| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jun-24-25 | |

| Add new links | Nisha | Sep-08-25 |

Read Next

- What Is Leverage in the Stock Market?

- Common Trading Mistakes Beginners Make (And How to Avoid Them)

- How to Pledge ETFs for Margin in India

- What Is Expiry Day Trading?

- Best ETF Platforms for Trading and Investment in India 2026

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

Short Straddle: Option Strategy with Examples

Navigating range-bound markets can be challenging, especially when it comes to identifying strategies that generate consistent profits. One such approach tailored for stagnant or sideways price movement is the short straddle. It is a popular strategy among experienced traders who believe a stock or index will not move much in the near future. But while it can generate attractive returns in range bound conditions, it also comes with unlimited risk if the market breaks out of its range.

In this blog, we will break down how a short straddle works, when to use it, what the profit/loss potential looks like, and help you understand it with an easy example.

What is a Short Straddle?

A short straddle is an options trading strategy that is used when you expect the market to stay flat, or not move much in either direction. It is a neutral strategy, meaning you are not betting on the price going up or down; instead, it will stay near the current level.

In a short straddle, you sell one call option and one put option with the same strike price and expiration date. You receive premiums from both short positions, which is your maximum possible profit if the market stays range bound. We will discuss the profit scenarios in a short while but let us first learn about the basic idea behind this strategy.

How does a Short Straddle Work?

The idea is simple – if the stock stays at the strike price until expiry, both options could expire worthless and you get to keep the premiums, which is your maximum gain.

However, if the price moves significantly up or down, the losses can significantly increase. There is no limit on how much you could lose, which makes this a high-risk strategy, best suited for experienced traders who can predict market conditions with some accuracy.

Read Also: Option Chain Analysis: A Detail Guide for Beginners

Key Components of Short Straddle

Before jumping into a short straddle, it is important to understand the key parts that make up the strategy. Here is what you need to know,

1. Strike Price

This is the price associated with the call and put options at which the options can be exercised or settled. In a short straddle, both options have the same strike price, ideally close to the current market price of the underlying asset or At the Money (ATM) options.

2. Premium Received

When you sell a call and a put, you collect premiums for both. These premiums are your maximum possible profit, but only if the price of the asset stays near the strike price until expiry.

3. Expiration Date

Both the call and put options in a short straddle must have the same expiry date. The closer you are to expiration, the faster the time value of the options erodes, which benefits the seller.

4. Implied Volatility (IV)

Short straddles work best when IV is high at the time of entry and is expected to fall. A drop in IV usually leads to a drop in option prices, which benefits the seller. But high IV also means higher risk, so timing matters.

Read Also: What Is an Option Contract?

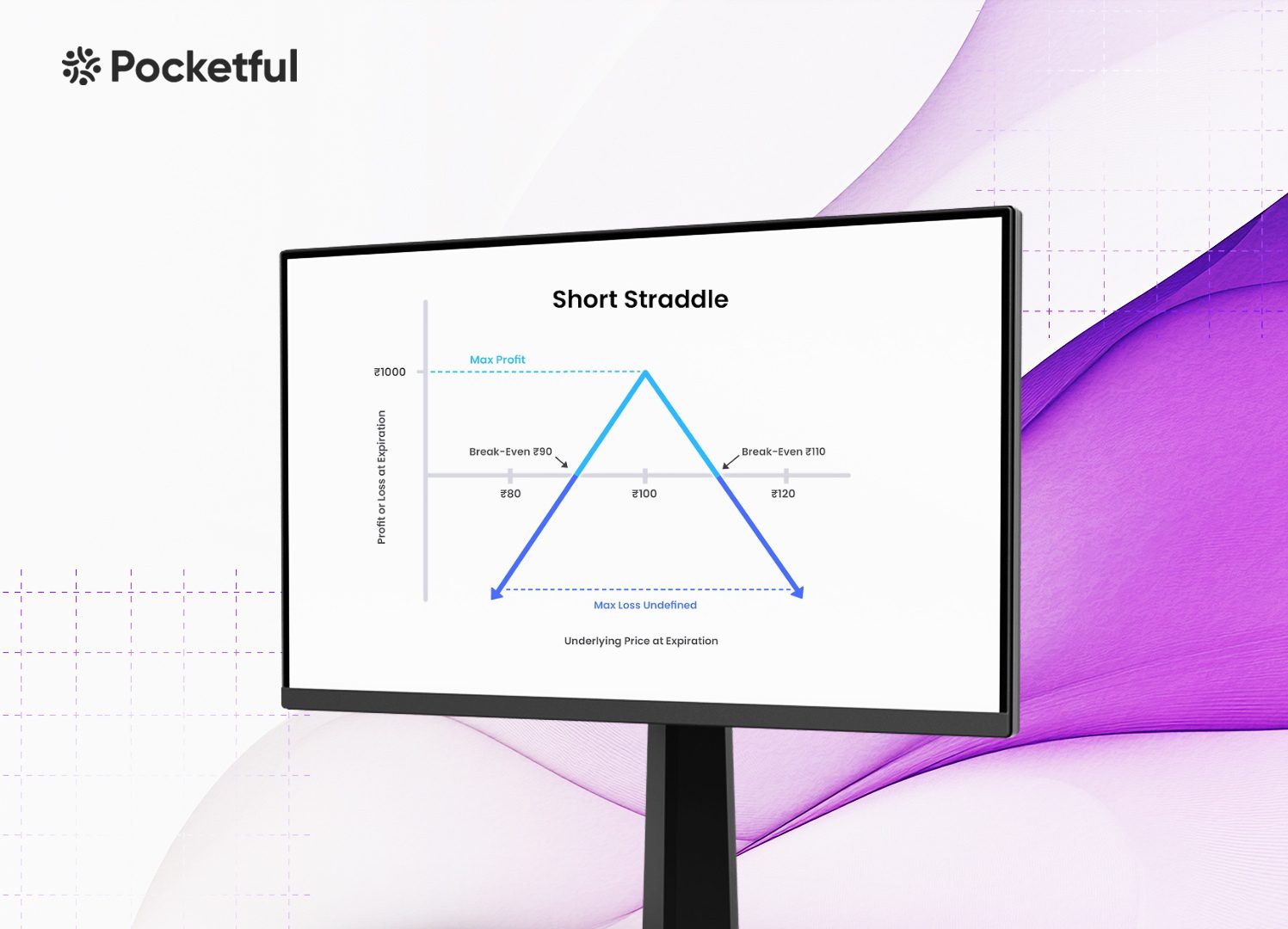

Profit, Loss and Breakeven in a Short Straddle

1. Maximum Profit

Your maximum profit is limited to the total premium you collect from selling the call and the put. This happens only if the underlying asset stays exactly at the strike price on expiry. In that case, both options expire worthless, and you keep the full premium.

2. Maximum Loss

The loss potential is unlimited on the upside, i.e., if the asset price rises sharply and substantial on the downside as asset prices cannot go below 0. Since you have sold both a call and a put, any big move, up or down, can lead to big losses.

3. Breakeven Points

There are two break even points in a short straddle, one on each side of the strike price:

- Upper Breakeven = Strike Price + Total Premium Received

- Lower Breakeven = Strike Price – Total Premium Received

If the price of the underlying asset stays within this range, you make a profit. If it goes outside, the position starts losing money.

Example of Short Straddle

Suppose ABC stock is trading at ₹100, and you are predicting that it is going to stay around this level for the upcoming days. So, you decide to create a short straddle.

You will need to execute the following trades;

- Sell 1 Call Option at ₹100 strike,

Suppose, Premium received = 6 points = ₹600, considering lot size to be 100

- Sell 1 Put Option at ₹100 strike,

Premium received = 6 points = ₹600

- Total Premium Collected = 6 + 6 = 12 = ₹1,200

Now let us consider three cases,

Case 1 : If the stock closes on ₹100 at expiry : The call and put both expire worthless and you keep the full ₹1,200 premium as profit, which is the maximum profit.

Case 2 : If the stock closes at ₹110 at expiry : Call is in the money and will be worth 10 points (110 – 100) or ₹1,000 at expiry, whereas put will expire worthless.

- Call Position = Premium received – intrinsic value of call = ₹600 – ₹1,000 = -₹400

- Put Position = Premium received – intrinsic value of put = ₹600 – ₹0 = ₹600

- Net P/L = P&L from call + P&L from put = -₹400 + ₹600 = ₹200

Case 3 : If the stock closes at ₹85 at expiry : Put option is in the money and will be worth 15 points (100 – 85) or ₹1,500 at expiry, whereas the call expires worthless.

- Call Position = Premium received – intrinsic value of call = ₹600 – ₹0 = ₹600

- Put Position = Premium received – intrinsic value of put = ₹600 – ₹1,500 = -₹900

- Net P/L = P&L from call + P&L from put = ₹600 – ₹900 = -₹300

Read Also: What is Implied Volatility in Options Trading

When to Use a Short Straddle?

A short straddle is useful in the following conditions:

1. When You Expect Low Volatility

If you believe the price of the stock or index will stay near its current level until expiry, a short straddle can generate good profits.

2. After a Volatility Spike

Selling a straddle when implied volatility (IV) is high and likely to fall can be smart because options premiums are inflated during periods of high IV, and you collect more upfront premium. If volatility drops, option prices fall, which is beneficial for the seller.

Advantages & Risks of Short Straddle

Advantages

1. High Premium Collection

You receive premiums from selling both call and put options. You can generate decent profits using this compared to many other strategies.

2. Profitable in a Range-Bound Market

If the stock stays within a range, especially near the strike price, the short straddle can be very effective. Time decay, which is also known as theta, works in your favour.

3. Simple Setup

It is a simple strategy. Same strike, same expiry, sell one call and one put. No need to manage multiple strikes or legs like that in iron condors or butterflies.

Risks

1. Unlimited Loss Potential

This is the biggest concern because if the stock makes a big move in either direction, losses can be steep. There is no upper limit on how much you could lose.

2. Requires Active Monitoring

You cannot simply create a short straddle and wait till expiry as it may be necessary to adjust the positions or exit the trading position if there is any global event.

3. High Margin Requirement

Because of the risk involved, brokers usually require you to keep a substantial margin amount in your trading account to execute this strategy.

Read Also: Types of Futures and Futures Traders

Conclusion

A short straddle is a powerful options strategy when markets are expected to stay quiet, but risky when they are not. It is best used by experienced traders who are comfortable managing trades actively and have a good understanding of market behaviour. The unlimited risk on both sides means you need to be very confident in your market view, keep an eye on your position, and be ready to act if things start moving against you. Remember to always manage risk smartly, because when the market moves, it can move fast. It is advised to consult a financial advisor before trading.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | What is Algo Trading? |

| 2 | What is Spread Trading? |

| 3 | What is Quantitative Trading? |

| 4 | Arbitrage Trading in India – How Does it Work and Strategies |

| 5 | Silver Futures Trading – Meaning, Benefits and Risks |

| 6 | Best Brokers for Low Latency Trading in India |

Frequently Asked Questions (FAQs)

When is a short straddle most profitable?

It is most profitable when the underlying asset closes exactly at the strike price at expiry. In this scenario, both call and put expire worthless and you keep the full premium received at the beginning.

How do I know the breakeven points in a short straddle?

You calculate breakeven by adding (upper breakeven) and subtracting (lower breakeven) the total premium received from the strike price.

Can beginners use the short straddle?

It is generally not recommended for beginners because of the high risk and need for active management.

Can I close the short straddle before expiry?

Yes, you can close your position anytime before expiry to lock in profits or cut losses.

How much margin do I need for a short straddle?

Margins requirements can differ across brokers but tend to be high due to the unlimited risk involved.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle