| Type | Description | Contributor | Date |

|---|---|---|---|

| Post created | Pocketful Team | Jan-03-26 |

Read Next

- Why Are Steel Share Prices Increasing in India?

- Top Nifty Metal ETFs in India 2026

- Best Gold Investment Schemes in India 2026

- How to Build a Portfolio With Exchange-traded Funds (ETFs)

- How to Invest in US Stocks from India

- Platinum Price Forecast in India (2026–2030)

- Why Is the Gold Price Going Down?

- Top 10 BESS Stocks in India (2026)

- Why is the Silver Price Going Down?

- Best Construction Stocks in India

- Why Gold Prices Hit ₹1,80,000 – Key Reasons

- List of Best Sensex ETFs in India

- Best Commodities to Trade in India

- Best Cyclical Stocks in India 2026

- How to Check the Purity of 20-Carat Gold: Easy Methods & Tips

- Why Are Silver Prices Rising in India?

- Difference Between Hallmark Gold, KDM Gold and BIS 916

- Why Are Gold Prices Rising in India?

- 1 Tola Gold in India: How Many Grams, Price & Investment Insights

- 22K vs 24K Gold: Which Is Better for Jewellery & Investment?

- Blog

- why tobacco stocks are falling in india

Why Tobacco Stocks Are Falling in India: ITC, Godfrey Impact

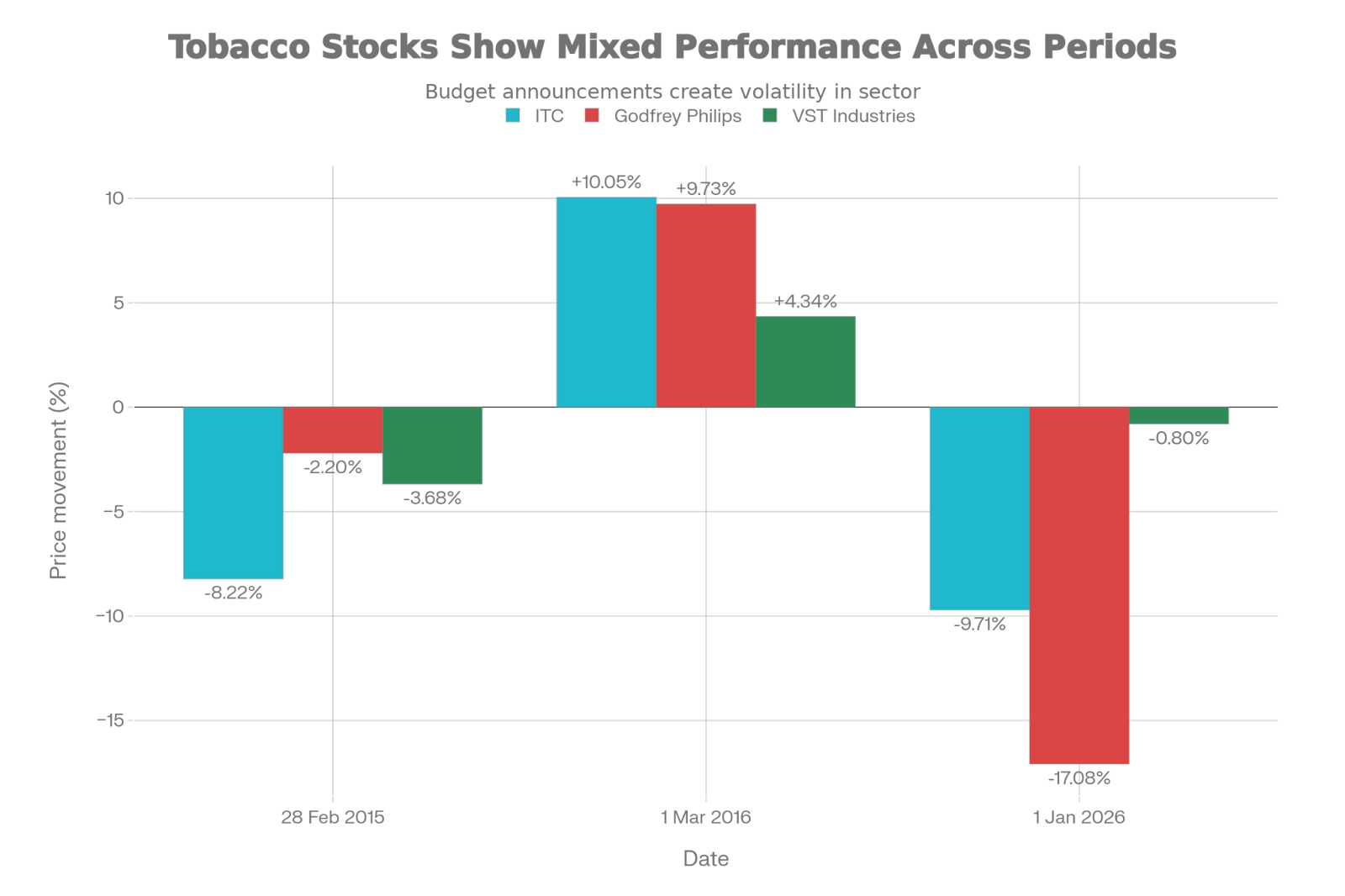

Tobacco sector stocks have recently shown weakness, with major names like ITC and Godfrey Phillips experiencing declines. The government has announced a new tax policy for cigarettes and tobacco products, effective February 1, 2026, which includes an additional excise duty along with GST. This change is expected to increase the overall tax burden, potentially impacting companies’ profits and sales, a concern that has made investors cautious.

Why Are Tobacco Stocks Falling?

- Sudden Fear Over Government’s New Tax Policy: The central government has announced that a new excise duty will be implemented on cigarettes and tobacco products from February 1, 2026, which will be an additional tax on top of the existing GST. This tax has been set at a rate of ₹2,050 to ₹8,500 per 1,000 cigarettes, which is significantly higher than before. This will increase the cost burden on companies and could lead to price increases.

- Heavy Selling Increases Investor Fear: Immediately after the announcement of the new tax, ITC shares fell by approximately 8–10%, and Godfrey Phillips shares saw a loss of about 10–19%. This decline also put pressure on the Sensex and the FMCG index in the stock market, as investors factored in the impact on these companies’ future earnings.

- Growing Concerns Over Earnings and Profitability: Analysts suggest that the tax increase could lead to higher retail prices for cigarettes and a potential decrease in sales, negatively impacting companies’ margins and EPS. Several brokerage firms have downgraded ITC’s rating or reduced their future forecasts. This fear was directly reflected in the decline in share prices, as investors became uncertain about future earnings.

- Policy Uncertainty Affects Credibility: The frequency and scale of changes in tax and GST regulations on cigarettes have increased in recent times. This has left investors uncertain about what further changes might occur in the future.

How ITC Is Impacted the Most

- Over-reliance on the cigarette business: While cigarettes account for a limited share of ITC’s total revenue, they contribute the most to its profits. A large portion of ITC’s total profit comes from cigarettes, so any increase in taxes directly impacts the company.

- Role in funding other businesses: ITC’s FMCG, hotel, and agri-businesses are not yet fully self-sustaining. The cash flow generated from the cigarette business plays a crucial role in running and expanding these businesses. Increased taxes could weaken this support.

- Market concerns regarding margins: Following the new tax policy, the market fears that ITC will either have to increase prices or reduce its margins. In either case, profits could be under pressure, even though the company is diversified.

- Short-term versus long-term impact: In the short term, ITC’s share price may remain under pressure due to uncertainty regarding earnings. The long-term impact will depend on how effectively the company can pass on the increased taxes and how stable the sales volume remains.

What Changed in the Cigarette Tax Structure?

| Tax Component | Before Feb 1, 2026 | From Feb 1, 2026 |

|---|---|---|

| GST (Goods & Services Tax) | Previously, it was primarily subject to 28% GST + Compensation Cess. | Now a new slab of 40% GST will be implemented (the compensation cess will be removed). |

| Excise Duty | Previously, there was only a small amount of excise duty. | The government has now imposed a new excise duty of ₹2,050-₹8,500 per 1000 cigarettes, which is in addition to the GST. |

| Compensation Cess | Different cesses were levied on top of GST. | The Compensation Cess has been abolished and replaced with a structured duty. |

| Overall Effective Tax Burden | Previously, due to GST + compensation cess, it was approximately 50–53%. | Now, with 40% GST + new excise duty, the total burden will be approximately the same or slightly higher, which will make cigarettes more expensive. |

Read Also: List of Best Tobacco Stocks in India

Godfrey Phillips and Other Tobacco Companies

- Limited Pricing Power: Companies like Godfrey Phillips don’t have the same market dominance as ITC. Due to their limited brand presence and distribution network, these companies cannot easily raise prices after tax increases.

- Greater Impact on Volumes: Even a slight price increase can directly affect these companies’ sales. Their customer base is more price-sensitive, increasing the risk of a decline in sales volume.

- Pressure from Rising Costs: The impact of rising costs of raw materials, packaging, and taxes is felt more acutely by smaller players. Their lack of economies of scale makes it difficult for them to absorb these costs.

- High Volatility in Share Prices: Due to their smaller market capitalization and lower liquidity, these stocks experience sharp declines or surges in response to news. This is why stocks like Godfrey Phillips show a much more pronounced reaction compared to ITC.

What Investors Are Worried About After ITC Share Fall

- The extent to which increased taxes can be passed on : The challenge for ITC is determining how much of the increased tax burden can be passed on to consumers through price increases. Too large a price hike could impact demand, while a smaller increase could put pressure on margins.

- Potential pressure on sales volume: Cigarette consumption is sensitive to price increases. Investors are concerned that post-tax price hikes could lead to a decline in volume, particularly in lower-price segments.

- Questions about demand sustainability: Frequent tax increases reduce the affordability of cigarettes. In the long run, this could limit demand growth for organized tobacco companies.

- Focus on cash flow and dividends: ITC’s strong cash flow is primarily derived from its cigarette business. If this comes under pressure, investors become cautious about the sustainability and growth of dividends.

- Increased competition from the illicit market: Higher taxes make illegal cigarettes cheaper. This could negatively impact the sales and market share of legal companies.

What Should Investors Watch Going Forward

- Management Strategy on Pricing and Margins: Investors should pay close attention to management commentary from companies, particularly regarding how price increases will be implemented and margins managed in the wake of increased taxes.

- Quarterly Sales and Volume Trends: Sales and volume figures for cigarettes in the coming quarters will be crucial. These will reveal the extent of the impact of the tax increase on demand.

- Information on Changes in Tax Implementation: Any clarification or modification from the government regarding the timing, rate, or structure of the tax could directly impact share price movements.

- Indications Regarding Future Tax Policy: Whether there are indications of further tax increases on the tobacco sector will be important for investor confidence. Any stricter stance could increase volatility in the sector.

Conclusion

The decline in the tobacco sector is due to tax-related concerns, not a sudden weakening of the business itself. The full impact of the increased taxes on prices and sales will become clear in the coming months. Currently, the market is reacting to this uncertainty. In such an environment, it’s crucial to focus on facts and company actions rather than market sentiment.

| S.NO. | Check Out These Interesting Posts You Might Enjoy! |

|---|---|

| 1 | List of Best Travel Stocks in India |

| 2 | List of Best Media and Entertainment Stocks in India |

| 3 | Listed AC Manufacturing Companies in India |

| 4 | List of Best Railway Stocks in India |

| 5 | List of Best Monopoly Stocks in India |

Frequently Asked Questions (FAQs)

What tax change did the government implement?

The government has imposed a new excise duty on cigarettes ranging from ₹2,050 to ₹8,500 per 1,000 sticks, effective February 1, 2026.

Did GST rates on tobacco products change?

No, there has been no change in the GST rate. The change is only in the additional excise duty.

How much of the retail price is tax now?

Now, approximately 53% of the retail price of cigarettes goes towards taxes.

Why did ITC shares fall so much?

ITC shares fell sharply due to concerns about increased costs, reduced margins, and the potential impact on sales as a result of the new duty.

Disclaimer

The securities, funds, and strategies discussed in this blog are provided for informational purposes only. They do not represent endorsements or recommendations. Investors should conduct their own research and seek professional advice before making any investment decisions.

Article History

Table of Contents

Toggle