| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Sep-01-25 |

Read Next

- What Is Leverage in the Stock Market?

- Common Trading Mistakes Beginners Make (And How to Avoid Them)

- How to Pledge ETFs for Margin in India

- What Is Expiry Day Trading?

- Best ETF Platforms for Trading and Investment in India 2026

- What Is Strike Price in Options Trading?

- What is Speculative Trading?

- What is Revenge Trading?

- What Is Time Decay in Options?

- What are Candlestick Patterns? 38 Candlestick Patterns Every Trader Must Know

- How to Read Stock Charts: A Beginner’s Guide to Chart Analysis

- What is Gold Trading?

- Top Algo Trading Programming Languages in 2026

- What is Short-Term Trading Vs Long-Term Trading Strategies?

- NSE Algo Trading Rules for Retail Traders in India

- What is a Harami Candlestick Pattern?

- What is Average Traded Price in Stock Market

- What is MIS in Share Market?

- 7 Common Mistakes in Commodity Trading New Traders Must Avoid

- Brokerage Charges in India: Explained

Collar Options Strategy – Meaning, Example & Benefits

It is easy to feel good about your investments when the stock market is doing well. But what if you are worried about a sudden drop in the market but still want to stay invested? This is when the collar options strategy comes in. It is a smart and easy way to keep your profits safe without giving up all the upside.

We will discuss the collar strategy, how it works, when to use it, and what its pros and cons are in this blog. If you know how to use a collar option strategy, you can lower your risk without missing out on opportunities, whether you are a conservative investor or a seasoned trader.

Understanding the Collar Options Strategy

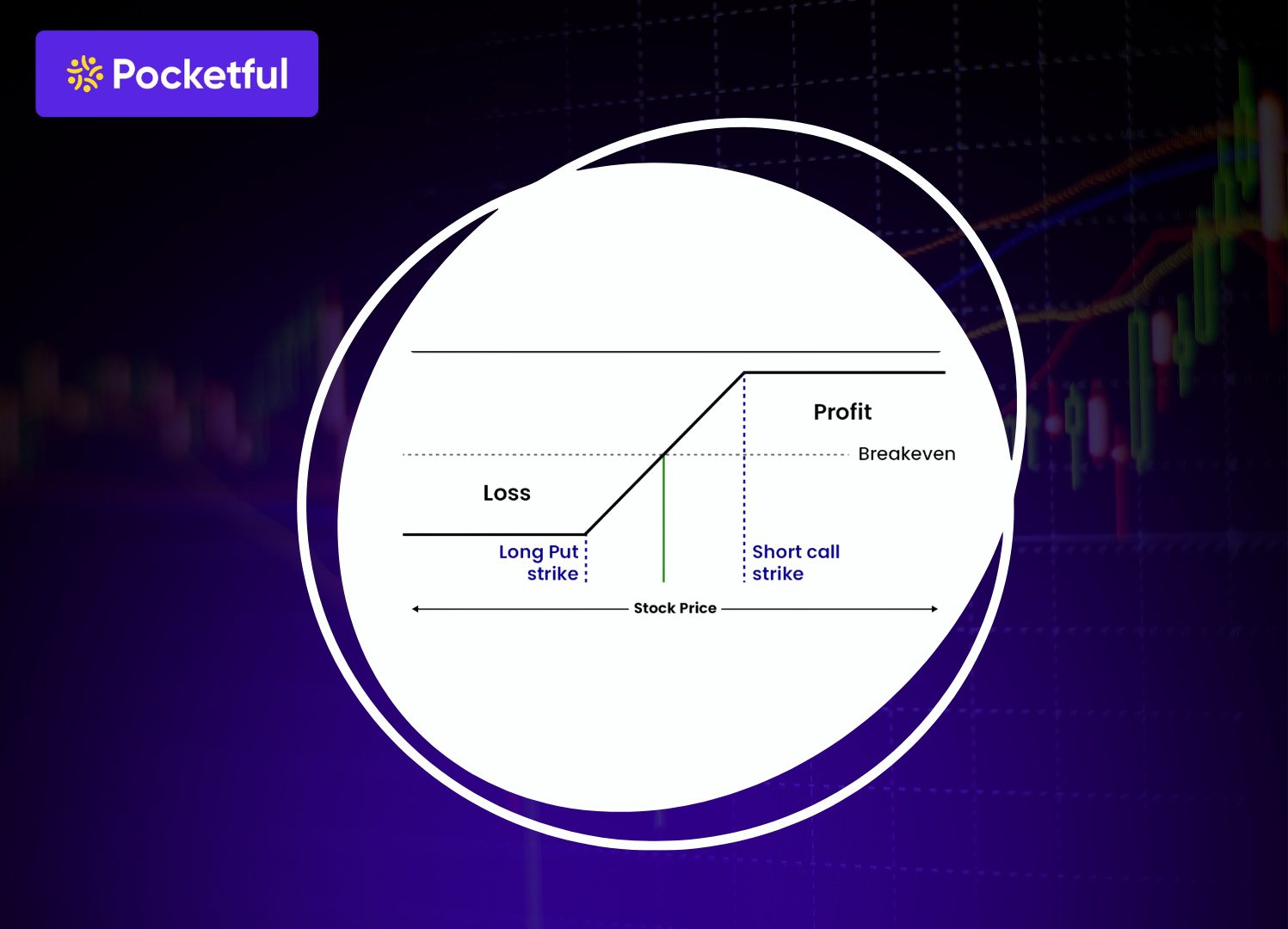

Applying a collar option strategy to your stock investment is like putting on a seatbelt. It protects your investment positions from big losses while still letting you make some gains, but not unlimited ones. This is how it works:

If you already own 100 shares of a company, you do two things:

- Buy an OTM put option; it is like insurance. It makes sure that you can sell your stock for a certain amount of money, even if the market crashes.

- If you sell an OTM call option, you agree to sell your stock for a price above its current market price and get paid a premium for this.

These two options positions basically “collar” your investment between a lower and upper limit. They protect you on the downside but limit your upside to some extent.

Example of Collar Options Strategy

Let us break down the Collar Strategy using an easy example. Suppose you currently own 100 shares of ABC, and the stock price is ₹1,500 per share. Although you have made decent gains, you are also a little anxious about the volatile market ahead.

Even though you aren’t interested in selling, you also don’t want to take the chance of seeing your gains vanish in a flash. This is precisely where the collar options strategy is useful.

Step 1: Buy a Put Option

You buy a put option with a strike price ₹1,400 (OTM put), giving you the right to sell ABC at that price even if it falls below ₹1,400. It is similar to stating, “I will never sell this for less than ₹1,400.” Assume that each put option has a lot size of 100 shares and costs you ₹3,000.

Step 2: Sell a Call Option

You also sell a ₹1,600 strike price call option (OTM strike), so you will have to sell it at that price if ABC rises above ₹1,600. However, you receive ₹3,000 for selling the OTM call option.

Therefore, the ₹3,000 you made from the call covers the ₹3,000 you spent on the put.

Because you’ll receive protection from the downside without actually paying out of pocket, it’s frequently referred to as a “zero-cost collar.”

What Could Happen, Then?

When your options expire, let’s examine three simple scenarios:

-ABC drops to 1,300

Instead of losing more, you sell your shares at ₹1,400 as your put option expires ITM. You have minimised your downside.

-ABC remains at about ₹1,500.

Neither option is exercised. Nothing changes; you continue to hold your stock.

-Now, ABC surges to 1,650

However, you will have to sell at ₹1,600 because you sold a ₹1,600 call. You lose on any gains over ₹1,600, but you still earn a fair ₹100 profit per share.

The result is that using collar option strategy is given below:

- Selling for ₹1,400 is your worst-case scenario.

- The best price you can get is ₹1,600.

- Additionally, you did not allocate any additional funds to protect yourself.

In other words, you created a haven around your investment, which can be quite satisfying, particularly when the markets are volatile.

Benefits of Collar Options Strategy

Some of the benefits of using collar options strategy is given below:

1. Your Downside Has a Floor

The put you buy is like a policy that protects you. You know the lowest price you will get, no matter how bad the market gets. That’s real peace of mind.

2. You do not have to sell your shares

Are you worried but still believe in the company in the long run? A collar keeps you in the market instead of selling at the first sign of trouble.

3. Sometimes protection is very cheap

The money you make from selling the call can help pay for the put or even pay for it all. So you might be able to protect yourself from losses without spending a lot of money.

4. Helps you keep the money you’ve already made

A collar helps you protect your profits if your stock has gone up a lot, but it also leaves some room for your call strike to go up.

5. You set the range

Choose the strikes that you feel comfortable with. If you want strong protection and are good with capping gains sooner? Pick strikes that are closer. Want more room for moving up? Go wider.

Read Also: Options Trading Strategies

Limitations of Collar Options Strategy

Some of the limitations of using collar options strategy is given below:

1. You may lose out on significant profits

You will likely regret selling that call if your stock unexpectedly rises in value because you will ultimately have to sell it at that fixed price even if it continues to rise. Yes, the collar protects you, but it also limits your earnings.

2. You Must Own the Stock for It to Work

This is not an approach that you can use randomly. It is intended to protect what you already own, not a stock you plan to buy in the future, so you must already own the stock.

3. You will have to Watch It

Options have expiration dates, so you can’t ignore them entirely. You may need to make some changes or switch to new options if the market becomes volatile or the stock moves a lot.

4. In an extremely bullish market, it is not the best course of action

A collar may seem like a disappointment if you believe the stock is going to rise. You will lose out on profits after your call strike because your upside is capped. If you were correct about the rally, that can hurt so badly.

5. There is a slight learning curve

Learning how puts and calls operate, how to pick the best strikes, and when to start everything up may take some time if one is unfamiliar with options.

Read Also: What is Options Trading?

Conclusion

The collar strategy is like putting a helmet on your investment. It might not make your investment journey more fun, but it does make it safer. For investors who want to hold on to a stock they trust while reducing downside risk, it’s a practical choice.

You can protect yourself from big drops, lock in some gains, and stay invested, all without spending much or even anything at all. Yes, your upside is limited, but for many investors, the peace of mind that comes with the collar options trading is worth it. The collar might be the best way to keep your risk under control, especially after the stock has had a good run recently.

Frequently Asked Questions (FAQs)

Is it possible to lose money with a collar options strategy?

Yes, but only down to the put strike price, so your losses are limited.

What will happen if the stock goes up a lot?

If it goes above your call strike, you will probably have to sell the stock at that price, which means you cannot earn any more money.

When is the best time to put on a collar?

When you have already made money on a stock and want to protect it during times of uncertainty.

Can I use a collar on index options?

You can do something similar with index futures or ETFs, but collars work best with stocks you own.

Is this a good strategy for people who are just starting out?

Yes, it is one of the easier option strategies and a great way to learn how options can help you control risk.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle