| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | May-08-25 |

Read Next

- Future Industry in India 2026

- What is Auction Market?

- Top Green Hydrogen Stocks in India

- Ashish Dhawan Portfolio : Top Holdings, Strategy & Lessons

- Top 10 Wind Energy Stocks in India

- Aluminium Price Predictions for Next 5 Years in India

- Zinc Price Predictions for Next 5 Years in India

- Best Sectors to Invest in Next 10 Years in India

- Why Tobacco Stocks Are Falling in India: ITC, Godfrey Impact

- Copper Price Predictions for the Next 5 Years in India

- Book Value vs Market Value of Shares: Meaning, Formula & Key Differences

- Why Share Market is Down Today? Reasons Behind Stock Market Fall

- Steel Price Predictions for the Next 5 Years in India

- What are Bond ETFs?

- Best ULIP Plans in India

- Difference Between Shareholders and Debenture Holders

- Nifty 50 vs Nifty 500: Which Is Better

- Big Bulls of Indian Stock Market: The Complete List

- Best Sugar Stocks in India

- What Is a Ponzi Scheme? Meaning, Scam & India Laws

- Blog

- top defence stocks to watch after operation sindoor

Top Defence Stocks to Watch After Operation Sindoor

A nation’s strength lies in its shield—its defense sector, guarding against threats and ensuring peace. India’s resolute “Operation Sindoor” on May 7, 2025, showcased this might, turning investor eyes towards the defense sector stocks. As the defense needs of the country increase, investors actively search for defense companies for investment.

After the Balakot airstrike in 2019, share prices of numerous defense companies increased considerably in the following days. Could a similar surge in defense stock prices follow Operation Sindoor? In this blog, we will discover which Indian defense companies are offering an opportunity to invest.

What is Operation Sindoor?

Operation Sindoor is the codename of missile strikes carried out by the Indian Armed Forces on 7 May 2025, targeting terrorist bases in Pakistan and Pakistan-Occupied Kashmir (PoK). The operation was carried out in response to the terrorist attack in Pahalgam, Jammu and Kashmir on 22 April, in which 26 tourists were killed. It not only had an impact from a strategic point of view, but also renewed investors’ interest in the Indian defense industry.

Historical Correlation: Wars & Stock Market Trends

History has shown us time and again that whenever India has taken a tough stand on the military front, defense stocks have surged. For instance, after the 2016 surgical strike and the 2019 Balakot airstrike, stocks of companies like Bharat Electronics (BEL), HAL, and BDL saw a good surge after both the incidents.

At a time when national security becomes a priority, the government increases the defense budget and approves new deals. This leads to new orders for defense sector companies and improves their profitability.

The Indian Defence Sector: 2026 Outlook

Currently, India’s defence sector is undergoing a significant transformation, driven by the ‘Make in India‘ initiative and the goal of self-reliance.

- Budget Allocation: The Defence Ministry has been allocated a record budget of ₹6.81 lakh crore for FY 2025-26, an increase of 9.53% over the previous year. It constitutes 13.45% of the total Union Budget, which is the highest among all ministries.

- Local production and exports: Under the ‘Make in India‘ initiative, India’s defence production has reached ₹1.27 lakh crore in FY 2023-24, while defence exports have reached an all-time high of ₹23,622 crore.

- Private sector participation: The government has encouraged private companies to participate in defence production, leading to increased participation from companies such as Larsen & Toubro, Adani Group and Tata Sons.

Through these initiatives, India is not only moving towards meeting its own defence requirements but also becoming a significant player in the global defence market.

Read Also: 10 Essential Financial Planning Tips for Military Members

Top Defence Stocks to Watch After Operation Sindoor

Some of the Indian Defense stocks to watch out for after Operation Sindoor are mentioned below:

- Hindustan Aeronautics Limited (HAL): India’s leading aerospace and defense manufacturer, HAL has recently received an order worth ₹13,500 crore for 12 Sukhoi fighter jets. Moreover, on 1 April, HAL bagged a ₹62,700 crore order for the manufacturing of 156 light combat helicopters.

- Bharat Electronics Limited (BEL): A leader in manufacturing of defence electronics systems, BEL recently won a ₹2,200 crore contract from the Indian Air Force for supplying advanced Electronic Warfare (EW) suite for their helicopters.

- Bharat Dynamics Limited (BDL): Headquartered in Hyderabad, Bharat Dynamics Limited (BDL) is a Public Sector Undertaking under India’s Ministry of Defence, established on July 16, 1970. BDL manufactures guided missile systems and allied equipment for the Indian Armed Forces, collaborating with DRDO and foreign OEMs.

- Mazagon Dock Shipbuilders Limited (Mazagon Dock): A global leader in the construction of submarines and warships, the company has a market capitalisation of ₹1.20 lakh crore. Taken over by the Government in 1960, The company has built 805 vessels, including 30 warships and 8 submarines, serving both the Indian Navy and global clients with advanced shipbuilding expertise.

- Data Patterns: Specialist in manufacturing of defence electronic systems such as radars, avionic systems and other electronic warfare systems, the company plays a key role in enhancing India’s defense capabilities. According to experts, this company is a rising star in the defence sector.

Top Defence Stocks

| Company Name | Key Highlights | 1 Month Performance |

|---|---|---|

| HAL (Hindustan Aeronautics Ltd.) | Sukhoi jet order worth ₹13,500 crore, strong Q3 results | 11.06% |

| BEL (Bharat Electronics Ltd.) | 60% market share, key electronics supplier | 10.66% |

| BDL (Bharat Dynamics Ltd.) | Missile systems manufacturer, strong order book | 14.74% |

| Mazagon Dock | Submarines and warships manufacturer | 22.09% |

| Data Patterns | Defence tech and software, emerging company | 35.30% |

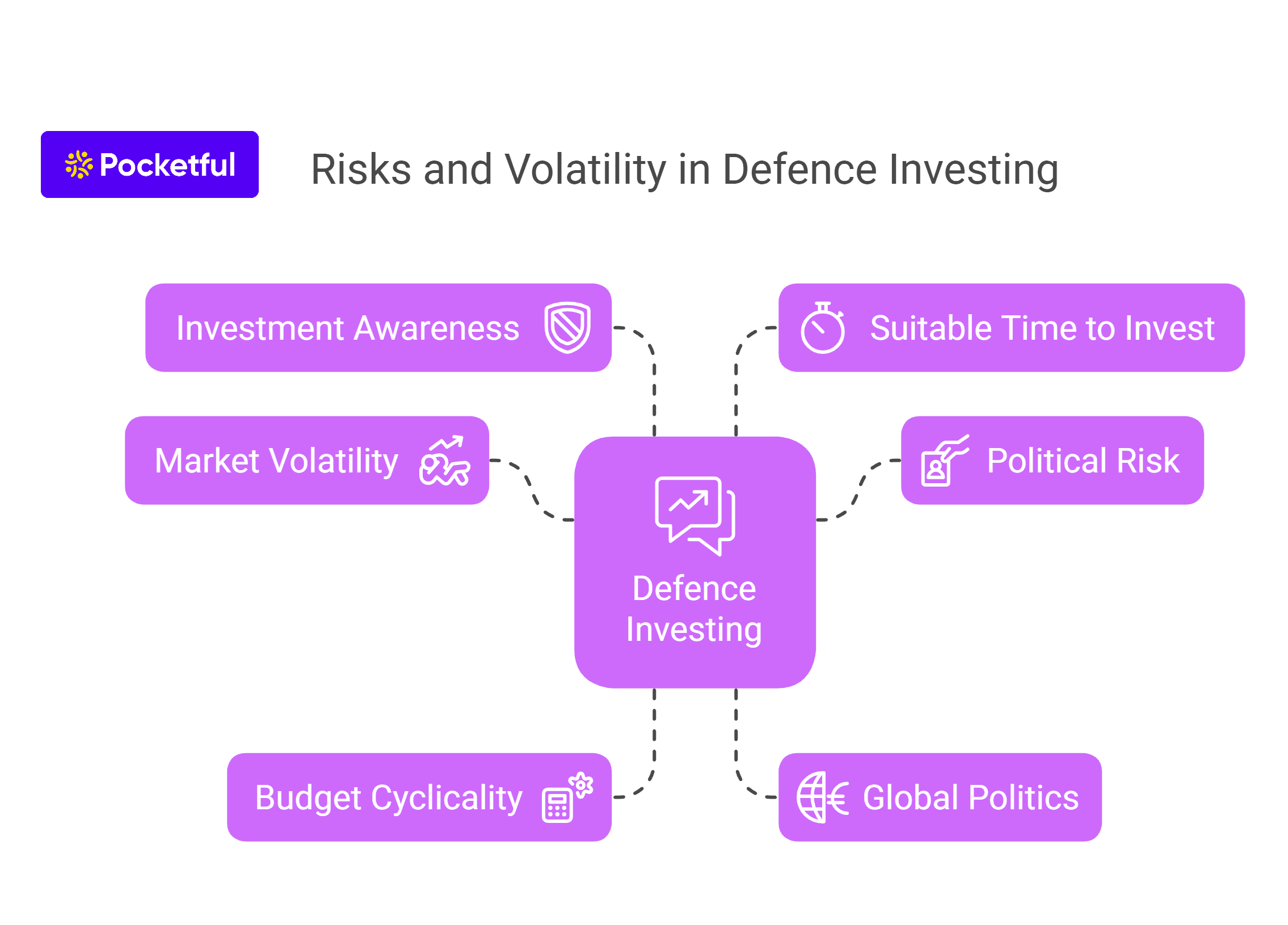

Risks & Volatility in Defence Investing

While investing in the defence sector, it is important to understand some key risks and fluctuations.

- Market volatility : Defence stocks experience volatility due to global events and political tensions. There was volatility in the Indian stock market after Operation Sindoor, which led to a decline in the shares of defence companies. The market may fall during war or conflict, while there may also be gains during peace. At such times, investors should remain cautious and pay attention to the market conditions.

- Political risk and delay in supply : The defence sector is affected by government policies and political decisions. Issues such as delay in supply of defence equipment, quality issues also pose risks to investors. Sometimes disputes in defence contracts or not completing production within the deadline lead to supply disruptions, causing uncertainty.

- Cyclicality in budget allocation : The defence budget fluctuates every year. Sometimes there is an underallocation, which can hinder the growth of defence companies. The defense budget has been increased for 2025-26, but despite this, further increase in capital expenditure may be required for this sector.

- Global politics and regional tensions : Geopolitical issues and regional tensions can also increase risks associated with investment in the defense sector. If tensions with neighboring countries increase, it will affect India’s defense sector as important supply chains of raw materials required by these companies may be hampered. Moreover, the global security situation may change after incidents like Operation Sindoor, resulting in losses to investors.

- Investment awareness : Before investing in the defense sector, investors need to understand its policies, budget, and global defense industry. Investing with a long-term perspective and taking decisions based on the right information can reduce risks.

- Suitable time to invest : After a fall in defense stocks, investing at the right time can yield benefits. Investors should plan their investments carefully, understanding the recent developments and constantly monitor their investments.

Keeping these risks in mind, investors should take a long-term view. The Indian defense sector has good growth potential, making it an attractive investment option.

Is It the Right Time to Invest?

The Indian defense sector has undergone significant changes, which have impacted investment in the sector. Favorable government policies and increased defense spending are expected to benefit the sector, but at the same time the market remains volatile.

- Long-term outlook : Defense production in India is getting a boost under the “Make in India” initiative. 193 defense contracts were signed in FY24-25, with a total value of over ₹2.1 trillion, the largest figure ever.

- Risks and volatility : While the long-term outlook for the defense sector is positive, the market witnessed volatility after Operation Sindoor. On May 7, the Sensex fell by 704 points, while the Nifty 50 fell by 169 points. This reflects market volatility, which poses risks for investors.

The defence sector has long-term growth potential, but given market volatility and external events, it is important to assess risks before investing in this sector.

Read Also: Best Small Cap Defence Stocks in India

Conclusion

Investing in the defense sector can be an attractive opportunity given India’s growing global presence. The government’s “Make in India” initiative and rising defense budgets have strengthened the long-term growth prospects for the sector. Events like Operation Sindoor give a new twist to the sector, but investors should also understand the risks involved, such as market volatility and political uncertainties.

The sector certainly has growth potential, but it is important to understand government policies, defense contracts and the global security situation before investing. Adopting a balanced approach, where both opportunities and risks are properly evaluated, will be key to succeeding in the stock market. Moreover, it is advised to consult a financial advisor before investing.

Frequently Asked Questions (FAQs)

What is Operation Sindoor?

Operation Sindoor was a strategic attack launched by India on 7 May 2025, aimed at taking quick and effective action against terrorists.

Which are the top defence stocks to consider after Operation Sindoor?

Key defense stocks include BEL (Bharat Electronics Ltd.), HAL (Hindustan Aeronautics Ltd.), and BDL (Bharat Dynamics Ltd.). These companies have long-term growth potential.

Is it a good time to invest in defence stocks?

The defence sector has good growth potential due to record number of defence contracts in the past one year, but due to market volatility and external events, it is important for investors to assess the risk or consult a financial advisor before investing.

What factors should be considered before investing in defence stocks?

Before investing you should understand the company’s financial position, government policies, defense budget, and global security scenario.

Can defence stocks outperform other sectors in India?

The defense sector has growth potential, but it may be riskier than other sectors, especially during unstable global conditions.

What is the role of “Make in India” in the growth of defence stocks?

The “Make in India” initiative is promoting domestic defence production, which supports long-term growth for Indian defence companies.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle