| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-25-25 |

Read Next

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

- What is a BTST Trade?

- How to Do Algo Trading in India?

- What Is CMP in Stock Market?

- MTF Pledge vs Margin Pledge – Know the Differences

- Physical Settlement in Futures and Options

Understanding Futures Pricing Formula

Why does the futures price of a stock or commodity often differ from the spot price? Is this just the effect of demand-supply or is there some mathematical logic behind it? Actually, futures pricing is based on a specific calculation, which is called the futures pricing formula.

In this blog, we will understand in simple language how futures contracts are priced, what are the factors behind it, and how this formula can help you understand the market better.

What Are Futures Contracts?

Futures contracts are an agreement in which two parties (buyer and seller) agree to buy or sell an asset at a fixed price on a fixed date in the future. This asset can be anything such as gold, crude oil, stocks, index or currency.

Example: Suppose a coffee importer needs a large quantity of coffee after 3 months. He wants to fix the price of coffee today itself so that even if the price increases in the future, his expenses do not increase. For this he makes a futures contract.

Who uses futures contracts?

Mainly two types of people are involved in it:

- Hedgers: Those who want to protect themselves from price risk.

- Speculators: Those who want to earn profit from price movement.

Types of Futures:

- Commodities Futures (like gold, silver, coffee)

- Stock Index Futures (like Nifty, Bank Nifty)

- Currency Futures (USD/INR, EUR/INR)

- Interest Rate Futures (based on government bonds)

All of these use the futures pricing formula, which decides what the future price of an asset should be.

The Basics of Futures Pricing

Futures contract prices often differ from spot prices, and the main reason for this is the Cost of Carry Model. This model shows that the cost (or benefit) of buying an asset today and holding it in the future affects futures pricing. It consists of three key elements:

- Risk-Free Interest Rate (r): The interest that would be earned on the amount of money if it were invested in a safe investment.

- Storage and Insurance Cost: These have a big impact, especially in commodities (e.g. gold, crude oil).

- Income Yield (d): Some assets, such as stocks or indices, provide dividends or yields over the holding period, which pull the price down.

All of these factors combine to determine whether the futures price will be at a premium (above) or a discount (below) the spot price.

No-Arbitrage Pricing Principle : The most important principle governing futures pricing in modern financial markets is the No Arbitrage Principle. Accordingly, if the difference between the futures price and the spot price is so great that a trader can make a profit without any risk, they immediately adopt an arbitrage strategy. The result is that the imbalance in pricing is quickly eliminated and the futures come closer to its theoretical value.

For example, if the futures price is too high, traders will buy the asset today and sell it in futures — which will increase demand and balance the price.

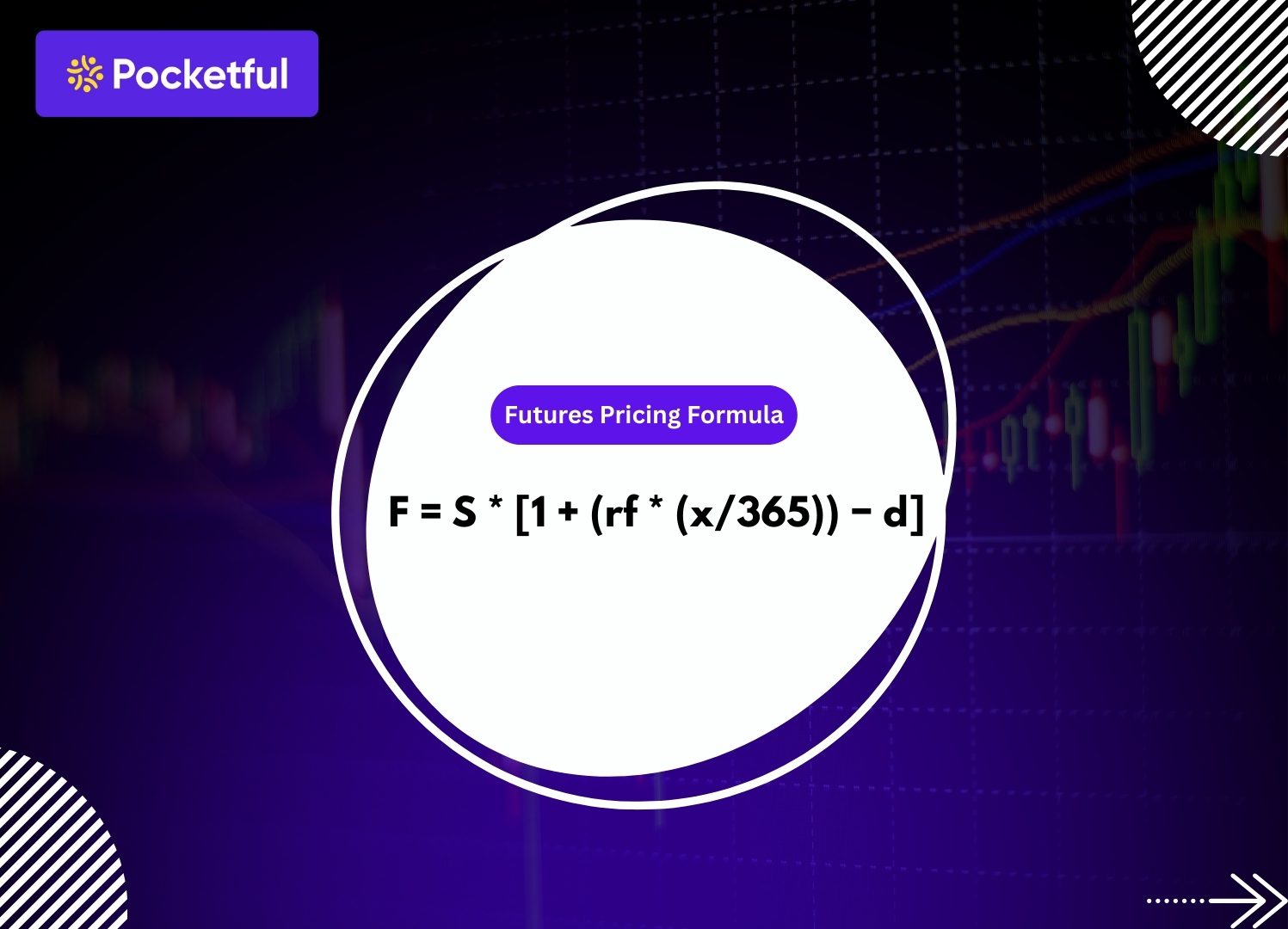

Futures Pricing Formula

In the Indian markets, futures contracts are priced using a discrete compounding formula, not the exponential version often used in global finance.

F = S * [1 + (rf * (x/365)) − d]

Where:

- F = Futures Price

- S = Spot Price

- rf = Risk-Free Interest Rate (e.g., RBI Treasury Bill rates)

- d = Dividend Yield (if any)

- x = Number of days till expiry

This formula applies specifically to index futures and stock futures. In commodity futures, storage and logistics costs are also added to it. This futures pricing formula helps to keep the prices in the market fair, logical and prediction-based.

Real-World Examples of Futures Pricing

Now we will understand how to apply the futures pricing formula practically with data.

Suppose in July 2025:

- Spot price of XYZ Corp = ₹2,380.5

- Risk-free rate (r_f) = 8.3528% per annum

- Days to expiry = 7

- Dividend (d) = 0

F = 2380.5 * [1 + (0.083528 * (7/365)) − 0]

F = 2380.5 * [1+0.0016] ≈ ₹2,384.06

So, the fair value of the futures contract after 7 days is ₹2,384.06.

When the Futures Pricing Formula Breaks Down?

- Market inefficiency : The futures pricing formula does not work well when there is low liquidity or sudden news-driven volatility in the market. In such a situation, prices may look different from the formula due to demand–supply mismatch.

- Expectation-based pricing : Many times traders price futures contracts based on what they think the future spot price will be rather than the pure cost of carry. This also leads to deviation from the formula.

- Margin requirements and Sentiment : Market sentiment and changes in margins by brokers also affect the pricing of futures. Panic selling or bullish speculation can cause prices to deviate significantly from the theoretical value.

Example: During the 2020 crash, Nifty futures prices were often trading 150-200 points below the actual spot. During extreme events, like the 2020 crash, Nifty futures often traded 150–200 points below spot. In such times, liquidity stress and sentiment temporarily overpower the cost-of-carry logic. This makes it clear that sometimes emotions and market conditions prove to be more effective than formula.

Applications of the Futures Pricing Formula

- Used in Hedging : Large corporates and exporters use this formula to determine how expensive or cheap it will be for them to hedge an asset in the future. This reduces their risk and makes budgeting easier.

- Arbitrage Trading : When the futures price is above or below its theoretical value, professional traders immediately catch the arbitrage opportunity. Even a small difference between the spot and futures price can become an opportunity to profit in lakhs.

- Valuation and Estimation : Analysts use this formula to estimate how the market is looking at interest rates, currency rates or stock movements in the next few months. Futures price in a way shows a forward-looking perspective of the market.

- Unique Insight : Professional traders compare the theoretical futures price and the actual traded price all the time. As the difference increases, they either hedge or create an arbitrage position — this edge sets them apart from the rest.

Common Myths Around Futures

- Futures prices predict the future : People often believe that futures prices indicate the future value of an asset. In reality, the futures pricing formula simply adds the cost of carry to the spot price to give a logical price—it is not a prediction.

- A premium in futures means the market is bullish : If the futures price is higher than the spot, it is not considered a bullish signal. This difference is often just due to interest rates, dividends, or holding costs.

- Expensive futures mean you should avoid : If the futures price is high, it does not necessarily mean that it is overvalued. This may include things like hedge demand, liquidity, or supply constraints.

- Futures should always be equal to or cheaper than the spot : There is often the belief that futures should trade around the spot, but it is normal for them to vary due to cost of carry, volatility, and demand/supply in different assets.

- Futures are only for speculative traders : Although speculation does occur, futures are primarily used for hedging and price discovery. Institutions and businesses use them to actively manage risk.

Conclusion

Futures pricing can be understood clearly through the cost of carry model. The fair value of a futures contract is determined by the spot price adjusted for interest rates, dividends or yields, and the time remaining to expiry. By applying this formula, traders and investors can evaluate whether a futures contract is trading at fair value, a premium, or a discount. This understanding is critical for making informed decisions in hedging, arbitrage, and speculation. It is advised to consult a financial advisor before trading in futures contracts.

Frequently Asked Questions (FAQs)

What is the formula for futures pricing?

The basic formula for calculating futures price is: F = S * [1 + (rf * (x/365)) − d], where, S = Spot Price , r = Risk-Free Interest Rate , x = Number of days till expiry and d = Dividend Yield .

Why does the futures price differ from the spot price?

Futures price is different from spot price because of factors like interest cost, storage, and time left to expiry.

Does futures pricing apply to all asset classes?

Yes, this formula applies to commodities, indices, currencies and other instruments — only the cost of carry may vary.

Can futures prices be lower than spot prices?

Yes, if the market is in backwardation, then futures prices can be lower than spot prices.

Is futures pricing important for retail traders?

Absolutely, this helps you identify overvalued or undervalued contracts and make better decisions.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle