| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Nov-28-25 |

Read Next

- Why Are Steel Share Prices Increasing in India?

- Top Nifty Metal ETFs in India 2026

- Best Gold Investment Schemes in India 2026

- How to Build a Portfolio With Exchange-traded Funds (ETFs)

- How to Invest in US Stocks from India

- Platinum Price Forecast in India (2026–2030)

- Why Is the Gold Price Going Down?

- Top 10 BESS Stocks in India (2026)

- Why is the Silver Price Going Down?

- Best Construction Stocks in India

- Why Gold Prices Hit ₹1,80,000 – Key Reasons

- List of Best Sensex ETFs in India

- Best Commodities to Trade in India

- Best Cyclical Stocks in India 2026

- How to Check the Purity of 20-Carat Gold: Easy Methods & Tips

- Why Are Silver Prices Rising in India?

- Difference Between Hallmark Gold, KDM Gold and BIS 916

- Why Are Gold Prices Rising in India?

- 1 Tola Gold in India: How Many Grams, Price & Investment Insights

- 22K vs 24K Gold: Which Is Better for Jewellery & Investment?

- Blog

- best investment options in india

Best Investment Options in India 2026

The year 2025 presents both new opportunities and challenges for investors. The Indian economy continues to grow, and stable interest rates have further improved the investment climate. At such a time, the biggest question is where and how to invest money to get good returns while minimizing risk? In this article, we will tell you about investment options for 2025 that are reliable and can help you achieve your financial goals.

What Defines a “Good Investment” in 2026?

A good investment is one where your money is safe and grows. It’s not just about getting high returns but also about having access to your money when you need it. The right investment is one that aligns with your life and goals, such as funding your children’s education, purchasing a house, or planning for retirement.

- Safety: The first rule of any investment is that your money shouldn’t be lost. If you have any doubts, choose reliable options like PPF, Post Office schemes, or government bonds. These may offer lower returns, b:ut they provide greater peace of mind.

- Returns: Everyone wants their money to grow, but the smart approach is to ensure the returns are higher than the inflation rate. By taking a calculated risk and investing wisely, you can achieve a good balance between equity and debt, which can provide a return higher than the inflation rate.

- Liquidity: Always keep some money in investments that can be easily accessed. You never know when you might need money in life. Fixed deposits or liquid funds are very useful in such situations.

- Taxes: Earnings only matter if there’s something left after paying taxes. Some investments like NPS or SGB are considered better from a tax perspective. Therefore, always consider the tax implications before making an investment.

- Goals: Every investment should have a purpose. If you plan to buy a car in two years, invest in a safe option. But if you are planning for retirement in ten years, choose growth-oriented options. The real benefit of an investment comes when it serves its purpose at the right time.

Low-Risk Investment Options

If you’re looking for an investment where your money is safe and you receive stable returns, these options are right for you. While the profits may be slightly lower, you’ll definitely have peace of mind.

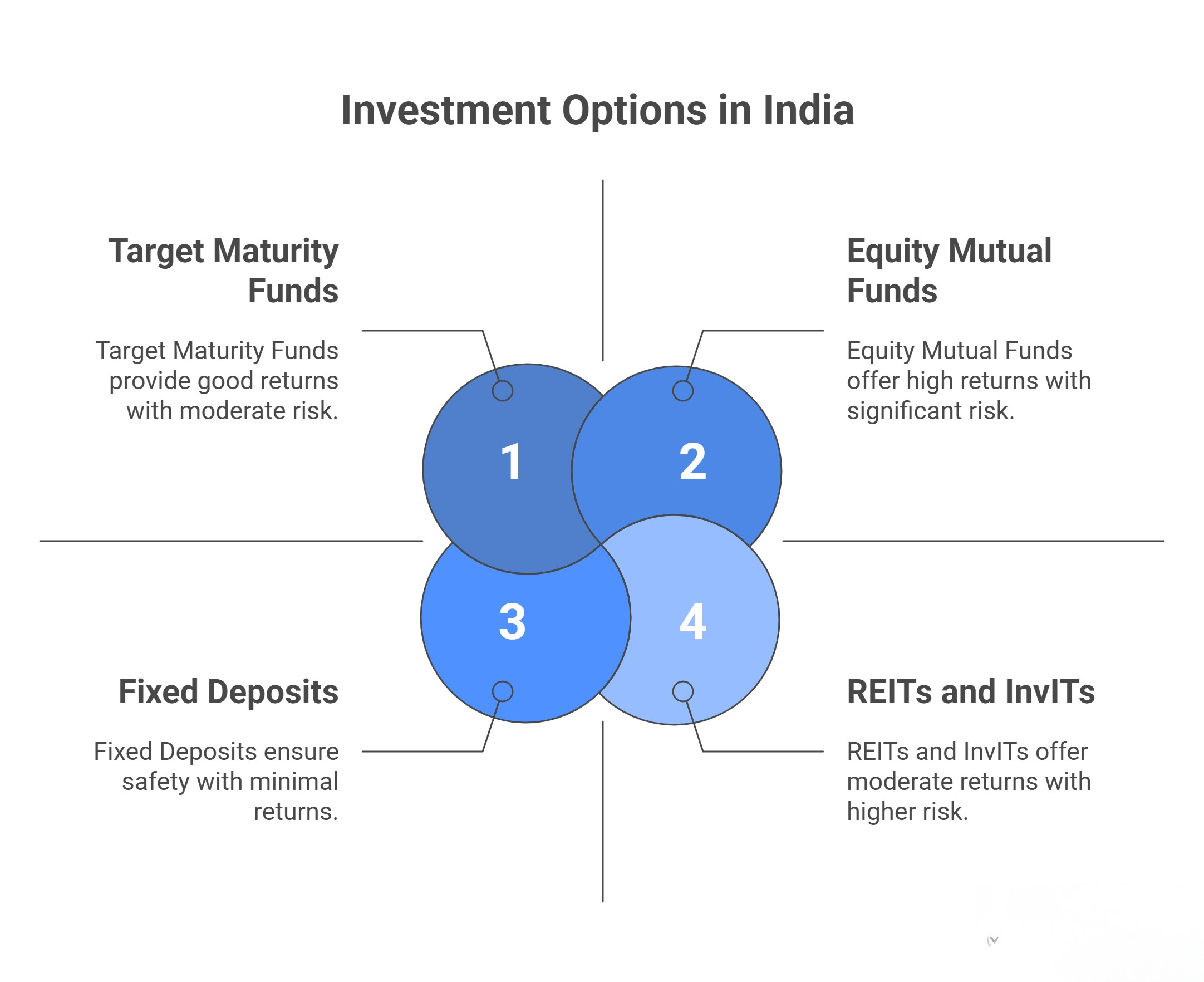

- Fixed Deposits (FDs) : FDs have always been the most reliable way to make a safe investment. Here, your money is locked in for a fixed period, and you know in advance how much interest you will receive. Currently, interest rates in most banks are between 6% and 7%. This option is best for those who want stable and risk-free returns.

- Public Provident Fund (PPF) : If you are looking for a safe investment for the long term, PPF is a great option. It comes with a government guarantee, an interest rate of 7.1%, and the earnings are completely tax-free. It can be used for retirement or long-term goals.

- Post Office Schemes : Post office schemes like NSC and Senior Citizen Savings Scheme are suitable for investors who want stable returns and don’t want to take any risks. These schemes offer both government security and a fixed interest rate.

- RBI Bonds and Treasury Bills : If you want your money to be completely safe, RBI bonds and Treasury Bills are a good option. These are issued directly by the government, so there is no risk of default.

Read Also: Best Safe Investments with High Returns in India

Medium-Risk Investment Options

These investments are suitable for people who want to grow their money moderately but cannot tolerate significant fluctuations. They generally offer better returns than fixed deposits and do not involve excessive risk.

- Target Maturity Funds (TMFs) : These are mutual funds that have a fixed maturity date. This means you know in advance when you will receive your money. These funds include government and PSU bonds, making them safe and providing good returns.

- Hybrid Mutual Funds : These funds are a mix of both equity and debt. The advantage is that returns increase when the market performs well, and losses are limited when the market falls. This is a good option for those who want to start investing in the stock market.

- Sovereign Gold Bonds (SGBs) : This is the best way to invest in gold. It is government-guaranteed, provides a small annual interest, and is tax-free on maturity. It’s a good way to stabilize your portfolio in the long term.

- REITs and InvITs : If you want to invest in real estate or infrastructure without buying any property, these two are excellent options. They provide regular income similar to rent, and the value of the asset can also appreciate over time.

Tax-Efficient Investments

Most people focus only on returns when investing, but they forget about the taxes they’ll have to pay. The reality is that the real benefit is what’s left after paying taxes. Therefore, before investing, it’s important to understand which method is more tax-efficient.

- Debt Mutual Funds: These funds no longer offer the same indexation benefits as before, meaning any profits will be taxable according to your income tax bracket. However, due to their liquidity and transparency, they are still considered slightly better than FDs.

- Sovereign Gold Bonds (SGBs): These are government-guaranteed and tax-free upon maturity. They also offer a small amount of interest annually. If you want to invest in gold but also avoid taxes, this is the cleanest and simplest method.

- National Pension System (NPS): This is a good and tax-friendly option for retirement planning. It offers an additional tax deduction of up to ₹50,000, which is not available in any other scheme. In the long term, it proves to be a safe and disciplined investment.

- Equity Mutual Funds and ELSS: If you want to save on taxes and grow your money, then ELSS is the right choice. It has a three-year lock-in period and offers a tax deduction of up to ₹1.5 lakh.

Read Also: 10+ Best Investment Plan for Monthly Income in India

Best Way to Invest Money by Goal

| Goal | Time Period | Best Option | Average return (per year) | Risk Level |

|---|---|---|---|---|

| Emergency Fund | 0–2 years | Fixed deposits, liquid funds | 5%-7% | Less |

| Saving for a home | 3–5 years | Target Maturity Fund, Hybrid Fund | 7%-9% | Medium |

| Children’s Education | 7–10 years | Equity Mutual Funds, ELSS | 10%-12% | High |

| Retirement Planning | 15 years or older | NPS, Index Funds, SGB | 9%-11% | Medium–High |

| Gold or security fund | At any time | SGB, Gold ETF | 6%-8% | Medium low |

Model Portfolios for Different Risk Profiles

| Type of investor | Investment Objective | Portfolio Structure | Expected Outcome |

|---|---|---|---|

| Conservative Investor | Protecting capital | 50% Fixed Deposit / TMF, 30% PPF / SSS, 10% SGB, 10% Large Cap Fund | Stable returns, low risk, money is safe. |

| Balanced Investor | A little growth, A little Security. | 40% Equity Fund, 35% TMF, 10% SGB, 10% REIT/InvIT, 5% Liquid Fund | Mid-level returns, balanced risk. |

| Aggressive Investor | Long-Term Growth | 60% Equity (Large + Mid Cap), 20% NPS, 10% Global Fund, 5% SGB, 5% TMF | High returns, slightly higher risk. |

Common Mistakes to Avoid When Investing

- Not Understanding Risk : Many times, people invest simply by following others, without considering how much risk they can handle. Everyone’s financial situation is different. The stock market might be right for some, but not for others. Investing without understanding your risk tolerance is one of the biggest mistakes.

- Chasing Past Returns : People often invest in funds or stocks that performed well in the previous year. But the market doesn’t always behave the same way. What was at the top yesterday might be at the bottom today. Therefore, making decisions based solely on past returns is not wise.

- Investing in Too Many Funds : More funds don’t necessarily mean more profit. On the contrary, it complicates your portfolio and makes it difficult to track. Stick to a few good and reliable funds to maintain better control.

- Ignoring Taxes and Charges : Many people invest only by looking at returns, but they don’t consider taxes or exit loads. These small details can significantly reduce your net return. Therefore, always understand the tax structure before investing.

- Not Creating an Emergency Fund : Many people invest all their money, but don’t keep anything aside for emergencies. When a sudden need arises, they have to liquidate their investments at a loss. Always keep an emergency fund equivalent to at least six months’ worth of expenses.

Read Also: Types of Investment in the Stock Market

Conclusion

Putting money in is only one aspect of investing; another is making sure it goes in the right direction. Your needs and time horizon should be taken into consideration when selecting an option. The best long-term outcomes come from consistent, deliberate investing that is not hurried. Your money will only grow steadily if you do this.

Frequently Asked Questions (FAQs)

What is the safest investment option in India?

PPF, RBI Bonds, and Post Office Schemes are considered the safest because they are backed by the government.

Which investment gives the best returns?

Equity mutual funds and NPS offer good returns in the long term if you invest regularly.

Is SIP better than a lump sum investment?

Yes, with SIP, you invest gradually, which reduces the impact of market fluctuations.

How much should I invest monthly?

It is generally considered best to allocate about 20-30% of your income towards investments.

Gold or Mutual Funds which is better?

Gold is considered safe, while mutual funds offer better growth in the long term.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle