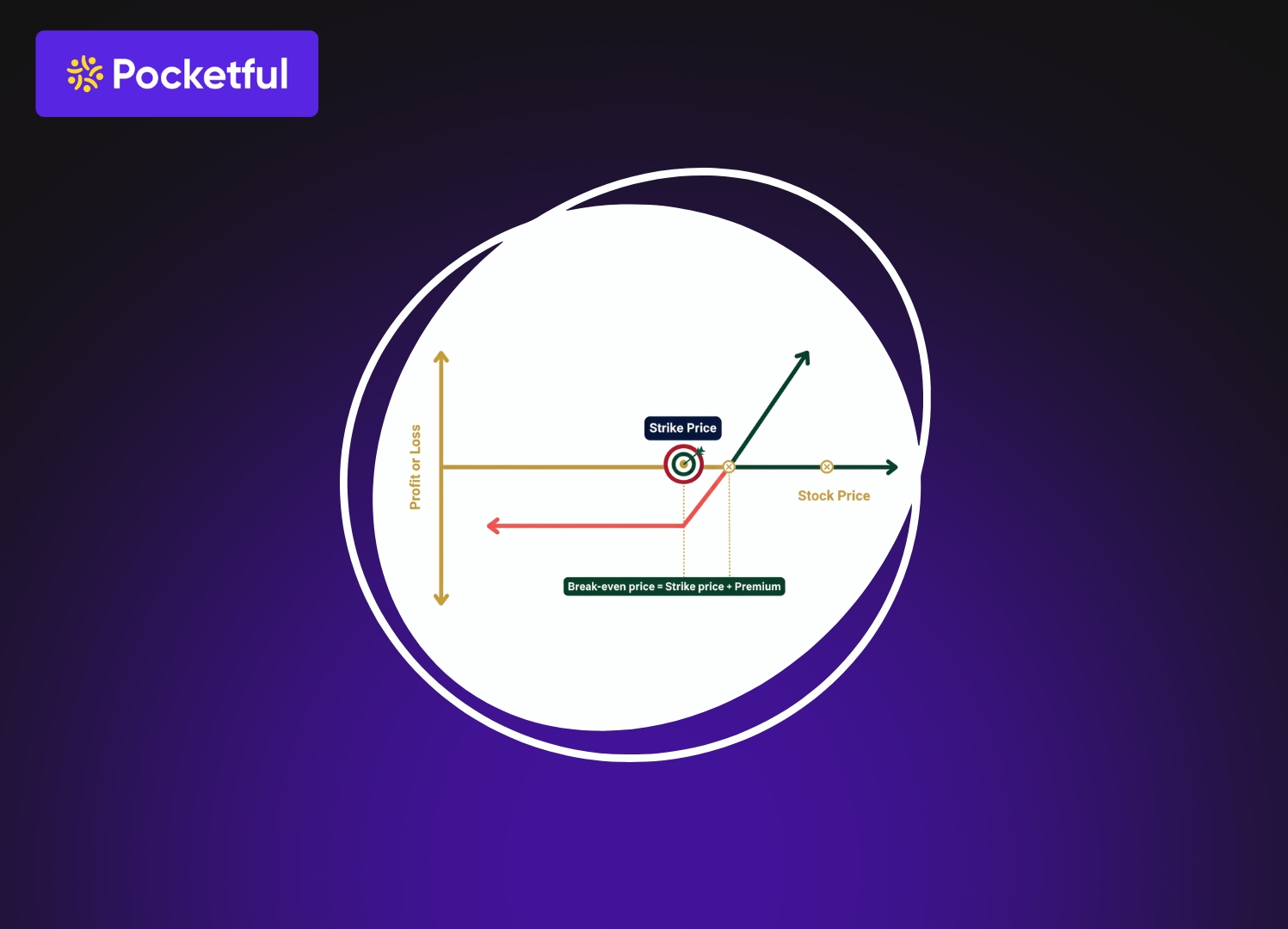

Strike price is the pre-determined price at which the option contracts are exercised. In simple terms, we can say that the strike price is the agreed price at which a trader buys or sells the underlying security on the expiry day of the option. The option buyer has only the right, but not the obligation, to buy or sell the security.

Importance of Strike Price in Options Trading

The key importance of the strike price in options trading is as follows:

- Profit and Loss: Strike price decides whether the option is in the money, out of the money or at the money, which affects the profits and losses.

- Strategy: The strike price helps an individual decide on the different strategies to use.

- Risk: Strike price defines the risk and reward in an option trade. As in the case of a call option, a lower strike price reduces risk but increases the cost.

- Market Participants: Trading volume in a particular strike price reflects the future price movement, volatility, and participation of traders.

How option values are determined ?

There are various factors that determine the option values. A few of such factors are:

- Intrinsic Value: It shows how much an option is in profit at a given price of the underlying asset. However, intrinsic value alone does not decide profit or loss. An option results in a loss if the intrinsic value at expiry is lower than the premium paid.

- Time Value: The profitability of an option contract depends on the time value. The time value decreases over time; hence, the option value shrinks as the expiry approaches.

- Volatility: Volatility reflects how much the value of the underlying asset fluctuates. The higher the volatility in the price of the underlying asset the higher the option premium.

- Interest Rate: The Interest rate determines the value of the call and put option. A higher interest rate increases the call option value and reduces the value of the put option.

Read Also: Call and Put Options: Meaning, Types, Difference & Examples

The relation between the strike price and the underlying security

The relation between the strike price and the underlying security is as follows:

- Determine Moneyness of Option: The strike price and underlying security help in identifying the moneyness of the option, whether it is in the money, out of the money or at the money.

- Affect Intrinsic Value: The intrinsic value of an option contract depends on the difference between the price of the underlying asset and the strike price.

- Affects Rewards: Deep out-of-the-money options are generally cheaper, but they require a strong price movement; hence underlying price can directly affect the profitability of the option.

Difference between strike price and exercise price.

In an option trade, strike price and exercise price are often used interchangeably. The key difference is in their meaning. The strike price is a pre-determined price at which the option contract is entered, whereas the exercise price is the price at which the investor actually exercises the option contract.

Difference between strike price and spot price

The strike price refers to the fixed price at which the investor enters an option contract, which allows the holder to buy or sell the underlying asset. On the other hand, the spot price refers to the current market price of the underlying asset at a given time. The strike price remains fixed throughout the life of the option contract.

Read Also: Options Trading Strategies

Moneyness of Option

There are three types of moneyness of options in India, the details of which are as follows:

- In-the-Money (ITM) Option: When an option is in the money, it is considered to have positive intrinsic value. In the case of a call option, the spot price must be greater than the strike price, whereas in the case of a put option, the spot price must be less than the strike price. In both of these cases, the option contract is considered in the money.

- Out-of-the-Money (OTM) Option: An out-of-the-money option has no intrinsic value. In the case of a call option, the spot price must be less than the strike price, and in a put option, the spot price must be greater than the strike price. Out-of-the-money options are cheaper and are highly volatile.

- At-the-money: This option does not have any intrinsic value. As in this case, the spot price is equal to the strike price. But at-the-money option carries the highest time value in an option chain.

Factors to consider before selecting a strike price

There are various factors to consider before selecting a strike price; a few of such factors are mentioned below:

- Market Movement: Before choosing a strike price, one needs to predict the market movement in future. If the momentum is bullish, one can prefer an ATM or OTM Call Option, and if the momentum is bearish, one can select an ATM or OTM Put Option.

- Time to Expiry: The premium decay in the strike price depends on the time to expiry. Short-term expiry contracts are preferred due to the faster decay of time.

- Volatility in the Market: Volatility can directly impact the change in option price. In case of high volatility, premiums are expensive, and the ATM and ITM strike prices are safer. OTM options are cheaper, offering better risk-reward.

- Risk – Reward Ratio: One should use a stop-loss while executing an option trade. And should select the strike price which offers the best risk-reward ratio.

Read Also: What is an ITM (In The Money) Call Option?

Conclusion

On a concluding note, the strike price is the essential element for investing in options. Choosing the right strike price determines the profitability of an option trade. The relation of the strike price to the underlying asset can affect the profitability. Selecting the strike price is not a prediction, as various factors, such as the time value of money, etc., also play a key role in it. However, it is advisable to consult your investment advisor before executing any trade in options.

Frequently Asked Questions (FAQs)

Does selecting the in-the-money option guarantee profit?

No, selecting the in-the-money option does not guarantee profit. Profitability depends on various factors such as market movement, volatility, and volume in option contracts.

Which strike price is better for conservative traders?

For conservative investors, at-the-money or in-the-money options are suitable as they offer a better risk-to-reward ratio.

Who decides the strike price?

Strike prices of option trades are decided by the stock exchange.

Why are out-of-the-money options cheaper?

OTM options are cheaper because they do not have any intrinsic value.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle