| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Aug-20-25 |

Read Next

- What Is Leverage in the Stock Market?

- Common Trading Mistakes Beginners Make (And How to Avoid Them)

- How to Pledge ETFs for Margin in India

- What Is Expiry Day Trading?

- Best ETF Platforms for Trading and Investment in India 2026

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

What Is Black-Scholes Model: Meaning, Formula & Benefits

Have you ever wondered how the correct price of an option is determined? In the world of trading, the Black-Scholes Model has provided a mathematical solution to this question. It is a mathematical model that helps in finding the correct value of a European option. Today, this model is used by traders, investment banks and fund managers around the world.

In this blog, we will understand in simple language what is Black-Scholes model, its formula, assumptions, strengths and limitations of Black-Scholes option pricing model.

What Is Black-Scholes Model?

The Black-Scholes Model is a mathematical method for calculating the theoretical price of a European option. It was developed in 1973 by Fischer Black and Myron Scholes, with later contributions from Robert Merton. For the first time, the model gave traders a scientific way to calculate what the “fair value” of an option should be.

The Black-Scholes option pricing model is still one of the most widely used models in the world, especially for pricing stock options and other derivative instruments. It is used by major investment banks, trading firms and portfolio managers to make the right decisions at the right time. The model focuses on :

1. Current Price

This is the actual market price of the underlying asset at the time when you are calculating the value of the option. As the price moves up or down, the option price is also directly affected.

2. Strike Price

The strike price is the price at which the option holder can buy or sell the stock in the future. For a call option, if the stock price is higher than the strike price, the option becomes more valuable. For a put option, the opposite is true—the higher the strike price, the higher the value.

3. Time to Expiry

This tells how much time is left till the maturity of the option (in years). The more time is left, the higher is the value of the option because the scope of favorable price movement is larger.

4. Volatility

Volatility means the possibility of fluctuations in the stock price.

Higher volatility means more uncertainty and therefore the option may be more expensive because its potential payoff is higher.In the Black-Scholes model, volatility is assumed to be constant.

5. Risk-Free Interest Rate

This is the interest rate that an investor can get without any risk (such as government bonds). This shows how much the future payout of the option should be discounted in today’s terms. Higher rates mean the value of the option may be affected.

Using all these factors, the Black-Scholes model determines what the fair price of an option should be. Now in the further sections we will understand its formula and real-life examples in detail.

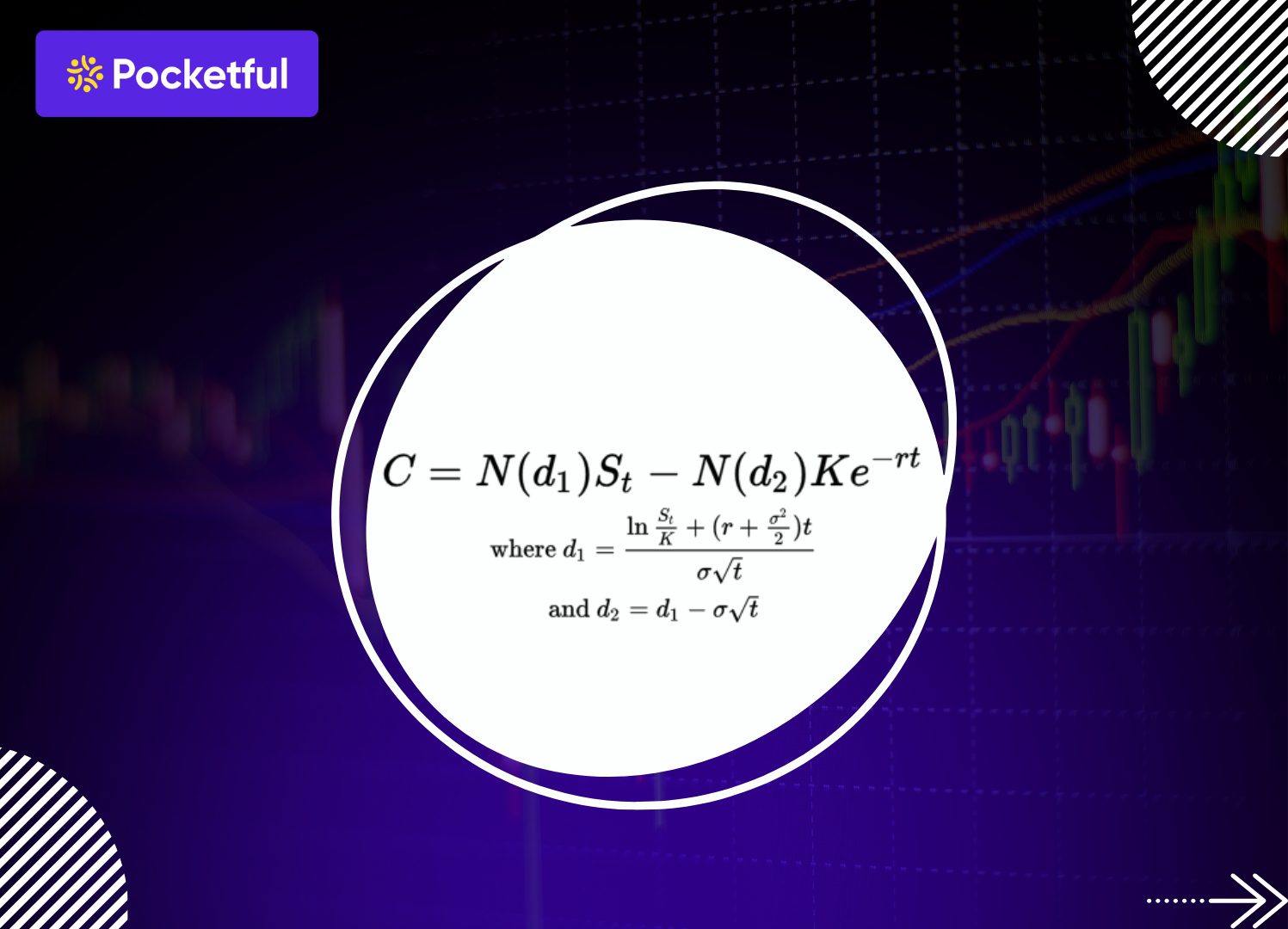

The Black-Scholes Formula

The Black-Scholes model is used to calculate the theoretical price of European style call and put options. The formulas for both are different but the base variables remain the same.

Black-Scholes Formula:

| Option Type | Formula |

|---|---|

| Call Option (C) | C = S*N(d1) − X*e^(−rt)*N(d2) |

| Put Option (P) | P = X*e^(−rt)*N(−d2) − S*N(−d1) |

Variables and their meaning (applicable to both Call and Put):

| Symbol | Represents | Simple Explanation |

|---|---|---|

| S | Current Stock Price | The market price of the stock at the time of option pricing |

| X | Strike Price | The predetermined price at which the option can be exercised in the future |

| r | Risk-Free Interest Rate | The return on a risk-free investment |

| t | Time to Expiry (in years) | The time remaining until the option’s expiration |

| σ | Volatility | The expected fluctuation or variability in the stock price |

| N(d1),N(d2) | Standard Normal Distribution | The probability values derived from the standard normal distribution curve |

| d1 | Intermediate Calculation | [ ln(S / X) + (r + σ² / 2) × t ] / (σ × √t) |

| d2 | Intermediate Calculation | d1 – σ × √t |

Example: Call Option Price Using Black-Scholes

| Parameter | Value |

|---|---|

| Nifty Spot Price (S) | 25100 |

| Strike Price (X) | 25000 |

| Time to Expiry (T) | 15 days = 15/365 = 0.041 |

| Risk-free rate (r) | 6.9% = 0.069 |

| Volatility (σ) | 13% = 0.13 |

Step 1: d1

d1 = [ ln(S/X) + (r + σ²/2) × T ] / (σ × √T)

= [ ln(25100 / 25000) + (0.069 + 0.13² / 2) × 0.0411 ] / (0.13 × √0.0411)

= [ 0.00399 + (0.069 + 0.00845) × 0.0411 ] / (0.13 × 0.2027)

= [ 0.00399 + 0.00317 ] / 0.02635

= 0.00716 / 0.02635 = 0.272

Step 2: Calculate d2

d2 = d1 – σ × √T

= 0.272 – 0.13 × 0.2027

= 0.272 – 0.02635 = 0.2457

Step 3: Find N(d1) and N(d2)

N(d1) = 0.6069

N(d2) = 0.5969

Step 4: Calculate Call Option Price

Call = S × N(d1) – X × e^(-rT) × N(d2)

= 25100 × 0.6069 – 25000 × e^(-0.069 × 0.0411) × 0.5969

= 15245.2 – 25000 × 0.9972 × 0.5969

= 15245.2 – 14918.4 = ₹326.8

Final Answer : Call Option Premium (Strike ₹25000) = ₹326.8

Benefits of the Black-Scholes Model

The benefits of Black-Scholes Model are given below:

- Fast and standard way to know Option Price : The Black-Scholes model gives a formula that allows you to calculate the price of options quickly and in a standard way. This helps traders to take fast decisions.

- Accepted Model in Global Financial Industry : This model is accepted and used by banks, institutions and analysts around the world. Its credibility is quite strong, which makes it easy for practical use.

- Makes it easy to compare different options : With the help of Black-Scholes, you can compare options of different stocks and expiry dates. This shows which option is more valuable.

- Foundation of Advance Financial Models : This model is the base of many advanced models like Binomial tree, Monte Carlo simulation. Meaning, this is a foundational concept that is important to understand.

- Helps in catching market inefficiencies : When the actual market price of an option is higher or lower than the theoretical price, this model can tell if there is some mispricing happening in the market.

Strengths and Limitations of the Black-Scholes Model

Strengths

- Precise and Quick Pricing : This model helps calculate the theoretical value of the option quickly and accurately, which is very useful for real-time trading decisions.

- Globally Accepted Standard : Black-Scholes is the most widely used option pricing model worldwide. Institutions, hedge funds, and traders use it as a benchmark.

- Mathematical Simplicity : Its formula may seem complex, but when the variables are right, its calculation is simple and repeatable. It can be easily implemented with Excel or programming tools.

Limitations

- Constant Volatility Assumption : Black-Scholes assumes that the volatility of the stock remains constant, whereas in the real world volatility keeps changing over time. This is a big limitation.

- Only for European Options : This model applies only to European options that can be exercised only at expiry.

- No Transaction Costs : The model assumes that there is no brokerage or transaction cost. But in real trading there are charges that affect the option price.

- Ignore Sudden Events : This model does not consider events like unexpected news, market crashes or earnings announcements, which can change the volatility of the asset significantly and cause a difference between the actual price and the model price of the option.

Conclusion

The Black-Scholes Model remains one of the most reliable frameworks for determining the theoretical value of options. While it is based on certain ideal assumptions, it continues to be highly relevant in real-world trading and risk management. For anyone looking to deepen their understanding of options and learn how fair valuation is determined, the Black-Scholes Model offers a strong foundation. With the right data and tools, its application is straightforward and can serve as a valuable guide for traders, investors, and financial professionals alike.

Frequently Asked Questions (FAQs)

What is the Black-Scholes Model used for?

This model is used to calculate the theoretical price of options.

Is the Black-Scholes Model still relevant today?

Yes, this model is still used a lot today, especially for valuing European options.

Can I use the Black-Scholes formula to calculate option prices manually?

Yes, but the calculations are a bit complex, it is easier to calculate using a spreadsheet or calculator.

What are the key inputs in Black-Scholes Model?

Spot price, strike price, time to expiry, risk-free rate and volatility – these are the main inputs.

Is the model accurate in all market conditions?

No, its accuracy may decrease in highly volatile market conditions.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle